Global investment banks are making major digital investments to keep pace with fintechs, Moody’s Investors Service reported in a research note this week.

The research study noted that global investment banks are focusing on enhancing their digital platforms, spending an average of $72 billion annually on IT. While they are increasingly partnering with fintechs, the study observed that not all will have the strategic ability or management commitment to execute.

“To succeed, global investment banks need to be customer-driven, data-driven, entrepreneurially minded and technologically savvy, with the infrastructure to support business-wide transformation,” Moody’s wrote.

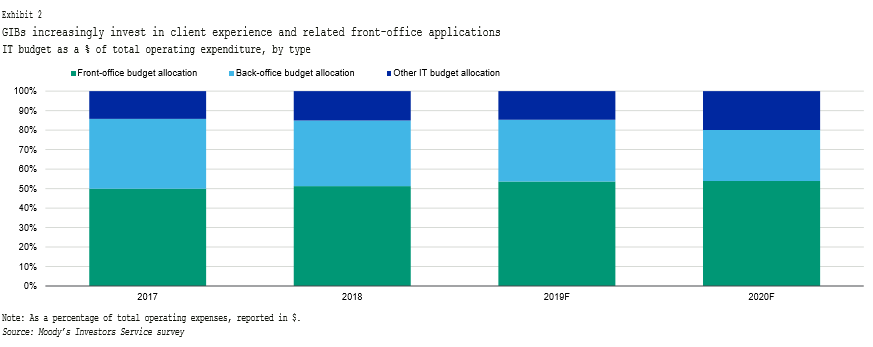

To combat margin pressure and retain profitable customer relationships, institutions have directed a growing number of their IT budgets toward front-office applications that are client facing. One key benefit of these user-friendly IT enhancements is that digital customers are “less costly to acquire and serve.”

With a higher proportion of consumer interactions handled digitally, branch interactions are shifting toward in-person service and advice for higher-value advisory and investment interactions. But despite the potential greater efficiency garnered from digitization efforts, the gains have so far have been insignificant, according to Moody’s.

Despite the challenges for banks, fintechs’ increasing friction on regulatory and funding fronts may spur imperatives to partner with banks, the study observed.

“[New friction] partially removes a key competitive advantage of new fintech entrants up until now: the almost full absence of regulatory oversight,” Moody’s argued. “[This] will likely slow the charge of fintechs and alleviate the immediate threat to the largest banks.”

Meanwhile, a growing number of startups are raising equity funding with the participation of incumbent banks, opening up opportunities for further collaborations. Fintechs benefit from the bank’s balance sheet and funding, as well as its risk assessment and compliance capacities, while banks gain new expertise in user experience, customer retention and creating “one-stop shop service” platforms.

For banks, however, partnerships are not a substitute for internal innovation, Moody’s suggested.

“Global investment banks will still need to make a concerted strategic effort to continually innovate,” the study noted.

This story first appeared on BankInnovation.net.