AFS 2019: Digital lending fintech enters auto

LAS VEGAS — Bank of Oklahoma has adopted Blend’s digital lending platform, the fintech announced at the 2019 Auto Finance Summit. Blend’s platform is designed to simplify user experience for the consumer to drive increases in completed online applications and funding rates.

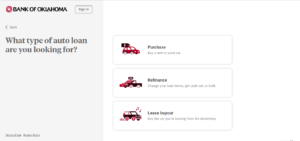

“Blend’s technology uses verified data to eliminate steps and the passing around of documents,” said Olivia Teich, Blend’s head of products. Customers can purchase a vehicle, refinance an existing loan or buy out the lease from the dealership.

Since piloting the program seven months ago, Bank of Oklahoma has reported a three-time increase in completed applications, a 10% increase in approval rates, and a 150% year-over-year increase in funded applications. Bank of Oklahoma has total managed assets of $38 million.

San Francisco-based Blend’s auto loan product is its latest iteration of consumer-facing finance products. The fintech also has a mortgage product, a deposit accounts product and a home equity product.