Why the Auto Finance Industry Needs a Greater Focus on Digital Sales & Marketing

Most sales and marketing job ads go something like this:

As an Inside Sales Relationship Manager, you will be contacting Auto Dealerships to sign up with AUTO FINANCE COMPANY NAME HERE as one of their sub-prime lenders. … The expectations for the first year at this job is to be making $60k – $100k per year. We have an amazing building with a built-in gym and break areas. Our environment is that of a positive sales floor with great competition to bring out your best. Auto industry experience is helpful but NOT required.

The problem is this ad hearkens to the old way of doing auto finance sales and marketing: pound the dealer, score some credit apps, repeat at the next dealership.

Auto finance sales and marketing needs to change, yet too many in the industry don’t realize it. We’re presenting the Auto Finance Sales & Marketing Summit to help with the transition.

The transition relates to how auto loans are originated.

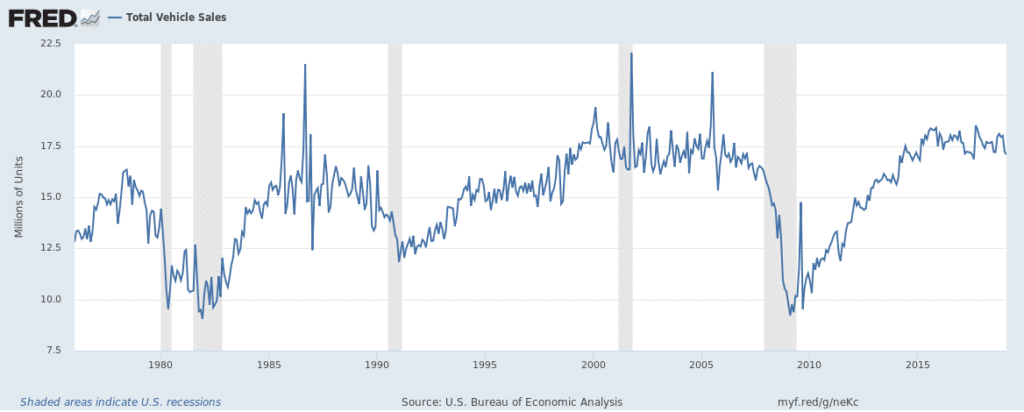

But, first, to the market dynamics. Car sales have been poised for softening for at least a year, and whether the market truly recedes or not, auto lenders should expect a time when credit applications do not flow regardless of the sales rep.

As the chart above illustrates, we are years into a significant expansion in car sales. The car market contracts with regularity: in the early 1980s, the early 1990s, and after the credit crisis. The data implies that the car market may undergo a sustained decline. Your sales and marketing operation should be ready for it.

But for what? An auto finance company can hire sales rep after rep to bolster its volume. But the market is changing — and sales reps are not the fount of originations they once were.

Auto Finance News conducted a survey of 200 consumers this month to find out just how significant is the digital originations channel today. About 65% of consumers are open to securing their auto loans online, with about 26% of them significantly inclined to do so. Today, around two-thirds of consumers finance their car purchases, so the numbers are significant — +10 million new vehicles in 2019.

Our survey also found that most consumers are shopping for cars online. For example, 54% of consumers will check out automobile enthusiast websites like Edmunds, Motor Trend, or CarAndDriver.com before making a purchase. The test drive is still crucial to consumers — 61% called it “extremely important” to the car-buying process — but vehicle marketing is an online game.

Here’s how consultancy BCG put it last August:

The growth of mobile devices, e-commerce, and social media has changed the ways people shop. Today, when consumers research products ahead of a purchase, they are likely to look beyond traditional information sources to new forms of guidance and recommendations, including social media and social media influencers. When they are ready to buy—whether it’s a dinner, a sweater, or a vacation—they expect services that make shopping convenient and fast, owing to their interactions with e-commerce giants such as Amazon and Alibaba. Consumers’ twin expectations of efficient service and instant gratification are now spilling over into their views about buying bigger-ticket items, including cars.

With that in mind, vehicle financing needs to be a digital game. More than 19% of respondents called the financing options the “most important” factor when purchasing a car — if the purchasing is happening online, so too must the financing.

As such, Auto Finance News is presenting the Auto Finance Sales & Marketing Summit. The Summit will explore how to respond to these changing dynamics. For example, we will investigate what “digital experience” means in auto finance; what new value propositions are needed; what technology can support your digital marketing; how expectations around customer service are changing; why there is no such thing as an alternative to omni-channel today; and how to analyze performance for improved digital results.

We expect that attendees will change how they view sales and marketing — to the point where that on-site gym access will be less of a benefit than previously thought.