1 of 10 consumers bring preapprovals to the dealership, survey finds

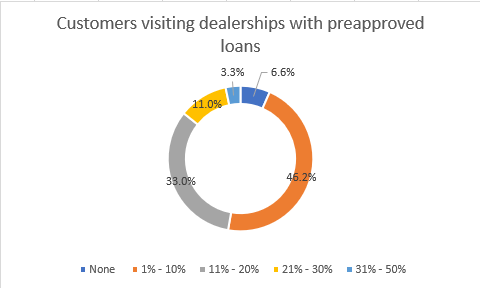

While the majority of dealers surveyed by Auto Finance News said that at least 10% of their customers came to the dealership with preapproved auto loans, respondents said the rate at which those preapprovals were converted into funded loans fell on both ends of the spectrum.

For nearly half of respondents, fewer than 10% of customers came to their dealership with preapproved loans from their preferred financial institutions. A third of dealers saw the number of preapprovals fall between 11% to 20% of their total customer base. A small segment of dealers surveyed — 6.6% — said none of their customers came armed with preapprovals. The remaining respondents saw the number of preapprovals represent more than 21% of their total customer base.

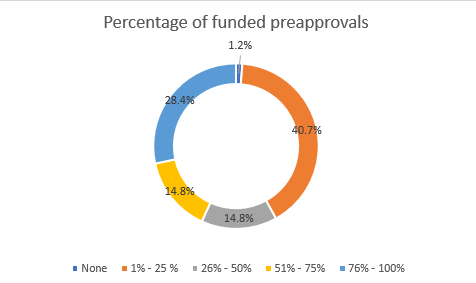

Yet, preapproval conversions fell on both ends of the spectrum. On one hand, 40.7% of respondents said that only a quarter of those customers secured funding with the lender offering the preapproval. On the other hand, 28.4% of dealers polled said preapprovals were converted as much as three-quarters of the time.

Most of the remaining dealers were split evenly, saying that preapproval conversions landed in either the 26%-to-50% range or the 51%-to-75% range.