You’re welcome: The Fed gifts a strong auto finance sector

Apparently, Halloween is the new Christmas in auto finance.

Yesterday, the Federal Reserve gifted the industry a 25-basis-point interest rate cut, the third time the Fed has cut rates this year. The central bank’s benchmark rate now stands at 1.5% to 1.75%. A present like that doesn’t even need gift wrapping.

“We believe monetary policy is in a good place,” Fed Chairman Jerome Powell said at a news conference following the decision, as quoted by Bloomberg. “We see the current stance of policy as likely to remain appropriate as long as incoming information about the economy remains broadly consistent with our outlook.”

OK, so rates will likely not decline again in December, but at 1.5%, there’s no need to pine for greater easing. I would suggest this latest rate cut now makes the current economic environment for auto finance at least as favorable as it has been over the past few years. The economic factors that most closely relate to the industry remain so favorable. The Fed has cut interest rates this year largely to “sustain expansion.” We are certainly in an expansion. In fact, it is the largest expansion in American economic history. And it is the auto industry — and auto finance, in particular — that arguably benefits most from the Fed’s largesse.

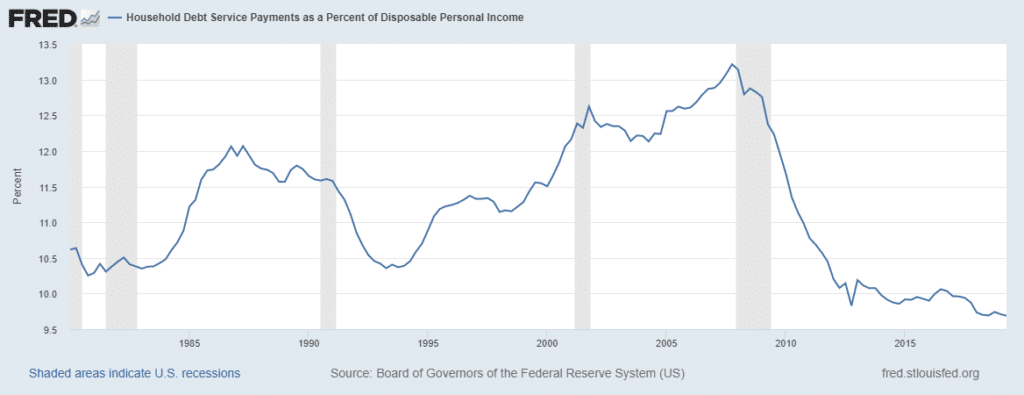

The key for auto finance is vehicle affordability, and it remains remarkably — perhaps even historically — positive for the industry. I could cite a host of data points, but one that might be among the more profound is household debt service as a percentage of disposable income, which at 9.7% remains at historic lows. And now the Fed with this rate cut has only improved vehicle affordability, perhaps not significantly, but still to the benefit of lenders.

The affordability also helps in credit performance. There are but nominal upticks in credit delinquencies and charge-offs. Consider US Bank. I sat down with John Hyatt, president of USB’s dealer services division, this week at the Auto Finance Summit in Las Vegas and he simply shrugged off the year-over-year increases in auto delinquencies (+4 basis points), charge-offs (+5 basis points), and non-performing loans (+5 basis points) at the bank last quarter. These are not material increases by any standard.

Ever-strong used-vehicle prices mean auto financiers are outperforming on the front end and the back end of credits. At the Auto Finance Summit, an executive from a major captive told me that its off-lease vehicle sales this year are yielding around $4,000 per vehicle above residuals. That’s something like a 20% bonus, by my rough calculation — and that’s found money.

This is likely why the atmosphere at the Auto Finance Summit was positively buoyant. Car sales are outperforming expectations; used-vehicle sales are outperforming expectations; credit performance is outperforming expectations — and now this gift from the Fed yesterday. Perhaps the only strike against the industry seems to be the overly conservative forecasting and modeling by lenders in the past few years. Chase Auto last quarter pumped up auto originations more than 12%, after at least a year of essentially flat growth driven by a conscious decision to limit risk. Hindsight, as they say, is 20/20, but Chase — like many other lenders — likely could have secured more originations, but didn’t. As they say, these are “good problems.”

I am bullish on 2020, especially after the rate cut. Generally, at an Auto Finance Summit, I will hear some biting scuttlebutt of this or that lender pricing irrationally. I heard none of that this year. There is a clear sense that the market is in incredibly good shape and performing and behaving better than anyone could have expected. The prospects for 2020 must be considered to be strong, at least as strong as 2019. Of course, uncertainty has become the new norm, but the likelihood of a recession in 2020 just dropped yesterday.

Merry Halloween, folks.