US jobs recovery falters as virus surge snaps hiring streak

The U.S. labor market lost jobs in December for the first time in eight months, reflecting a plunge in restaurant employment that highlights how surging coronavirus infections are taking a greater toll on parts of the economy.

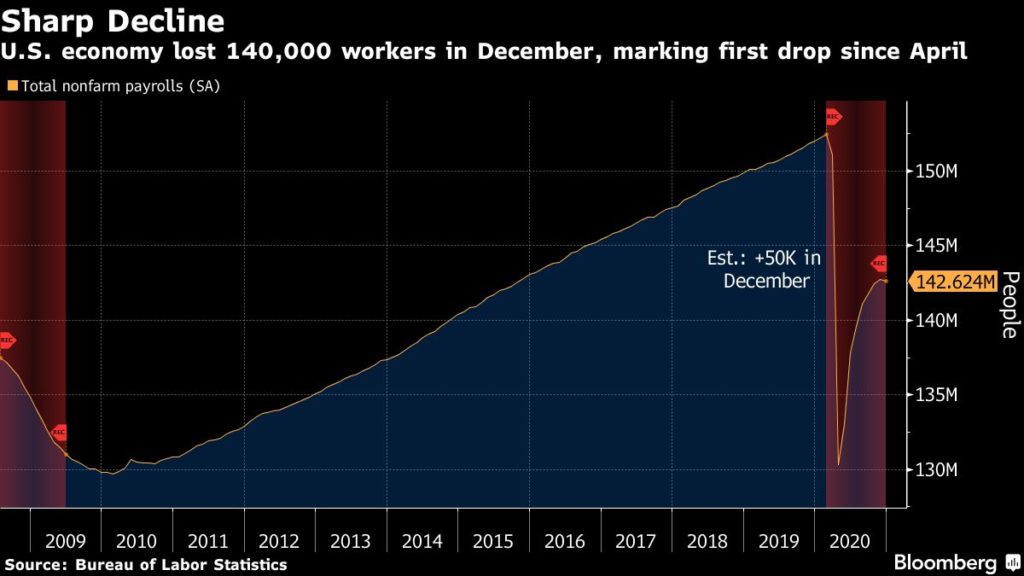

Nonfarm payrolls decreased by 140,000 from the prior month, according to a Labor Department report Friday that bucked economists’ forecasts for a modest gain. The unemployment rate held at 6.7%, halting a string of seven straight drops.

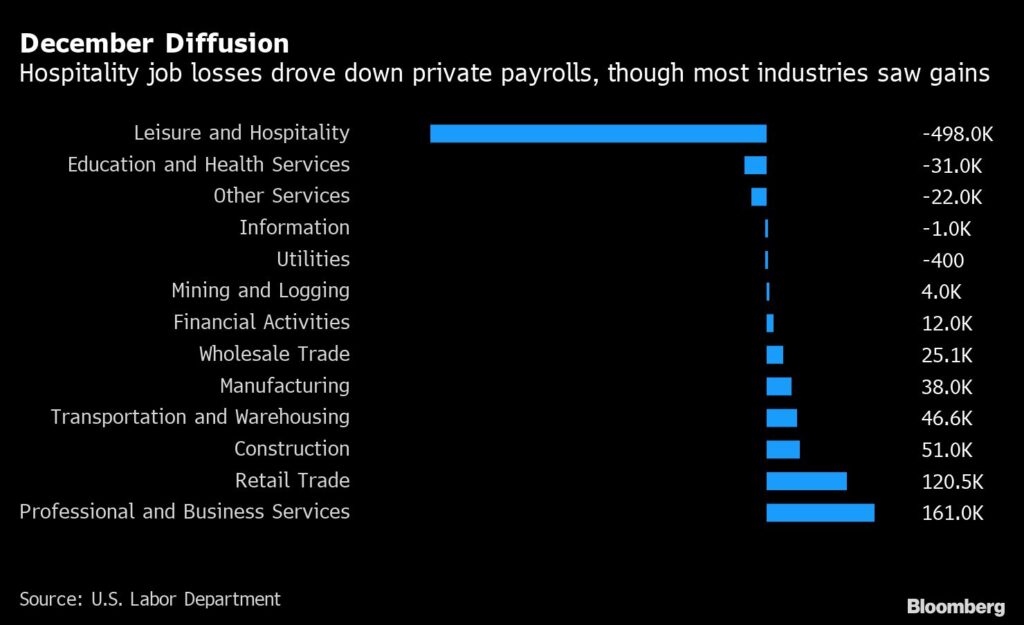

The weakness was concentrated in restaurants, bars and other businesses hit hard by fresh pandemic restrictions, underscoring the importance of a vaccine rollout as infections and hospitalizations set new records in many states each day.

The good news is that other parts of the labor market held up in December. Retail, professional and business services, construction and manufacturing all posted solid job gains, indicating much of the economy continues its gradual return to health. In another positive sign, the number of unemployed Americans who permanently lost a job declined to a four-month low of 3.37 million.

Read more: TOPLive Transcript of U.S. Employment Report

Investors bid up stocks after the jobs report hit, betting that the weak headline number will add to the pressure on the incoming Biden administration to push another big fiscal stimulus package through Congress on the heels of the $900 billion approved last month.

“Outside of consumer-facing sectors the remainder of the economy continues to show resilience,” said Michael Gapen, chief U.S. economist at Barclays Plc. “It does show that if we can get control of the pandemic, then we can restore economic activity and labor market conditions over the course of this year. It’s a pandemic-driven number, a pandemic-driven composition.”

What Bloomberg Economics Says…

“The drop in payrolls, while worse than consensus expectations, is not as troubling upon further inspection for two reasons: First, while the labor market is stalling, the recent passage of substantial fiscal stimulus will provide critical support to the economy over the next several months. Second, hiring weakness was concentrated into obvious categories where lockdown measures would clearly take a toll, such as restaurants, bars and hotels.”

— Carl Riccadonna, Andrew Husby and Eliza Winger, economists

For the full note, click here

Even so, President-elect Joe Biden will inherit an economy that’s down almost 10 million jobs compared with before the pandemic. The pace of hiring will be hard-pressed to accelerate until a meaningful portion of the general population is vaccinated, with distribution in the U.S. running slower than planned and potentially holding back the recovery.

A new virus strain that led to new or extended lockdowns in the U.K. and Germany has been identified in the U.S., which risks spurring more restrictions that hinder hiring in the coming months.

Those Americans getting vaccinated are essential workers or the elderly — people that either have already been working through the pandemic or are retired — which doesn’t lead to job gains in the immediate term.

While leisure and hospitality payrolls plummeted by almost a half million, most sectors added jobs in December, suggesting the economic pain was relatively contained. Construction employment rose by 51,000 and manufacturing added 38,000, while retail advanced 120,500 and professional and business services increased by 161,000.

“The report is remarkably weak with regards to leisure and hospitality,” Jeffrey Rosenberg, a senior portfolio manager at BlackRock Inc., said on Bloomberg Television. “That’s really what’s taking the headline number down. That is very clearly about the Covid resurgence we are seeing and underscoring the need for more fiscal policy.”

Average hourly earnings rose 0.8% from the prior month, the biggest gain in April, which the Labor Department attributed to the “disproportionate number of lower-paid workers in leisure and hospitality who went off payrolls.”

For the full year, payrolls declined by 9.37 million, the most in records back to 1939 and exceeding the combined slump in 2008 and 2009 during the Great Recession and its aftermath.

The number of long-term unemployed — those jobless for 27 weeks or more — edged up to 3.96 million in December. Long spells of unemployment can make it more difficult for workers to get reemployed, earn higher wages and prevent skills atrophy.

Read more: ‘Why Am I Not Getting a Job?’: Months of No Work Show Risks

Private-sector payrolls — which exclude government jobs — decreased 95,000 during the month following an upwardly revised 417,000 gain in November. State and local government jobs declined by about 51,000 last month, which could also bolster hopes for aid to such entities.

The unemployment rate declined for Black and Asian Americans but ticked up slightly for White Americans. Hispanic Americans saw the biggest monthly increase in their jobless rate, rising from 8.4% to 9.3%.

At the same time, the participation rate for Black, Hispanic and Asian Americans also declined, while it rose slightly for White workers.

–With assistance from Kristy Scheuble, Sophie Caronello, Edith Moy, Benjamin Purvis, Julia Fanzeres, Reade Pickert and Catarina Saraiva.