US jobless claims jump to three-month high amid new shutdowns

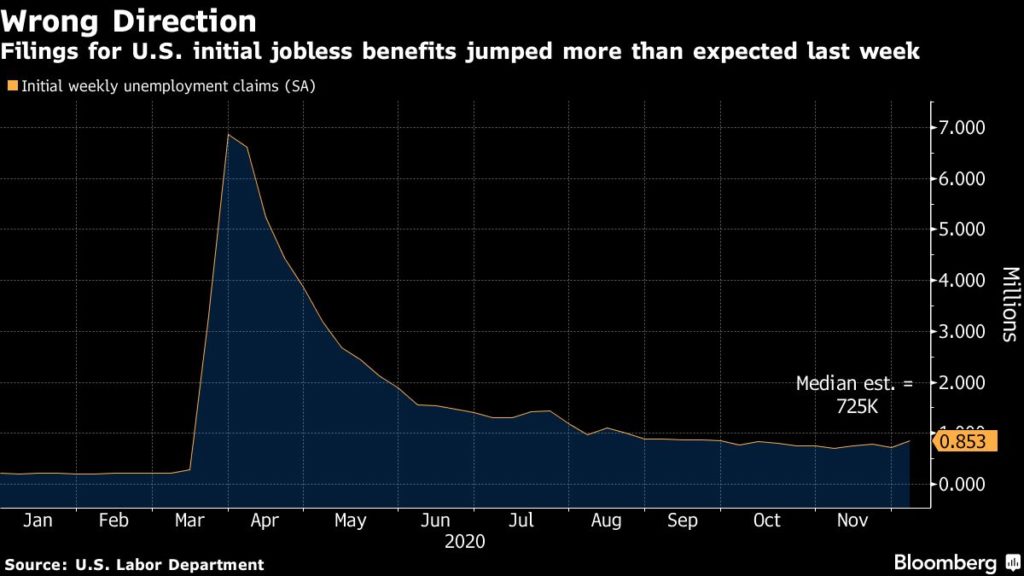

Applications for U.S. unemployment benefits surged last week, topping estimates with the highest level since September, suggesting that widening business shutdowns to curb the pandemic are spurring fresh job losses.

Initial jobless claims in regular state programs rose by 137,000 to 853,000 in the week ended Dec. 5, Labor Department data showed Thursday. On an unadjusted basis, the figure increased by almost 229,000. The prior week included Thanksgiving, and data tend to be volatile around holidays.

Continuing claims, which reflect Americans on ongoing unemployment benefits, jumped by 230,000 to 5.76 million in the week ended Nov. 28. It was the first increase since August.

The claims reading topped all but one estimate in a Bloomberg survey of economists that had called for 725,000 initial claims and 5.21 million continuing claims, on an adjusted basis.

The increase in new claims — which remain at more than triple pre-pandemic levels — implies that the labor market recovery will be held back in coming weeks by new restrictions on restaurants and other in-person businesses. Expected distribution of the first virus vaccines this month could help curb spread and ease restrictions, but it’ll likely take months for it to reach a meaningful number of Americans.

“In general, the trend of employment growth clearly is slowing,” said Jay Bryson, chief economist at Wells Fargo & Co. “Clearly, we’ve lost momentum in terms of the job market.”

The release signals a shaky start for the labor market this month, which could be reflected in the Labor Department’s monthly jobs report for December. Hiring faltered in November with a 245,000 gain that was the weakest in seven months.

What Bloomberg Economics Says…

“The jump in claims is consistent with our expectation that the next jobs report will likely deliver a negative print, reinforcing the need for immediate fiscal stimulus to support the economy.”

— Eliza Winger, associate

For the full report, click here

Meanwhile, the fate of an additional federal pandemic relief package remains unresolved as Democrats and Republicans continue to negotiate. If a deal isn’t reached by the end of the year, millions of Americans could start the new year with lapsed unemployment benefits.

U.S. stocks fell at the open on concern that prospects for a stimulus deal remained elusive and later traded little changed.

The number of Americans claiming Pandemic Emergency Unemployment Compensation, a federal program that extends benefits to those who have exhausted what’s allocated in state programs, decreased slightly to 4.53 million in the week ended Nov. 21.

Data Disclaimer

Continuing claims for Pandemic Unemployment Assistance, which provides benefits to self-employed and gig workers, fell to 8.56 million in the week ended Nov. 21. Those figures, however, have been inflated in recent weeks due to multiple-counting and fraud.

The report included a new disclaimer from Labor, which added a footnote to the newest release saying that the number represents weeks of benefits claimed, rather than the total number of Americans on jobless benefits. This followed a government watchdog’s report that found the figures to be “flawed.”

Read more: Jobless-Claims Data to Come With Disclaimer on Accuracy

“Continued weeks claimed represent all weeks of benefits claimed during the week being reported, and do not represent the number of unique individuals filing continued claims,” the disclaimer said. In total, the report indicated that Americans claimed more than 19 million weeks of unemployment benefits during the week ended Nov. 21, a number that would also include some filings that were made retroactively.

California, Illinois and Texas reported the largest increases in initial claims, while Kentucky, Louisiana and Michigan were among those that posted the largest declines. In the Golden State, where some business restrictions began before the Thanksgiving holiday, claims jumped 36% to almost 178,000.

Read more: Lockdown in Los Angeles Has Rest of Country Wondering Who’s Next

A separate Labor report showed Thursday that a measure of prices paid by consumers rose in November by more than forecast as costs of hotel stays, airfares and apparel jumped, though inflationary pressures elsewhere remained subdued. The consumer price index rose 0.2% from the prior month after no change in October.

The rise in claims “is testing investors’ optimism,” said Jack Ablin, Chief Investment Officer at Cresset Capital Management. “While investors are rightfully celebrating the vaccines, I think that they’re not set up to endure two quarters of pretty daunting economic news.”

–With assistance from Jordan Yadoo, Edith Moy, Henry Ren and Sophie Caronello.

–By Olivia Rockeman (Bloomberg)