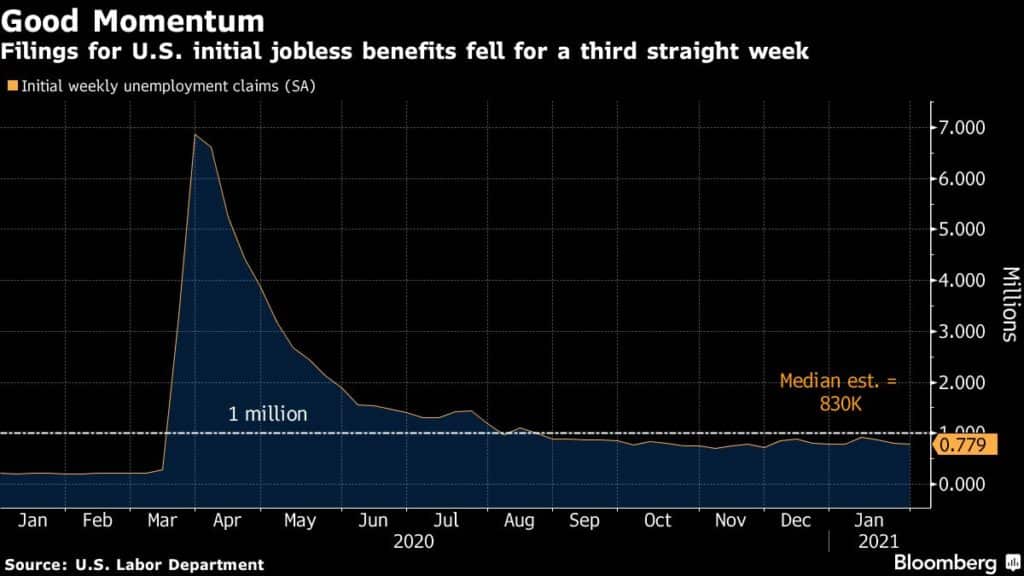

US jobless claims fall to lowest level since end of November

Applications for U.S. state unemployment benefits fell last week to the lowest level since the end of November, a sign that job cuts are starting to slow as Covid-19 infections ebb.

Initial jobless claims in regular state programs decreased by 33,000 to 779,000 in the week ended Jan. 30, the third straight decline, Labor Department data showed Thursday. On an unadjusted basis, applications dropped to 816,247.

Continuing claims — an approximation of the number of Americans filing for multiple weeks of state benefits — decreased to 4.59 million in the week ended Jan. 23. Economists in a Bloomberg survey forecast 830,000 initial claims and 4.7 million continuing claims.

The figures, while still elevated, indicate that layoffs related to the pandemic are starting to ebb after jobless claims picked up in December and early January. In the coming months, as more Americans get inoculated and virus cases fall, economic activity is poised to resume and job cuts may decline further.

Policy makers are starting to lift some of the most stringent business restrictions, which should also help to stabilize the labor market. New York Governor Andrew Cuomo said indoor dining can reopen in New York City on Feb. 14, and California Governor Gavin Newsom lifted the state’s stay-at-home order on Jan. 25.

The S&P 500 rose for a fourth day and the yield on the 10-year Treasury note increased to its highest since mid-March. Some economists, including those at Goldman Sachs Group Inc., raised their forecasts for January payrolls following the claims report and other recent labor market data.

Jobs Report

The jobless claims data precede Friday’s monthly jobs report, which is forecast to show the economy added about 100,000 jobs last month after a 140,000 decline in December. Data from ADP Research Institute Wednesday showed company payrolls increased by 174,000 in January.

On Tuesday, Senate Democrats put President Joe Biden’s $1.9 trillion stimulus plan on a fast track to passage, increasing the likelihood it eventually passes on a party-line vote. The bill text has not been drafted yet, but Biden’s proposal includes an extension of expiring federal unemployment programs through September and an increase of supplemental benefits from $300 to $400 per week.

Separate data Thursday showed productivity — or output per hour — fell in the final three months of 2020 by the most since 1981. The decline was a result of a larger jump in hours worked than in output, as more Americans headed back to work.

Other Details

- States reporting the largest declines in initial claims included Illinois, which showed a more than 55,000 decrease; Among others, Texas and Kansas had declines that exceeded 8,000

- Initial claims in California surged by more than 46,000

- Initial claims for Pandemic Unemployment Assistance for self-employed and gig workers fell by 54,678 to 348,912 last week on an unadjusted basis. The program has been subject to widespread fraud, with California estimating that 95% of the state’s fraudulent payments were for PUA claims

- In the week ended Jan. 16, there were 3.6 million continuing claims for Pandemic Emergency Unemployment Compensation, which provides extended jobless benefits for those who have exhausted their regular state benefits

–With assistance from Erik Wasson, Sophie Caronello and Reade Pickert.