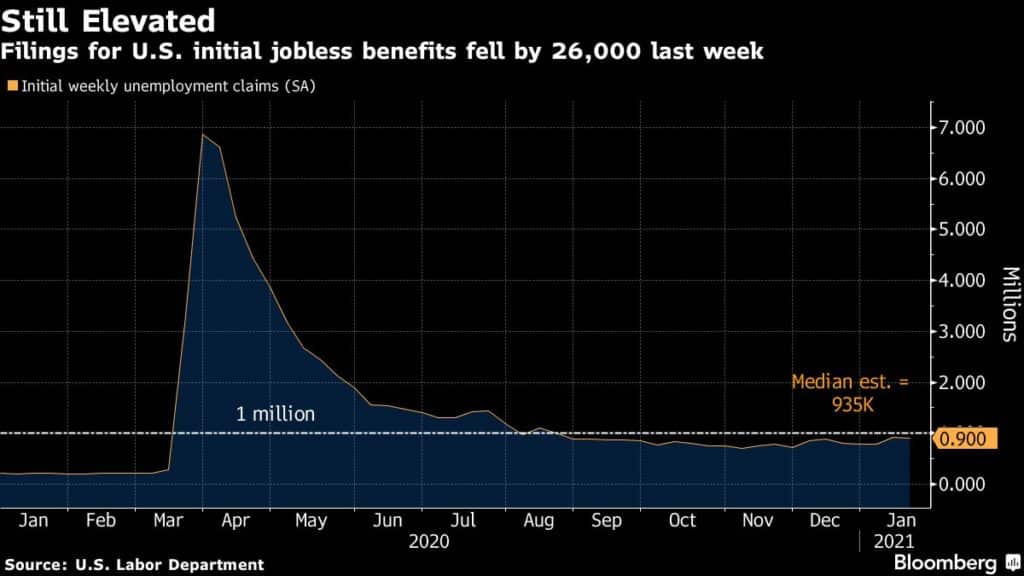

US jobless claims fall slightly, though remain near 1M

Applications for U.S. state unemployment benefits fell only slightly last week and remained elevated, signaling heightened pandemic-related strain in the U.S. labor market just as Joe Biden begins his first days as president.

Initial jobless claims in regular state programs declined by 26,000 to 900,000 in the week ended Jan. 16, according to Labor Department data Thursday. On an unadjusted basis, the figure dropped by more than 151,000 to 960,668.

Continuing claims in state programs — an approximation of the number of people receiving ongoing jobless benefits — decreased by 127,000 to 5.05 million in the week ended Jan. 9. The median forecasts in a Bloomberg survey of economists called for 935,000 initial applications and 5.3 million continuing claims.

The figures continue to far exceed their pre-crisis levels as the resurgent pandemic leads to more stringent business restrictions and stokes people’s fears of infection. Vaccine distribution is expected to restore economic activity later this year, but the rollout has been slower than expected and is limiting the speed at which the job market is able to recover.

“Widespread vaccination is key to stopping the mounting labor-market damage,” said AnnElizabeth Konkel, economist at Indeed Inc. “Until people feel safe again, industries like hospitality and tourism cannot ramp back up. Right now, it’s a muted recovery at best.”

The latest jobless claims figures coincide with the survey week for the monthly employment report, suggesting that the January jobs figures, which will be released on Feb. 5, could show weak payroll gains in the month.

While the U.S. economy has been steady in some areas like housing and manufacturing in recent months, the labor market has struggled to bounce back. The $900 billion pandemic aid package approved in December should provide some relief for workers and businesses in the current quarter, especially if businesses receive Paycheck Protection Program loans and keep employees on payrolls.

Another report Thursday showed new home construction climbed at the strongest pace since late 2006, the latest sign of strength in the housing market. Permit applications were also the firmest in 14 years.

Read more: Housing Starts Rose to Fastest Pace Since 2006

Last week, Biden released details of his $1.9 trillion economic relief plan. If approved by Congress, it would provide $400 per week in supplementary unemployment benefits through September, aid for state and local governments and direct payments of $1,400 to individuals, on top of the $600 approved in December.

Janet Yellen, Biden’s pick for Treasury Secretary, said during a confirmation hearing Tuesday that after the initial relief package, she intends to focus on a second package to “build back better” that would include investment in infrastructure, research and development, training and workforce development.

Other Details

- On an unadjusted basis, the drop in applications for benefits was broad-based across states with California reporting an estimated 58,655 decrease

- Claims for three other states, including Florida, Wyoming and Virginia, were also estimated

- Pandemic Unemployment Assistance, a program for self-employed and gig workers, saw a 138,848 increase in initial claims last week to 423,734 on an unadjusted basis

- In the week ended Jan. 2, there were 3.03 million continuing claims for Pandemic Emergency Unemployment Compensation, which provides extended jobless benefits for those who have exhausted their regular state benefits

–With assistance from Chris Middleton and Sophie Caronello.

–By Olivia Rockeman