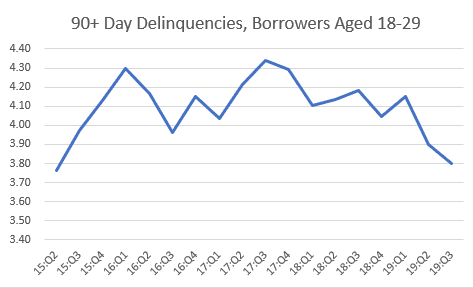

Serious delinquencies improve for young borrowers

Serious delinquencies — auto loans 90 days or more past due — for borrowers aged 18 to 29 years dropped 38 basis points to 3.8% year over year, marking this age group’s lowest delinquency level since 2Q15, according to the New York Federal Reserve’s third-quarter Report on Household Debt and Credit.

Though this age group’s serious delinquency level is the lowest its been in four years, the group still remains the segment with the highest rate of serious delinquency. Borrowers’ delinquency rates in their 30’s came in at 2.98%; 40’s at 2.32%; 50’s at 1.68%; 60’s at 1.41%; and 70+ at 1.75%.

Average delinquency rates across all age brackets came in at 2.34%, an increase of 4 basis points year over year.

Overall, total auto debt in the third quarter increased 3.9% year over year to $1.32 trillion.