Honda, BMW suspend production due to decline in demand

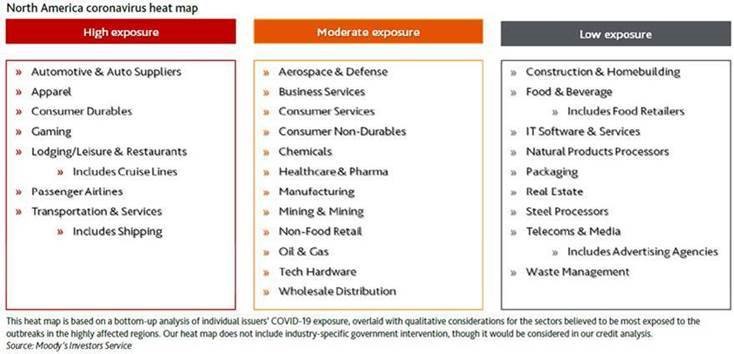

The automotive industry is at risk of high exposure due to fallout from COVID-19, according a Moody’s Investors Service report on coronavirus’ negative impact exposure that was shared with Auto Finance News.

In fact, American Honda suspended manufacturing production this morning in the U.S., Canada and Mexico starting March 28, due to “an expected decline in market demand,” according to a company statement. The plants will be closed for six days, halting production on an estimated 40,000 vehicles.

“As the market impact of the fast-changing COVID-19 situation evolves, Honda will continue to evaluate conditions and make additional adjustments as necessary,” the company said.

BMW AG, too, is also closing its some of its dealerships and plants in Europe said Oliver Zipse, chairman of the board of management, in a presentation to investors today. “The next few weeks will be critical,” he said. “Demand for cars, like many other goods, will decrease significantly.”

Fiat Chrysler, Ford Motors and General Motors also plan to close their manufacturing plants, according to published reports this afternoon, after announcing partial plant closures Tuesday. Cox Automotive expects the SAAR to drop below 16.6 million units, a spokesperson previously told AFN.

Production halts from OEMs could potentially put strain on inventory if pauses are long in duration and consumer demand remains resilient, according to a research note provided by JD Power.

Moody’s expects the spread of coronavirus to affect about 16% of companies under its “baseline scenario,” which “assumes infections rise through the second quarter, leading to further travel restrictions, quarantines, and closures of schools, factories and businesses” around the globe, according to the report. Under the baseline scenario, U.S. GDP-20 growth is estimated to be 2.1% in 2020, down 30 basis points from a previous February forecast.

“Monetary and fiscal measures will help support the global economy later in 2020,” the report said, noting that transportation — including shipping — and consumer durables were also under the same threat as the auto industry.

On the other hand, the number of companies affected by the coronavirus’ spread could jump to 45% under Moody’s “downside scenario,” which forecasts an environment where monetary and fiscal stimulus “won’t be sufficient to buoy the global economy.” In that scenario, U.S. GDP-20 growth is expected to fall to 1.4% by the end of the year.

In addition, nonbank lenders, such as captives, will likely find it harder to secure liquidity from capital markets as the virus spreads, according to a report by S&P Global. Wider spreads could also put pressure on funds as investors flock toward higher yields, the rating agency noted.