Fraud Alert: 70% of early payment defaults tied to fraudulent applications

Certain ZIP codes have a higher concentration of defaults

Early payment defaults are rising amid inflationary pressures, contributing to an increase in auto fraud risk, especially in areas with high percentages of early defaults.

Up to 70% of auto loans in which the borrower stops paying within six months of origination include fraud on the application, according to risk management platform Point Predictive’s latest auto lending fraud trends report. In fact, 91% of lenders surveyed in the report stated that early payment default (EPD) is an early indicator of fraud that was originally missed by lenders.

“Early payment default is a red flag because it is relatively rare,” Point Predictive Chief Fraud Analyst Frank McKenna told Auto Finance News, adding that EPD occurs in less than 1% of prime auto loans and less than 5% of subprime transactions. “It means that somebody has gone into a dealership, given information about their income, their identity and where they’re employed, and seemed to be a good risk of paying the loan back. Then they leave the dealership, and, suddenly, they don’t pay.”

Rising EPD rates

While most EPD is linked to misrepresentation during the loan application process, the rest is related to a borrower’s inability or unwillingness to pay back a loan due to factors such as a lost job, natural disaster or medical emergency, McKenna said, adding that economic challenges are causing EPD rates to rise.

“Cars are getting more expensive and interest rates are higher, so it’s making the car less affordable, and people are lying more to get into those cars,” he said. “People are also maxed out on credit cards and personal loans and are taking on more debt just to live.”

Financiers will typically review loans that default early on for potential fraud, and when evidence of fraud is found, many lenders will push those loans back to the dealers to recoup their funds, McKenna said.

Lenders have named dealer fraud as one of their top three priorities to solve in 2023 with 85% indicating that they require dealers to buy back loans at least some of the time when fraud is found, according to the report.

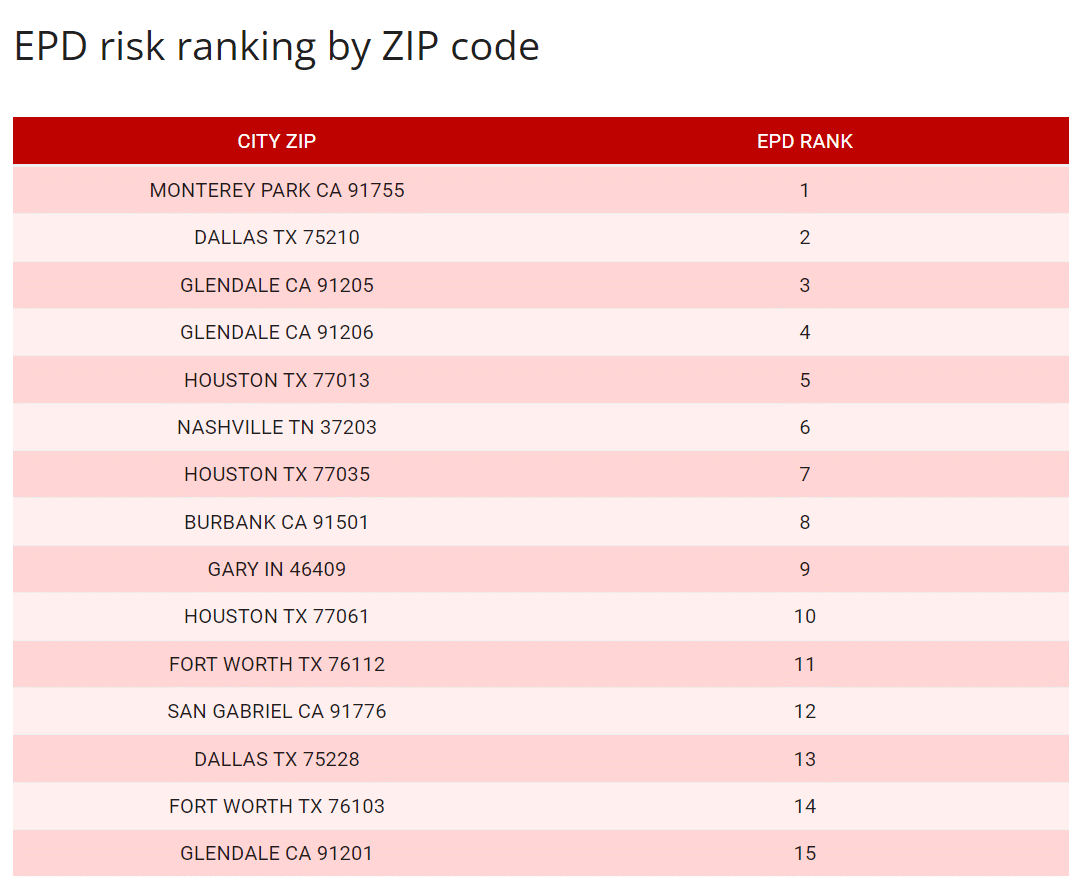

EPD risk by ZIP code

Certain areas of the country carry higher EPD rates, likely indicating they are at high risk for potential fraud, McKenna said. “When you have a high concentration of loans that are defaulting within the first six months, it suggests there could be active fraud,” he said.

ZIP code 91755 in Monterey Park, Calif., had the highest concentration of EPD in 2022 for all areas included in Point Predictive’s analysis, according to ZIP code fraud analysis data provided exclusively to AFN. The list spans more than 800 ZIP codes nationwide.

ZIP code 75210 in Dallas was ranked second in EPD concentration, followed by 91205 and 91206 in Glendale, Calif. ZIP code 77035 in Houston rounded out the top five areas based on EPD concentration.

“Glendale is a pretty high-risk area in California for certain types of fraud ring activity,” McKenna said, adding that identity theft and credit card fraud often occur there. “Houston is just a hotbed for fraud.”

ZIP codes may see a higher EPD concentration if some dealerships manipulate borrower information, McKenna said. “You see that, as well, where a car dealer in a certain ZIP code is taking in a lot of fraud. That’ll make a ZIP code pop up because all the people in that area are going to that dealership,” he said.

Natural disasters that destroy vehicles or massive layoffs at a large employer might also contribute to an uptick in EPD in certain ZIP codes, McKenna said, noting that some areas always see high rates of EPD while an uptick in others is driven by short-term factors.

Source: Point Predictive

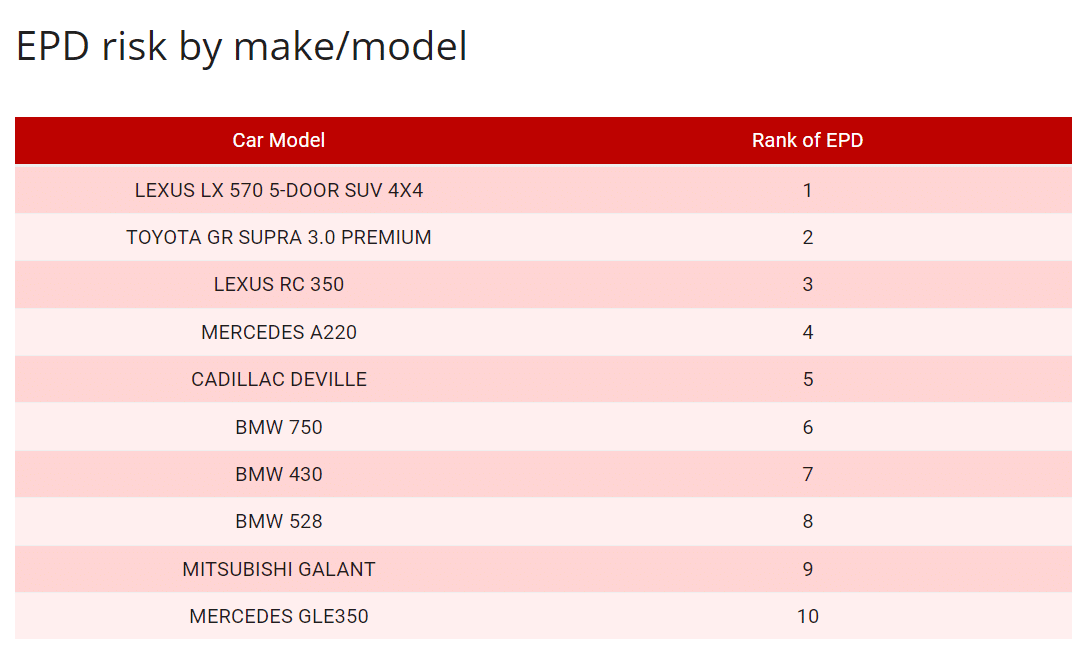

EPD by make and model

Certain vehicle makes and models also tend to carry a higher risk of EPD and a large portion are tied to fraudulent activity, McKenna said. Many vehicles tied to loans that defaulted within six months are luxury brands, with Lexus, Mercedes and Cadillac models topping the most recent list, according to Point Predictive data provided exclusively to AFN.

Toyota, Nissan and Dodge models also saw a high concentration of EPD risk in 2022. Older used cars may be tied to EPD activity because a consumer stopped paying due to the vehicle’s condition, McKenna said.

“You’ll see some luxury vehicles that have high rates of EPD because they’re sought after by fraudsters,” he said. “Then every so often … if you get an old car and drive it off the lot and it breaks down, you’re likely not to make your payments.”

Source: Point Predictive

— Additional reporting by Joey Pizzolato

Editor’s note: This story is the second in a three-part series providing an in-depth look at trends in auto finance fraud in 2022.

The Big Wheels Auto Finance Data 2023 report, the only tabulation of the top 200 auto lenders by outstandings, is available now.