Ally sets record with used-car volume

Used-car loan originations hit $5.24 billion at Ally Financial in the second quarter, the highest level ever for the lender.

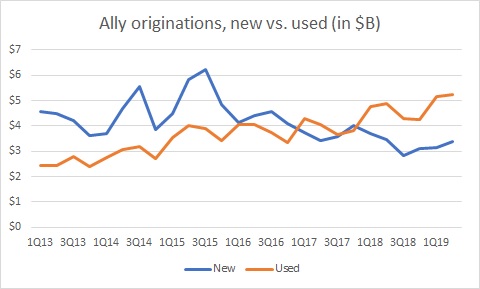

Ally initially surpassed the $5-billion mark for used-car volume in the first quarter, notching $5.15 billion in originations. Used volume has been on an upward trajectory at Ally since the third quarter of 2017.

“We have made a very concerted effort to go after the used business,” Erin Klepaski, Ally’s executive director of strategic alliances, told Auto Finance News. “Strategically, used is really important to our business because it’s depreciated up front and it’s not subject to the incentive structure of the OEM. So that’s a great way for us to balance our portfolio.”

The higher used-car volume has bumped up yields for Ally. The company expects full-year yields in the 7% to 7.5% range, Chief Financial Officer Jenn LaClair said on the company’s second-quarter earnings call. Ally’s retail portfolio yield was 6.58% at midyear, up from 6.40% last year and 5.80% in 2017.

For now, dealers are eager to stock their lots with off-lease vehicles. “What drives it for us is that a lot of dealers are focused on finding used inventory,” Klepaski said. “There’s pretty high demand for that. And [dealers] have talked to us about a struggle to find that right mix of use inventory, but that they have a strong desire to find it. So, if that’s their focus, that’s going to be our focus.”

Looking ahead, though, the third and fourth quarters are typically “more of a new-vehicle season” for Ally, LaClair said. Already, Ally is seeing evidence of that trend. “August is going to be a huge new-car month,” Klepaski said. “You’ve got five weekends in August, and you’ve got Labor Day coming into August.”

Ally’s new-car volume has been hovering around $3.5 billion since early 2017. As a percentage, new-car loans accounted for 35% of originations last quarter down 20 percentage points from 2015 levels.

Here’s a look at Ally’s new-versus-used origination volume since 2013: