Capital One originations increase more than 20%

Capital One Auto Finance’s originations grew in the first quarter following several quarters of year-over-year declines. Originations totaled $7.5 billion,...

by Amanda Harris and Joey Pizzolato – October 3, 2022

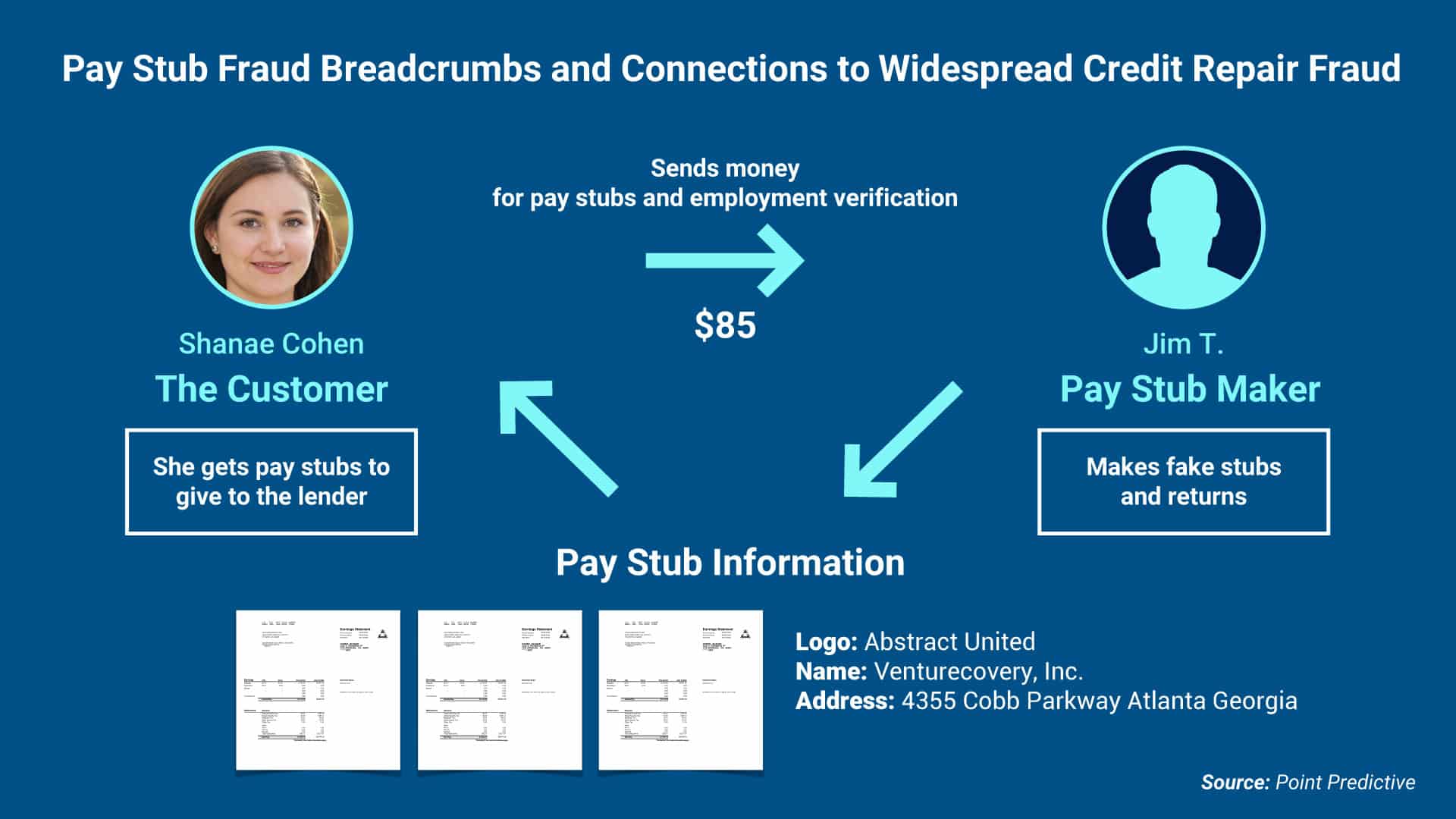

Meet Shanae Cohen: Her name was created by a random name generator and her face made with an artificial intelligence (AI)-powered face generator; she has a birthdate, email address, and Facebook and Instagram accounts.

It took only 35 minutes for Auto Finance News to make a digital footprint for Cohen, and just two days later she had a credit privacy number (CPN) and multiple pay stubs “verifying” her $52,000 yearly salary from working at debt management and investment company Venturecovery, Inc., located in Atlanta.

This entirely fictitious person was created by the AFN editorial staff to investigate just how easy it is to obtain a CPN, tradelines and the fraudulent pay stubs necessary to apply for an auto loan.

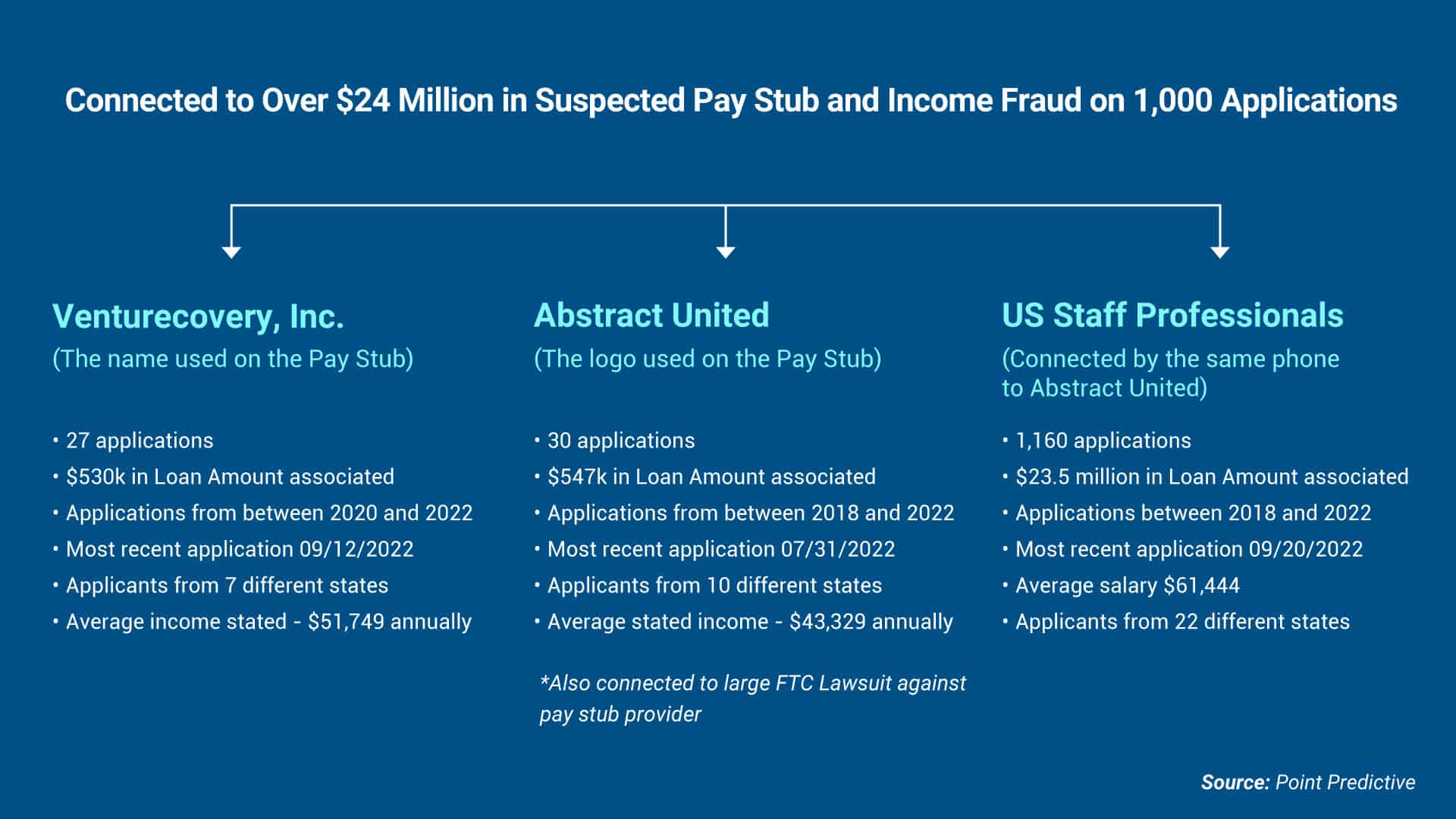

Venturecovery and Abstract United, a logo also stamped on Cohen’s pay stub, along with an “employer” phone number, are all linked to more than $24 million in fraudulent auto loan applications between 2018 and 2022, according to an analysis of documents AFN obtained during the course of the investigation by risk management platform Point Predictive.

In total, it took about 20 hours and $160 sent via PayPal and Venmo for the fictitious Cohen to have nearly everything necessary to apply for a car loan using a false credit and employment history. The AFN team was able to “verify” Cohen’s employment history with Venturecovery via a phone call a few days later.

While AFN did not purchase tradelines, “activate” the purchased CPN or use any of the false documents to apply for credit, the surprising ease and speed with which the editorial team was able to create a false borrower and obtain basic funding stipulations documentation demonstrates how credit fraud has become even more challenging to stop.

Synthetic identity fraud is a type of identity theft that often uses a consumer’s real name and birthdate along with a false Social Security number or CPN, and it has plagued the auto finance industry for years. But pandemic-accelerated shifts in how the industry does business and transacts with its customers have opened additional opportunities for fraudsters.

Post-pandemic, more auto lenders are implementing online applications and moving their platforms to cloud-based technologies as consumers increasingly prefer shopping and applying for credit online. In fact, during the first half of 2022, the volume of digital auto finance transactions grew 122.1% year over year in Q1 and 282% YoY in Q2, according to the Wolters Kluwer Automotive Finance Digital Transformation Index.

As banks and financial institutions adopt auto decisioning tools to streamline the loan application process, lenders are missing applications created with fake pay stubs or fraudsters adding fake auto tradelines to make it look like the consumer meets the parameters, however it’s nothing more than a synthetic profile, Scott Ellefson, fraud specialist at VW Credit, told AFN.

“Fraudsters prey on the fact that lending has become much more automated,” said Mike Pereira, vice president of lending operations at Clearwater, Fla.-based MidAtlantic Finance Company.

These scammers are able to falsify employment and income information and are causing a spike in fraudulent activity. Fraud specifically tied to income and employment misrepresentation is estimated to have cost auto lenders $4.7 billion in 2021, according to data from Informed.IQ, an AI and machine learning (ML)-powered document analysis provider.

By another measure, this means nearly 60% of all auto loan fraud included falsified income or employment information last year, according to a similar analysis by Point Predictive.

The cost of fraud:

In total, fraud and misrepresentation cost auto lenders an estimated $7.7 billion in 2021. This number, measured by funded originations that were identified as likely having some element of fraud, was up 5.5% YoY and up 10% compared with end of year 2019, according to Point Predictive’s 2022 Auto Fraud Trends Report.

On the ground, lenders both large and small are dealing with this mounting problem.

At Ally Financial, for one, synthetic fraud is a major issue, Kevin Faragher, senior director of product and strategy at the bank, said at the Bank Automation Summit in September. “We have folks that are either partially or completely making up a credit profile that is designed to get through our underwriting systems.” Ally had $92.7 billion in auto outstandings as of Q2 2022.

Fraudulent pay stubs are common in synthetic fraud, Faragher said. “If you’re going to have a synthetic identity, you’ve got to have a pay stub that supports your synthetic identity.”

At MidAtlantic Finance Company, “the fake pay stub issue is probably our biggest issue that we see today,” Pereira told AFN, noting that as a deep subprime lender, MidAtlantic heavily relies on pay stubs and bank statements for loan decisioning.

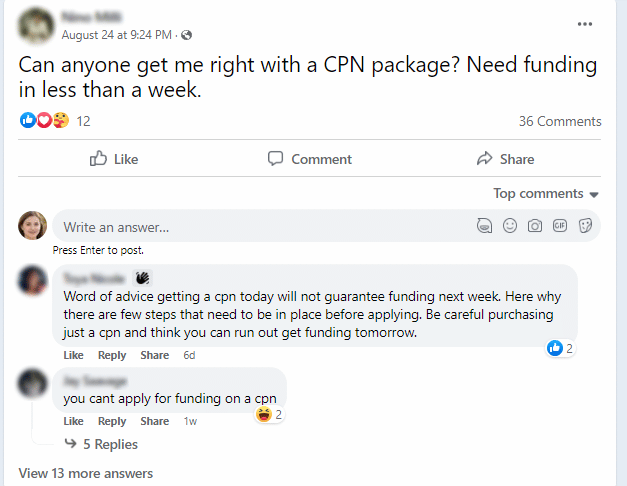

Fraudsters have latched onto the well-intentioned credit repair industry and are preying on consumers looking to improve their financial health with misrepresented products and services.

“Credit repair is typically the root cause” of synthetic identity fraud, Point Predictive Chief Fraud Analyst Frank McKenna told AFN. “When we think about credit repair, 99% of the industry is totally legitimate; credit repair exists to help consumers … with their credit, or fixing errors on their credit report.

“What’s emerged over the last 10 to 15 years is the seedy element: Those people that are taking advantage of those consumers that don’t have good credit and are taking them down the route to unknowingly committing fraud,” McKenna said. “And how it starts is, you’re on social media and you see an advertisement.”

VW Credit’s Ellefson noted that the current fraud problem has grown out of the credit repair programs that were initially designed to help consumers.

“The id theft dispute process was a system designed with good intentions to help true victims of identity theft … but it has been completely tainted and taken over by credit repair companies.” — Scott Ellefson

Ellefson said the cost associated with fraudulent income verification at VW Credit could be in the millions, noting that lenders can only estimate fraud losses based on what they find. “It’s how good are you at categorizing your fraud,” he said. “You can put in all the tools upfront that you want, but unless you’re also doing your back-end audits to have that positive feedback loop, you’ve only solved half of it.”

Many lenders are fighting back.

MidAtlantic’s Pereira estimates pay stub and bank statement fraud cost the lender “millions of dollars” a year and a half ago, but losses are about half that now, he said. “We have had a significant reduction in losses and a large part of it is because of what we’re doing on fraud prevention.”

The lender works with software-as-a-service provider TurboPass to analyze and verify bank statements and with Point Predictive to identify income discrepancies, he said. It is also working to sign on with a new fintech partner within the next 90 days that will verify pay stubs, he added. Ally, too, is partnering with Informed.IQ to identify fraudulent pay stubs using robotic process automation (RPA) and AI.

And to be fair, not all fraudulent applications yield a loss. Some accounts that used a falsified pay stub or CPN to open an auto loan are actually performing, VW Credit’s Ellefson said. In fact, Point Predictive data indicates that only 30% of auto loans industrywide that included fake employer information in 2021 were charged off, and 60% of those charge-offs defaulted within the first six months following origination.

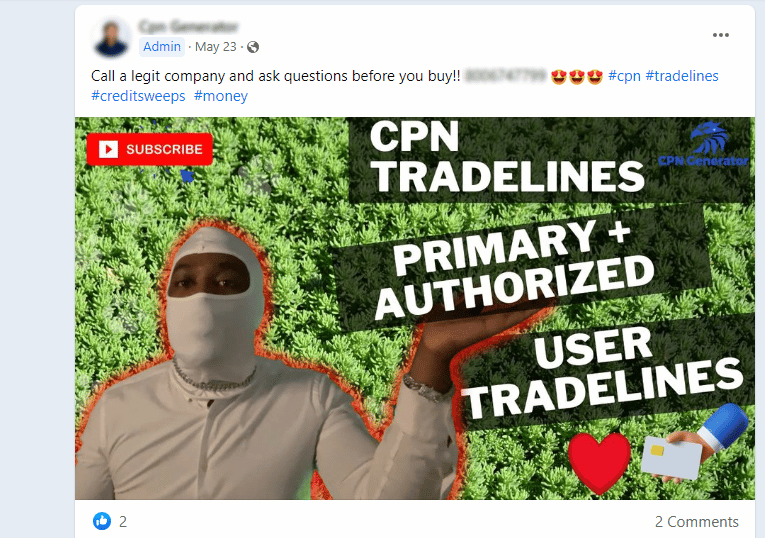

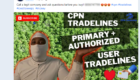

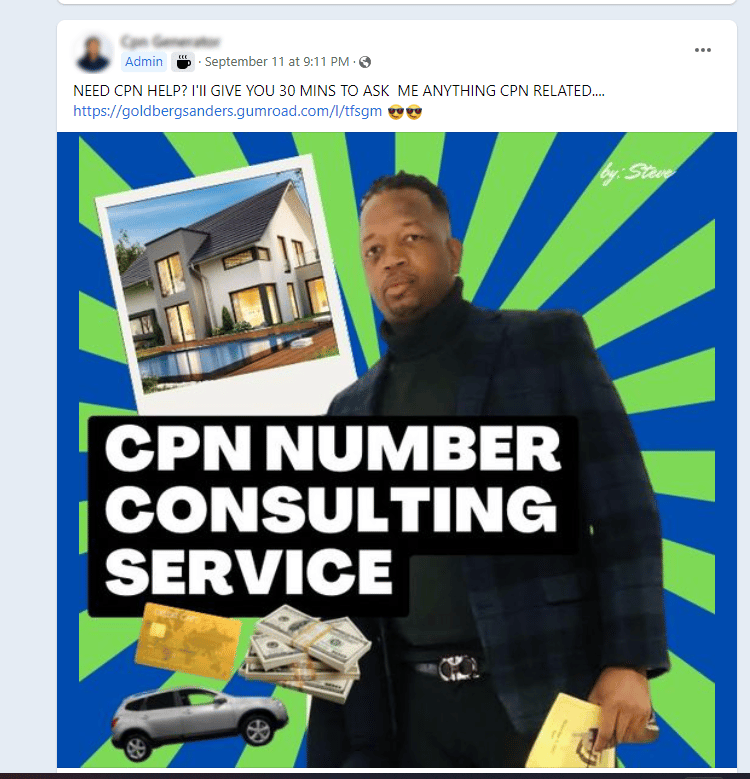

The proliferation of social media and content creation websites has made fake pay stubs “so prevalent and so easy to come by,” Ellefson said, noting videos on social media platform TikTok and YouTube teach consumers how easy it is to repair their credit and delete “bad” tradelines. “You don’t have to go to the dark web to add tradelines on anymore; they’re right there at your Googling fingertips. It’s wholly unregulated.”

In fact, a simple search on Facebook for “credit repair” populated hundreds of different groups with membership ranging from the hundreds to tens of thousands. The hashtag #creditrepair had more than 122,000 mentions on Facebook as of Oct. 3.

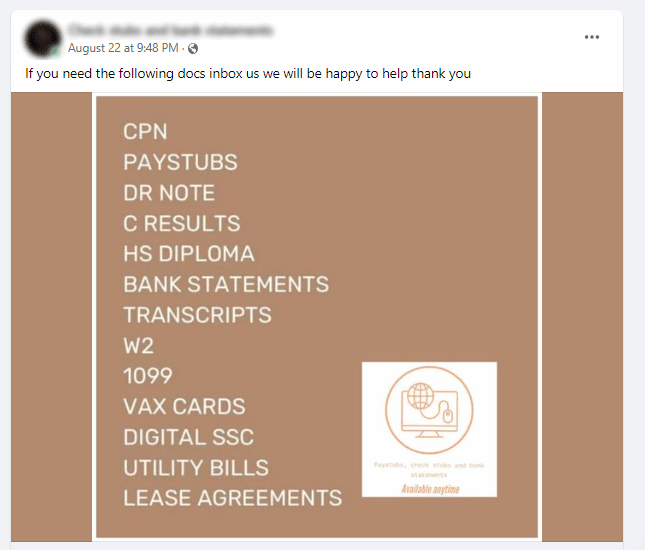

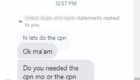

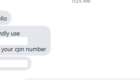

Within these groups, users openly post solicitations to sell CPNs, tradelines and fake pay stubs, among other “novelty” products, such as doctors notes. Users can also openly request fraudulent documents, and sellers will reply and instruct the buyer to send them a private message (PM). The remainder of the transaction, including arranging payment, takes place through PMs.

It’s a similar story on Instagram, where users dedicate entire accounts to advertising credit repair services. Many services provide phone numbers and email addresses, and potential buyers can also contact sellers directly via PM. The number of posts on Instagram containing the #creditrepair hashtag amounted to more than 2.4 million as of Oct. 3.

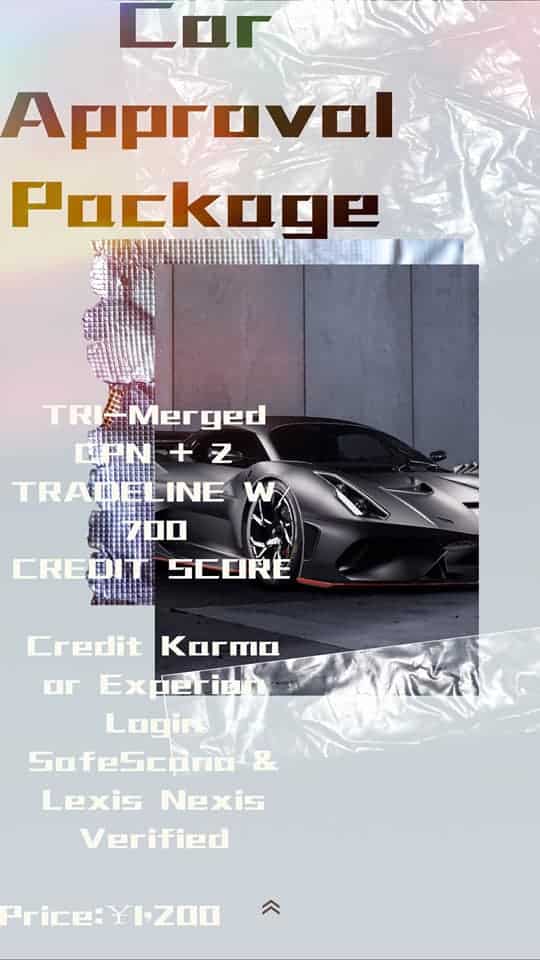

AFN, with the help of fraud analysts at Point Predictive, identified more than a dozen known and likely sellers of CPNs and fraudulent pay stubs on Instagram and Facebook. CPNs without tradelines were advertised for as little as $75 and pay stubs without verification are sold for only $30. CPNs with active tradelines and the promise of an “800” credit score ranged from $485 to $800.

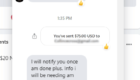

Under the guise of the fictitious Shanae Cohen, AFN sent out seven private messages to sellers across Facebook and Instagram, and posted in a credit repair group on Facebook, which generated 14 private messages over the course of two weeks. Within hours of initial outreach, Cohen was discussing service options and pricing with multiple individuals. In total, she heard back from four providers and landed on purchases from two.

Meta, the parent company to Facebook and Instagram, has policies in place that “do not allow the sharing of private information or inauthentic behavior,” a spokesperson told AFN. Under the policy, it is forbidden to share personally identifiable information about oneself or others, including Social Security Numbers, credit privacy numbers and civil registry information, among others.

Cohen was provided a CPN via Facebook Messenger, along with screenshots of pay stub formats to choose from, then received the final documents through email.

It is not immediately clear which, if any, of the posts and communications are against Meta’s terms of service. Meta did not respond to additional requests for comment when provided evidence of advertisements for falsified pay stubs, CPNs and other documents listed on Facebook along with examples of Cohen’s interactions with providers through the platform.

The pay stubs provided to AFN from one Facebook user, who has been given an alias for privacy reasons, were tied to $24 million in applications flagged as fraudulent, according to a Point Predictive analysis of the stubs. The company cross-referenced key identifying information on the stubs — such as the employer’s name, phone number and logos — with its own fraud consortium data.

Three key identifiers were tied to three known fraud rings.

Cohen’s listed employer, Venturecovery, was tied to 27 fraudulent loan applications representing $530,000 in loan amount from 2020 to 2022, according to Point Predictive. Those auto loan applications came from seven different states, with the most recent one coming Sept. 12. Venturecovery was incorporated in 2018 in Georgia, according to OpenCorporates, which monitors corporate filings.

Abstract United, whose company logo was listed in the top right of the pay stub, has been tied to 30 fraudulent applications representing about $547,000 in loans, according to Point Predictive. Applications have been received from 10 different states between 2018 and 2022, with the most recent application made July 31.

Abstract United is a now-defunct limited liability company that once operated in Texas until 2018, according to OpenCorporates. That same year, the company was also the subject of a Federal Trade Commission (FTC) lawsuit in the Southern District of Texas that sought injunctive relief against the company’s owner, George Jiri Strnad II, for the marketing and sale of false documents such as pay stubs, bank statements, tax forms and employment verification, according to the filing. In addition to Abstract United, PayStubDirect.com, PaycheckStubOnline.com and iVerifyMe.com were also listed in the complaint.

Finally, a phone number associated with auto loan applications listing Abstract United was also connected to a separate known fraud ring, which lists a temp agency, US Staff Professionals, as the employer. More than 1,160 applications have come through the consortium from 2018 to 2022, representing $23.5 million in associated fraudulent loan amount, with the most recent application hitting on Sept. 20.

A spokesperson from Venturecovery verified Cohen’s employment tenure and income with a Point Predictive analyst who posed as an auto lender for the phone call.

Police, federal investigators, lenders and dealers are aware how increasingly easy it is for consumers to obtain false pay stubs with verification of employment to apply for a car loan. However, they are too overwhelmed by the sheer volume of fraudulent documents coming through on a daily basis to weed out providers.

Sgt. Darren Schlosser, who oversees vehicle fraud investigations at the Houston Police Department, started the department’s dedicated vehicle fraud unit five years ago to solely focus on auto dealership cases involving fraud. Prior to the narrowed focus, the unit also handled motor vehicle burglaries and stolen credit card usage. Since the unit began focusing on high-value crimes at dealerships, it has prevented about $5.9 million in fraudulent vehicle sales tied to suspects who were arrested for committing fraud inside dealerships, Schlosser said.

The unit works closely with dealerships to identify cases where a fraudster has used, or attempted to use, a fake ID to purchase a vehicle; the unit alerts other dealerships within the Department’s jurisdiction, and trains dealers on how to prevent fraudulent purchases, Schlosser told AFN.

In addition to sending out active fraud alerts in real time, the unit communicates with the Houston Automobile Dealers Association and the Houston Independent Automobile Dealers Association along with insurance companies and finance companies such as Toyota Financial Services, Wells Fargo and Chrysler Capital to identify and prevent attempted fraud, Schlosser said. The prevention of millions in fraudulent loans by the unit was made possible largely because dealership personnel could see the scammers in person, he noted.

But it is much harder to identify the perpetrators committing fraud from behind a keyboard — and this is just one difficulty law enforcement personnel face in policing online synthetic identity and pay stub fraud.

“The people who are financing the credit, they don’t know whether the person is fraudulent or a real individual,” said Schlosser, a 26-year veteran of the police force. “Eventually, the lender gets saddled with this debt that turns into collections. Who is going to collect on that?”

On the other hand, when real consumers purchase false documents, some are purposefully breaking the law while others might not realize they are doing something illegal, Schlosser said. “Both forms are hard to prove because there is no real method in place that verifies 100% that somebody is using a fraudulent CPN,” he said, emphasizing how easy it is for anyone to get a CPN with a “fully developed credit profile” online for a few hundred dollars.

Online scammers are also trained to hide their identities, making it difficult for police to act, Katherine Romano Schnack, of counsel for law firm McGlinchey, told AFN. Schnack’s fraud experience spans more than 20 years, starting with her position as an attorney at the FTC from 2000 to 2005 and across roles at multiple law firms.

“Even if [police] get a lot of complaints from consumers who might have thought that they were using legitimate companies, and that what they were doing was legal, tracking down the actual scammers that are behind the operation is much more difficult because they know how to hide,” she said.

Another challenge is identifying fraudulent information on pay stubs and credit applications. Typically, consumers will use their real name, date of birth and driver’s license number but obtain a CPN to provide a better credit history on the loan application, Schlosser said, noting it is difficult for law enforcement to verify Social Security Numbers with the Social Security Administration due to the administration’s policy.

Building a synthetic identify fraud case is also nearly impossible with the current resources at law enforcement’s disposal, especially since much of the fraud is being perpetuated on websites or social media profiles that aren’t clearly tied to any one perpetrator, Schlosser said.

“In order for us to make a case, we must know that a [specific] person did it. We don’t have the resources, the manpower or technology in place to backtrack where all these people are, to track their IP addresses, to figure out they’re working at this place. Even if we have the IP address, we can’t typically prove a specific person did the transaction,” he said.

“When everything is done online, we can’t do anything because we don’t have the resources to take them down.” — Sgt. Darren Schlosser

As of mid-September, Schlosser alone had 30 open vehicle fraud cases on his desk in a jurisdiction that covers the Greater Houston area. The unit’s cases can include document fraud, identity theft and synthetic identity fraud, he said, noting the vehicle fraud division includes himself and one detective. The department clears cases as quickly as possible, sometimes closing a case until new information becomes available, but longer-term investigations can be open more than a year, he noted. “We’re just massively overwhelmed with the sheer volume.”

When does selling a number become illegal? This is a bit of a legal gray area, Schlosser said. Selling a random number for $100, for example, doesn’t rise to the level of lawbreaking unless it is attached to a credit profile or actual identifying data.

The struggle for law enforcement and the courts lies in determining the difference.

Regardless, selling a CPN is never legitimate, Schnack said. By the same token, falsifying employment information or pay stubs and selling these to consumers online is illegal, but the challenge lies in enforcing the law, she said.

“For criminal charges, that would be up to local authorities for what constitutes fraud under their state’s law,” Schnack said, noting that creating a pay stub for the purpose of helping a consumer submit a falsified income history for a loan application typically constitutes fraud in a criminal sense.

“It’s more of an issue of resources; [police] obviously can’t go after everybody,” she said. “They have to prioritize what kinds of crimes particular law enforcement agencies are going to focus on. [Pay stub and synthetic identity fraud] tends to be one of the lower priority items.

“If you want to purchase somebody else’s information on the dark web, there are tons of places where you can do that,” Schnack added, noting that there are substantial cybercrime operations in foreign countries dedicated to defrauding Americans, especially in the financial services space.

“We know that it is happening, but that is not something that law enforcement can eradicate because it does not have jurisdiction and the country will not cooperate with the U.S.” — Kat Schnack

While internet fraud is likely here to stay, combating cybercrime is not impossible, Schnack said, noting agencies such as the U.S. Secret Service and the Federal Bureau of Investigation (FBI) have dedicated cybercrime task forces to prevent, detect and investigate financial crimes.

The FBI’s Criminal Investigation Division declined AFN’s multiple requests for an interview.

The FTC and the Consumer Financial Protection Bureau (CFPB) also have authority to go after fraudulent practices, Schnack said. The CFPB can investigate practices that are unfair, deceptive or abusive and could argue that those selling falsified documents and CPNs online are engaging in deceptive practices that in reality does affect a substantial number of consumers, she said.

While regulators could file civil enforcement actions against scammers — such as the FTC’s 2018 case against Abstract United — they are required first to identify who is behind the operation, Schnack said. “You’re bringing an enforcement action against someone who already doesn’t care if they’re violating the law. Giving them another order of a court that says stop [defrauding people] will be meaningless to someone who is an actual scammer.”

Communication is one effective prevention method, Schnack said, noting law enforcement, lenders and federal agency members often share information with each other, such as an uptick of fraud activity within a particular area. “Information-sharing is one of the best ways to try to prevent and mitigate this kind of fraud,” she said.

“Some of these pay stubs, if you really look at them closely you can see — without even doing any kind of analytics on it — that there are things in there that are noticeably altered.” — Mike Pereira

Under the Bank Secrecy Act, financial institutions are required to file suspicious activity reports within 30 days of detecting facts that “may constitute a basis for filing a suspicious activity report,” or within 60 days if no suspect was identified on the date of detection.

“Everyone understands that law enforcement can only do so much, so the more that financial institutions can share information among themselves, the better,” Schnack said, noting lenders will flag multiple applications using the same name or suspicious-looking information.

And there are other red flags lenders can watch out for, such as pay stub templates that are available for purchase online, VW Credit’s Ellefson said. In fact, the pay stubs provided to AFN had the key characteristics of a template, Point Predictive said, including incorrect deductions, incorrect overtime rate, reused numbers and font size variance, among others.

“Some of these pay stubs, if you really look at them closely you can see — without even doing any kind of analytics on it — that there are things in there that are noticeably altered,” MidAtlantic’s Pereira said.

Shanae Cohen may be fake, but the costly problem she represents is all too real for lenders.

Cohen was well on her way to an “800” credit score; a few hundred dollars, a couple more messages and a willingness to break the law is all it would have taken. She represents the real consumers who daily obtain false pay stubs and fraudulently enhance their credit history to get an auto loan, whether the intent is malicious or not, Point Predictive’s McKenna said.

“It’s harder to get a loan when you’re self-employed, and it’s impossible to get one when you’re unemployed,” McKenna said.

“There’s always going to be fraud. No matter what you do,” he said. “People will always find a way around whatever you do. It’s about managing it to a certain level of acceptable risk.”

— Additional reporting by Whitney McDonald and Riley Wolfbauer.

Auto Finance Summit, the premier industry event for auto lending and leasing, returns October 26-28 at the Wynn Las Vegas. To learn more about the 2022 event and register, visit www.AutoFinanceSummit.com.

Capital One Auto Finance’s originations grew in the first quarter following several quarters of year-over-year declines. Originations totaled $7.5 billion,...

Used-vehicle values continue to trend downward from 2022’s peak levels but are outpacing pre-pandemic levels. Used-car values remained unchanged from...

U.S. new-vehicle sales are projected to decline in April while the seasonally adjusted annual rate is expected to finish above...

| Cookie | Duration | Description |

|---|---|---|

| 34f6831605 | session | General purpose platform session cookie, used by sites written in JSP. Usually used to maintain an anonymous user session by the server. |

| a64cedc0bf | session | General purpose platform session cookie, used by sites written in JSP. Usually used to maintain an anonymous user session by the server. |

| CookieConsentPolicy | 1 year | Used to apply end-user cookie consent preferences set by our client-side utility. |

| cookielawinfo-checkbox-advertisement | 1 year | Set by the GDPR Cookie Consent plugin, this cookie is used to record the user consent for the cookies in the "Advertisement" category . |

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| crmcsr | session | General purpose platform session cookie, used by sites written in JSP. Usually used to maintain an anonymous user session by the server. |

| JSESSIONID | session | The JSESSIONID cookie is used by New Relic to store a session identifier so that New Relic can monitor session counts for an application. |

| LS_CSRF_TOKEN | session | Cloudflare sets this cookie to track users’ activities across multiple websites. It expires once the browser is closed. |

| LSKey-c$CookieConsentPolicy | 1 year | Used to apply end-user cookie consent preferences set by our client-side utility. |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

| Cookie | Duration | Description |

|---|---|---|

| __cf_bm | 30 minutes | This cookie, set by Cloudflare, is used to support Cloudflare Bot Management. |

| _zcsr_tmp | session | Zoho sets this cookie for the login function on the website. |

| 663a60c55d | session | This cookie is related to Zoho (Customer Service) Chatbox |

| e188bc05fe | session | This cookie is set in relation to Zoho Campaigns |

| Cookie | Duration | Description |

|---|---|---|

| _ga | 2 years | The _ga cookie, installed by Google Analytics, calculates visitor, session and campaign data and also keeps track of site usage for the site's analytics report. The cookie stores information anonymously and assigns a randomly generated number to recognize unique visitors. |

| _gid | 1 day | Installed by Google Analytics, _gid cookie stores information on how visitors use a website, while also creating an analytics report of the website's performance. Some of the data that are collected include the number of visitors, their source, and the pages they visit anonymously. |

| CONSENT | 2 years | YouTube sets this cookie via embedded youtube-videos and registers anonymous statistical data. |

| vuid | 2 years | Vimeo installs this cookie to collect tracking information by setting a unique ID to embed videos to the website. |

| Cookie | Duration | Description |

|---|---|---|

| __Host-GAPS | 2 years | This cookie allows the website to identify a user and provide enhanced functionality and personalisation. |

| _dc_gtm_UA-1038974-3 | 1 minute | Used to help identify the visitors by either age, gender, or interests by DoubleClick - Google Tag Manager. |

| _fbp | 3 months | This cookie is set by Facebook to display advertisements when either on Facebook or on a digital platform powered by Facebook advertising, after visiting the website. |

| fr | 3 months | Facebook sets this cookie to show relevant advertisements to users by tracking user behaviour across the web, on sites that have Facebook pixel or Facebook social plugin. |

| test_cookie | 15 minutes | The test_cookie is set by doubleclick.net and is used to determine if the user's browser supports cookies. |

| VISITOR_INFO1_LIVE | 5 months 27 days | A cookie set by YouTube to measure bandwidth that determines whether the user gets the new or old player interface. |

| YSC | session | YSC cookie is set by Youtube and is used to track the views of embedded videos on Youtube pages. |

| yt-remote-connected-devices | never | YouTube sets this cookie to store the video preferences of the user using embedded YouTube video. |

| yt-remote-device-id | never | YouTube sets this cookie to store the video preferences of the user using embedded YouTube video. |

| yt.innertube::nextId | never | This cookie, set by YouTube, registers a unique ID to store data on what videos from YouTube the user has seen. |

| yt.innertube::requests | never | This cookie, set by YouTube, registers a unique ID to store data on what videos from YouTube the user has seen. |

| Cookie | Duration | Description |

|---|---|---|

| caf_ipaddr | session | No description available. |

| city | session | No description available. |

| country | session | No description available. |

| gnt_eid | session | No description available. |

| gnt_eu | 6 hours | No description |

| iamcsr | session | Zoho (Customer Support) sets this cookie and is used for tracking visitors (for performance purposes) |

| system | session | No description available. |

| traffic_target | session | No description available. |