Used vehicle market: Not what it used to be

Used market still suffering from pandemic-era supply shortages

The used-vehicle market isn’t what it used to be.

Pandemic-induced supply chain shortages coupled with a downturn in leasing have had lasting change on the used-vehicle market, leaving manufacturers and consumers to navigate higher prices and limited supply while lenders address growing affordability challenges.

“Consumers’ expectations or perceptions of what’s normal do not match with today’s reality,” Ivan Drury, senior manager of insights at Edmunds, an automotive information site, told Auto Finance News. “Prices are down, but they are still much higher than what people are accustomed to paying or want to pay.”

Fewer off-lease vehicles

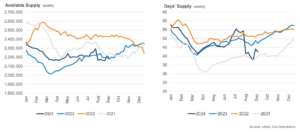

Lease returns are especially crucial for rebuilding the supply of 3-year-old vehicles. These remain in short supply even compared with the pandemic-era market three years ago, David Paris, director of product and market intelligence at J.D. Power, a data analytics company, told AFN.

“If you think back to the vehicles that weren’t being produced — millions and millions during the production constraints — and all the leases that weren’t being originated back then, it’s starting to rear its head,” he said.

The number of leases expiring in August 2024 decreased 16% year over year, according to an Aug. 29 J.D. Power report.

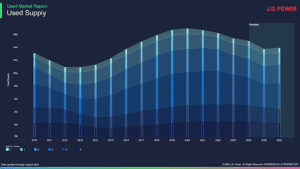

Overall, used-vehicle supply is flat from a year ago but down from two years ago.

There were 2.18 million used vehicles on franchise and independent dealerships lots as of Sept. 5, according to a Sept. 20 report by Cox Automotive. Though that is roughly unchanged YoY, used-vehicle supply was down 11.4% from September 2022, when there were 2.46 million units, when inventory was closer to pre-pandemic levels, according to Cox Auto.

Vehicles that would have been produced or added to leasing fleets in 2021 and 2022 are missing from the market, Kevin Filan, senior vice president of marketing at Open Lending, a platform that offers automated lending solutions to auto lenders, told AFN. Those vehicles would typically be coming into the used-vehicle market now.

“You can’t make a used vehicle,” he said.

“You can’t make a used vehicle.” — Kevin Filan, Open Lending

Used-vehicle supply isn’t expected to rebound until 2026 as more off-lease units reenter the market and the effects of the supply chain shortage start to ebb, J.D. Power’s Paris said.

Vying for supply

With used supply being scarcer, dealerships have started sourcing inventory directly from consumers.

However, fewer consumers want to trade-in their vehicles as they bought them when prices were high and they have accrued high levels of negative equity, Juan Alarcon, president and chief operating officer of Car Pros Automotive Group, a dealership group with locations in Washington and California, told AFN.

“Most of our inventory comes through trade-ins,” he said. But Car Pros is seeing fewer opportunities for trade-ins “now that consumers are buying their lease out or selling [their vehicle] to the highest bidder such as big centers like CarMax or Carvana,” he added.

Instead of turning to auctions, Car Pros has incentivized its sales and service departments to buy used vehicles directly from consumers. This is known as making off-street purchases, Alarcon said, noting that competition for those vehicles has picked up.

Carvana, CarMax source over 80% of inventory from consumer purchases

Carvana sources around 80% of its used vehicles from consumers, whether as trade-ins or one-way purchase transactions, Meg Kehan, senior director of capital markets and investor relations at the retailer, told AFN.

From the first quarter of 2022 to Q2 2024, Carvana purchased 1 million cars directly from consumers after purchasing the same number of cars from consumers from 2018 to 2021, according to a company release today.

At CarMax, 269,000 vehicles were purchased from consumers — 90% of its total vehicle purchases — during the retailer’s fiscal year 2025 second quarter, which ended Aug. 31, according to a Sept. 26 earnings report.

The high-demand, low-inventory auto market began about three years ago and is affecting consumers’ ability to shop for their next car, Joshua Fetting, vice president of consumer lending at Bakersfield, Calif.-based Valley Strong Credit Union, told AFN.

The negative equity challenge

Negative equity has increased because cars were sold above sticker price three years ago, which has made it more difficult for consumers to get out of their current vehicles, Fetting said. He added that it’s challenging for lenders to make deals that work for both them and their customers.

In Q2 2024, nearly 25% of consumers financing a new vehicle with a trade-in were underwater on their previous loans, with 23.9% showing negative equity — the highest level since Q1 2021, when it was 31.9%, according to a July 10 report by Edmunds.

“People are coming in with a lot of negative equity, and dealerships are also struggling on their end because it’s harder for them to find vehicles at prices that give them the margin that they need,” Fetting said. “The dealerships have compressed margins, and there are compressed margins on all sides. That’s been our struggle.”

Demand high, sales strong

Despite the pricing and supply challenges, demand for used vehicles remains high and sales are strong.

The used-vehicle turnover rate was up 8.4% YoY to 43 days in August 2024, according to J.D. Power data provided to AFN.

While used-vehicle inventory is below pre-pandemic norms, demand is above pre-pandemic levels, when 49 days to turn was typical, J.D. Power’s Paris said.

Days to turn measures how many days a vehicle takes to sell from the day a dealership acquires it until it is sold, Paris said. It is a measure of how quickly inventory is sold and replaced.

Retail used-vehicle sales climbed 13.7% YoY and 8% month over month in August 2024 at 1.7 million units, the highest level since October 2021, according to a Sept. 16 Cox Auto report.

“We’re still seeing used vehicles flying off of dealer lots,” Paris said.

Sales tick up as values decline

As demand has picked up, used-vehicle prices have come down, which partly explains the uptick in sales, Edmunds’ Drury told AFN.

But although prices are falling, they remain well above pre-pandemic levels, he said.

“You’re better off if you’ve never bought a car before, because you wouldn’t know what to expect,” Drury said. “People are not accustomed to seeing used values still as high as they are, and that is the problem for a lot of people.”

“You’re better off if you’ve never bought a car before, because you wouldn’t know what to expect. People are not accustomed to seeing used values still as high as they are, and that is the problem for a lot of people.” — Ivan Drury, Edmunds

In August, for example, the average transaction price (ATP) of a used vehicle was $27,099, a 5.6% YoY decrease. However, the ATP for used vehicles up to three years old fell only 0.1% YoY to $29,542, according to Edmunds.

Most used-vehicle price drops are for older models with higher mileage, Drury said.

According to August 2024 Edmunds data:

- 5-year-old used vehicles had an ATP of $24,416, down 5.6% YoY;

- 7-year-old model ATPs were $18,882, down 5.8%YoY; and

- 9-year-old used car ATPs were $14,798, down 2.7% YoY.

Meanwhile, in March 2020, the month the pandemic hit:

- Average used ATP’s were $20,484;

- 3-year-old model ATPs were $22,706;

- 5-year-old used car ATPs were $18,487;

- 7-year-old used-vehicle ATPs were $13,214; and

- 9-year-old used car ATPS were $10,765.

Used-vehicle prices are expected to normalize in 2025 with values likely to fall in most segments, Jeremy Robb, senior director of economic and industry insights at Cox Auto, told AFN. However, lease maturities are expected to be down 11% for the year in 2024, and down 17% in 2025.

This decline will further reduce the supply of 3-year-old used vehicles, he said. Because of that, he said prices aren’t likely to fall as much as in other segments.

Affordability hasn’t slowed used-vehicle demand, J.D. Power’s Drury said.

“What are your alternatives? Your only alternative is a new car,” he said.

Supply issues hurt CPO sales

A similar supply-and-demand scenario is playing out for certified pre-owned vehicles (CPO), Ian Hunter, vice president of sales at JM&A Group, told AFN. That segment has been especially hard-hit by the decrease in lease returns. JM&A is a finance and insurance and dealer services provider that launched a J.D. Power-backed CPO program in January 2022.

CPO sales in August were down 3.3% YoY in August to 235,150 units, according to a Sept. 16 Cox Auto report.

At American Honda, which includes Honda Motor Co. and Acura brands, demand for CPO vehicles is outweighing supply, Dan Rodriguez, director of auto remarketing and fleet operations at American Honda, previously told AFN. CPO inventory at American Honda dealers averaged 22 days as of Aug. 23, he said.

American Honda has been selling around 20,000 cars a month, with 13,000 cars in its inventory, Rodriguez said.

“Our biggest challenge is trying to get enough supply to meet demand,” he said.

Combined sales of Honda and Acura CPO vehicles were down about 5% YoY as of Aug. 23, Rodriguez said.

“If we had the product, we would hit those numbers,” he said. “We’re selling everything we can get our hands on.”

— Additional reporting by Amanda Harris

Auto Finance Summit, the premier industry event for auto lending and leasing, returns Oct. 7-9 at Wynn Las Vegas. To learn more about the 2024 event and register, visit www.AutoFinanceSummit.com.