Finding the Perfect Sweet Spot For Your Auto Loan Pricing

How Old-Fashioned Pricing Strategies Affect Profitability, Competitiveness, Loan Volume and More.. and What Auto Lenders Can Do About It

“We need to increase rates 50 basis points in all cells in order to meet our spread target for the next release.”

This request is quite common among auto finance vendors. Yet, it is also more challenging to fulfill than you might think. Most auto finance companies are not able deploy rates fast enough and without IT’s help. Moreover, many let the cost of funds and product type alone dictate the rates they would offer, leaving other data variables out of the equation. Such strategies may affect loan volume if priced too high or threaten profitability and increase delinquencies if priced too low.

It may be especially challenging in an unpredictable rate environment accompanied by high vehicle prices.

For example, according to Cox Automotive March 2023 Report*, the U.S. new vehicle market is being reshaped by higher prices and many automakers that traditionally served buyers with lower credit scores struggled with sales in Q1, as rates and credit availability remained an obstacle for many buyers. In the UK however, car finance new business fell by 8% in March 2023 compared to the same period in 2022 and used car business fell by 10%, as reported by the Finance & Leasing Association**, driving competition among lenders for remaining business.

Such a climate may give some auto loan lenders a reason to pause – to the point of rethinking their past aggressive strategies – to avoid pricing loans incorrectly and affecting their loan profitability in the long run.

Going back to the initial request to increase rates by 50 basis points…

This initial question usually leads to two more. “How do we know that 50 basis points (bps) is the right amount? What will this do to my pull through and overall volume?” Inevitably the answer to both was “wait and see.” “Be prepared to be reactive. We will see in next month’s auto loan volume numbers how this change impacts the overall product.”

This approach always leaves a lot of frustration within pricing teams. While it is important to keep your spread target and cost of funds in mind when pricing and deploying auto loan rates, it is just as important (if not more) to understand how customers and the overall market would react to pricing adjustments.

For example, when a blind increase across cells is deployed, auto lenders frequently see a significant drop in loan volumes and pull through. This scenario makes sense since it is simple supply and demand:

Low Rate = Low Spread = Higher Pull Through/Volume

High Rate = High Spread = Lower Pull Through/Volume

The lower the rate, the lower the spread; the higher the pull through/volume. Conversely, the same was true: the higher the rate, the higher the spread, but the lower the pull through. It always left me wondering where the proverbial sweet spot was. In other words, could we do more to maintain a healthy spread, offer market-competitive rates for auto loans, and truly have insight into each individual cell that I was pricing?

The ability to quickly adjust rates is surely beneficial, yet without the insight needed to proactively and optimally price auto loans, lenders would never be able to find the perfect price sweet spot. There had to be a better way.

A Closer Look at Proactive Pricing

What does it mean to have a proactive, optimal pricing strategy? The first, and most simple answer, is the ability to understand how the market will react to changes in price – how this will affect auto loan volumes – and then identify the ideal price across all cells. In order to be proactive, it is imperative that you are able to accurately model and forecast how various changes in rates will impact a customer’s probability of closing a loan.

To put it another way, how can auto lenders maintain volume without pricing too low to threaten their overall profitability and even increase the risk of loan delinquencies?

The answer lies in agile pricing, a better way for auto lenders to price loans and other product offers and manage overall risk. Today, technology enables auto lenders to become faster, more agile, and more successful in their pricing strategies and other touchpoints with customers and prospects.

Powerful pricing solutions now use next-generation technologies such as advanced data analytics, ML and AI, and autonomous monitoring to enable auto dealers and lenders to manage all aspects of their lending program. Pricing teams can now access and model large volumes of data, run detailed “what-if” scenarios, and use machine learning and AI-driven insights to create and deploy better prices and rate offers.

More agile pricing helps auto lenders improve their ability to deploy rate offers into the market proactively (faster) and with the understanding of how these adjustments will impact volume, spread, and pull through. This also eliminates the need for past “guess-and-check” approaches, which will be replaced by forecasts and actuals – clearly a better method.

How can lenders develop a proactive pricing strategy that allows you to deploy rates backed by data analytics? Here are the 3 pillars of a successful pricing strategy.

Agility

An AI-based pricing software integrated into your company’s LOS gives you the ability to deploy rates as often as you like, without using IT resources. This could be done daily as opposed to having to wait for the next monthly IT release.

Granularity

Analytics backed pricing solutions designed specifically to help auto finance companies enable a lender to increase granularity and expand the total number of pricing cells. Gone are the days of using a 12×12 pricing grid composed of credit score and model year. Earnix enables lenders to segment pricing criteria infinitely and can price by LTV, mileage, previous loan history, dealer group, past bankruptcies, make, model, and other variables.

With powerful automation and machine learning capabilities, such pricing software can also easily manage complex pricing segments and accompanying grids to promote efficiency and reduce manual operational errors. Employees don’t have to update every cell in the rate sheet anymore. Instead, the pricing engine offers the ability to automatically update and deploy rates to the market. Hence also reducing manual errors and miscalculations.

Simulation

In times like this, when forecasting is very tricky due to unpredictable market conditions, simulation is an essential capability of a pricing analytics solution. Analytical capabilities enable lenders to import internal and external data to create a demand model to simulate and test different pricing strategies prior to deployment to help you proactively determine the sweet spot for every cell in your portfolio.

By importing your existing demand model or building one from scratch within the pricing software instance, you can accurately predict a customer’s probability of closing a loan at a given price point.

Example of proactive, more effective pricing

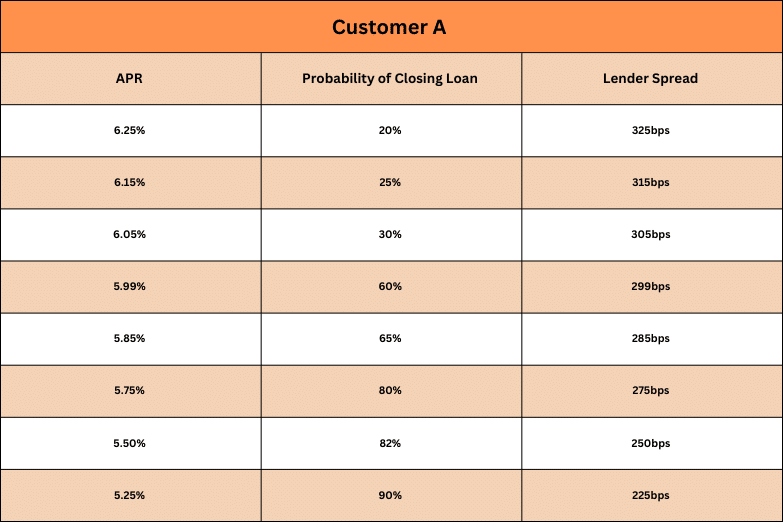

The following table shows what many of our clients would consider to be their pricing sweet spot. It shows that Customer A has an 80% chance of closing the loan at an APR of 5.75%. If we were to increase the rate by 10 basis points, the customer probability of closing the loan drops by 15%. This is only possible by having more insight: we see that reducing the offer by 10 more points only increases the probability of closing by just 2%.

This is what an advanced analytical pricing software allows you to do (at an even more granular level): to proactively model, analyze, and simulate across all pricing cells to make sure you are offering the best price in all cells. Say goodbye to reactive pricing and hello to a faster, better way to deploy the best rates possible.

In the upcoming years, auto lenders will find it essential to prioritize both speed and accuracy. Success, both in the short and long term, will depend on their ability to utilize sophisticated pricing data, analytics, and competitive intelligence to provide borrowers and dealers with the simplest delivery structure and the most favorable rates and offers. With an advanced analytics-based pricing engine, cutting-edge technology and competitive insights, lenders can balance profitability and risk while presenting their best possible offer to borrowers.

* https://www.coxautoinc.com/news/cox-automotive-forecast-march-2023-u-s-auto-sales-forecast/

** https://www.credit-connect.co.uk/news/consumer-car-finance-new-business-fell-by-8-in-march/