US jobless claims top 5.2 million, erasing a decade of gains

More than 5 million Americans filed for unemployment benefits last week, bringing the total in the month since the coronavirus pandemic throttled the U.S. economy to 22 million and effectively erasing a decade worth of job creation.

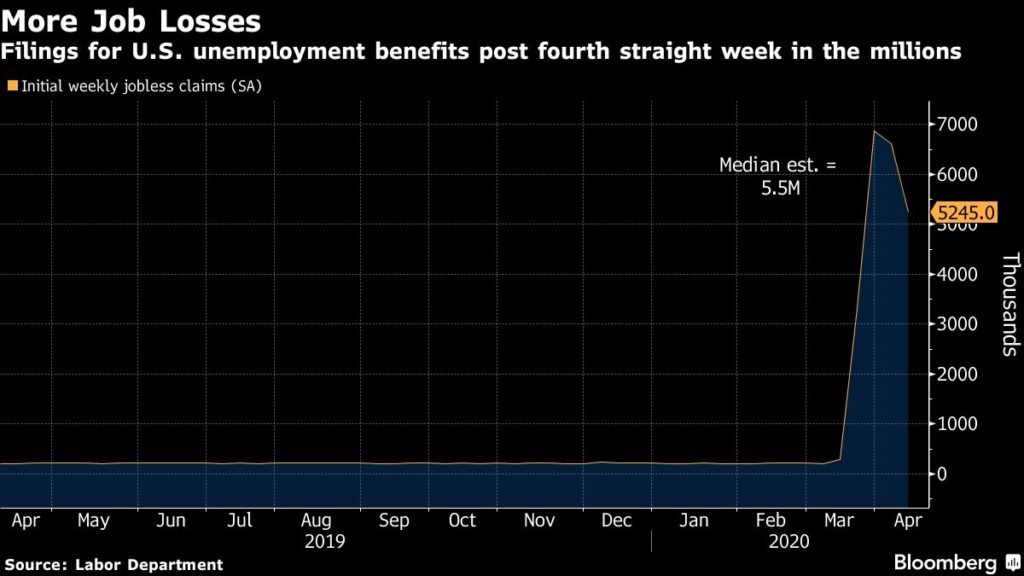

Initial jobless claims of 5.25 million in the week ended April 11 followed 6.62 million the prior week, according to Labor Department figures Thursday. The median estimate of economists was for 5.5 million, with projections ranging as high as 8 million.

The four-week sum compares with roughly 21.5 million jobs added during the expansion that began in mid-2009.

The latest figures suggest an unemployment rate currently around at least 17% — far above the 10% reached in the wake of the recession that ended in 2009 — in a sign that the effects of shutdowns have spread well beyond an initial wave of restaurants, hotels and other businesses. Another reason for elevated claims is that Americans are getting through on outdated or overwhelmed systems after previously being stymied.

Even so, the data showed most states reported declines in claims from the prior week on an unadjusted basis, suggesting that the breakneck pace of job losses is starting to slow, if just a bit.

Continuing claims, or the total number of Americans receiving unemployment benefits, jumped by 4.53 million to a record 12 million in the week ended April 4. Those figures are reported with a one-week lag.

Other reports Thursday showed the broadening and deepening impact of efforts aimed at preventing the spread of Covid-19.

Housing starts slumped in March by the most since 1984, while manufacturing in the Philadelphia Fed’s region contracted in April by the most since 1980.

Read More on the Pandemic’s Economic Impact:

- American Jobs Collapse Worsens With Gig Workers Stuck in Limbo

- Worst-Case Fears of 20%-Plus U.S. Jobless Rate Are Now Realistic

- U.S. Economic Data Show Deep Hit in March, Collapse in April

- Eight-Week Clock Ticks Too Fast for Small Firms Facing Failure

- Rescue Fund to Run Dry Today, Leaving Small Firms Shut Out

Last week also marked when banks were starting to lend to small businesses to keep payrolls intact, part of a $2 trillion stimulus package. The Paycheck Protection Program was on the verge of depleting its $349 billion in funds this week and lawmakers were haggling over boosting the plan, while many companies reported difficulty accessing the money.

In addition to the extent to which the pandemic is brought under control, the delivery of stimulus funds to Americans and businesses will help determine the speed of any recovery in output and employment. Most economists expect a rebound starting in the second half, though it could take several years or longer to return to employment levels seen before Covid-19 arrived in the U.S.

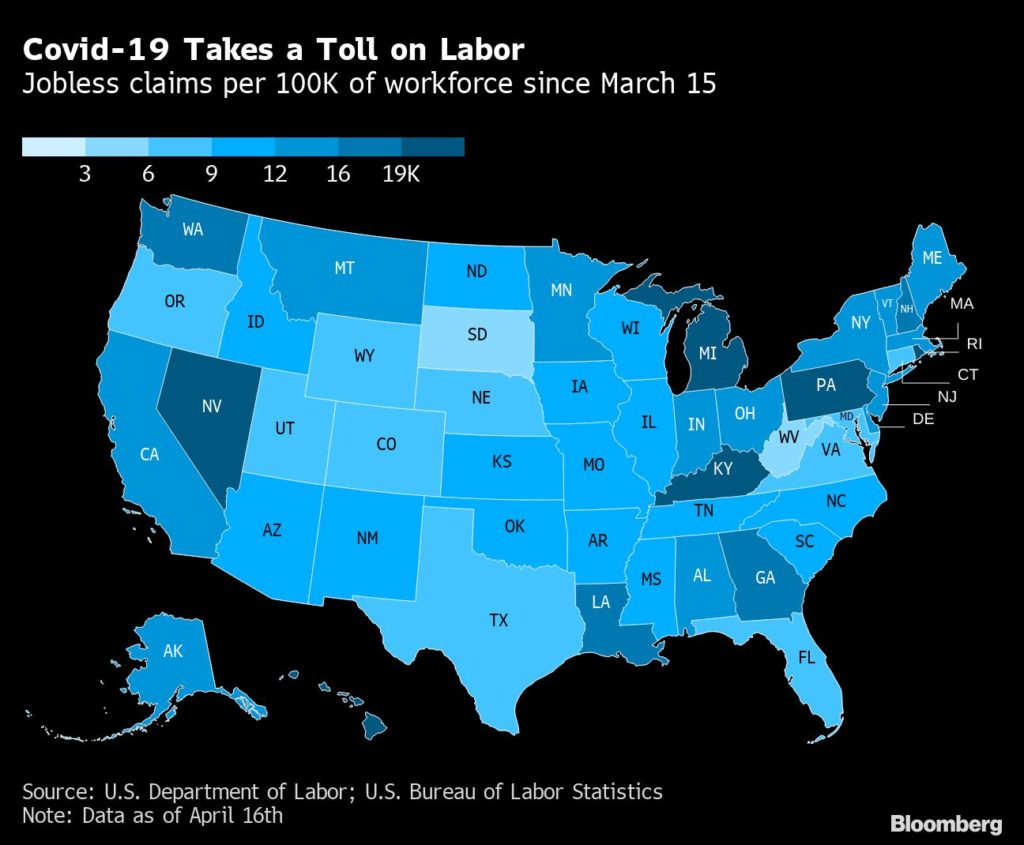

State Totals

- California had the most claims last week, at about 661,000 on an unadjusted basis, down from 919,000 the previous week

- New York was next at about 396,000, followed by Georgia at 318,000 and Texas at 274,000

–With assistance from Jordan Yadoo, Sophie Caronello and Samuel Dodge.

— By Katia Dmitrieva (Bloomberg)