US consumer prices surged in June, topping all estimates

Prices paid by U.S. consumers surged in June by the most since 2008, topping all forecasts and showing higher costs associated with the economy’s reopening continue to fuel inflationary pressures.

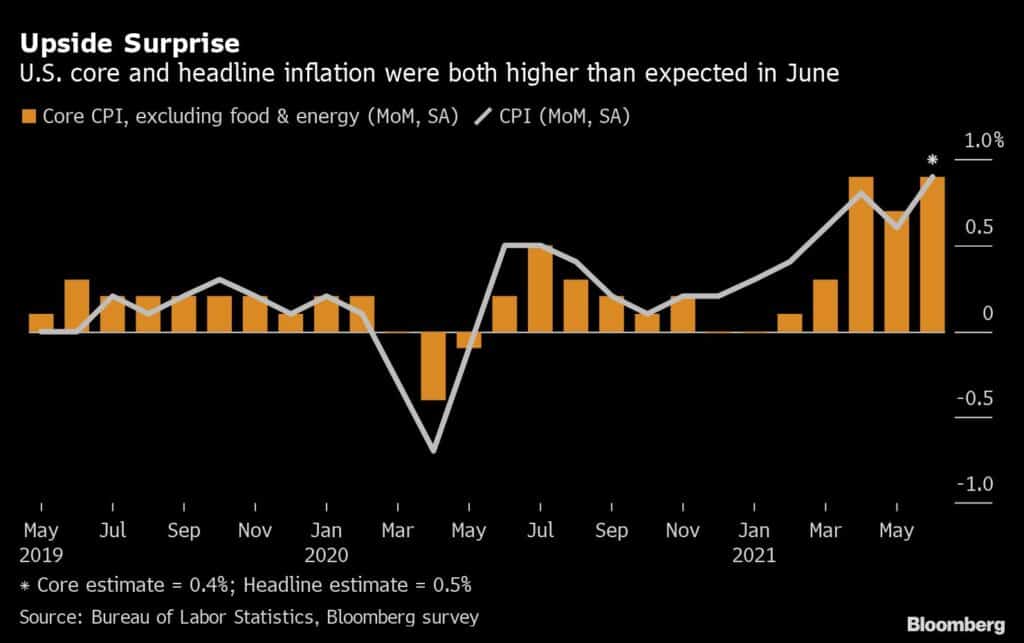

The consumer price index jumped 0.9% in June and 5.4% from the same month last year, according to Labor Department data released Tuesday. Excluding the volatile food and energy components, the so-called core CPI also rose 0.9%. The core increased 4.5% from June 2020, the largest advance November 1991.

Used vehicles accounted for one third of the gain in the CPI last month, the agency said. The outsize increase in the June CPI was also driven in large part by the pricing rebound in categories associated with a broader reopening of the economy including hotel stays, car rentals, apparel and airfares.

Expectations that those increases will normalize help explain the Federal Reserve’s view that inflation is transitory.

The median forecasts in a Bloomberg survey of economists called for a 0.5% gain in the overall CPI from the prior month and a 4.9% year-over-year increase. Treasury yields climbed following the data, while the dollar jumped and S&P 500 futures fell.

The year-over-year figures have shown outsize gains in recent months partly because of so-called base effects — the CPI retreated from March through May of last year during the pandemic lockdowns. While the annual figures are expected to peak, it’s not yet clear how much moderation will occur over the coming months.

Feeding Through

Household spending on merchandise, fueled in part by government stimulus, has left businesses scrambling to fill orders while facing shortages of materials and labor. That dynamic is contributing to higher costs, which often feed through to consumer prices.

Meanwhile, the lifting of pandemic restrictions is propelling purchases of services like travel and transportation, another contributor to inflationary pressures.

Fed Chair Jerome Powell has said that recent price increases are the result of transitory reopening effects, though more recently acknowledged the possibility of longer-term inflationary pressures. Sustained constraints in the production pipeline raise the risk of an acceleration in consumer inflation.

“Bottlenecks, hiring difficulties and other constraints could continue to limit how quickly supply can adjust, raising the possibility that inflation could turn out to be higher and more persistent than we expect,” Powell said after the June Federal Open Market Committee meeting.

Read More: Inflation Being Here to Stay Has Preparing More Price Hikes

Economists have been watching to see whether price pressures broaden out to categories other than those that are just now rebounding after pandemic-related lockdowns.

–With assistance from Kristy Scheuble, Sophie Caronello and Benjamin Purvis.