The Story Behind NMAC’s $40M Auto Financing Settlement

Auto finance is risky. It can also be very bizarre. The recent lawsuit between Nissan Motors Acceptance Corporation and a group of New York-based Nissan and Infinity dealers is an example.

In this unfortunate situation, it took just 10 months for NMAC to find itself a whopping $30 million deep with a new client before calling out the client on a mountain of default activity. That’s was just the beginning. Despite insolvency, the client sued NMAC demanding it be allowed to keep operating! After an expensive court battle lasting 18 months, NMAC finally emerged victorious with a $40M judgment in its favor.

This whole case sounded very bizarre to me. I wanted to understand it better so I reviewed the court proceedings. Below I summarize this crazy tale, and then I provide charts showing how we might actually have seen it coming.

The history of NMAC vs. Nissan Manhattan, et al.

- December 2015: NMAC established a floor plan finance relationship with a new dealership group that consisted of 4 locations in and around Manhattan. NMAC gave them an $8 Million credit line.

- March 11, 2016: NMAC provides an additional $12M short-term construction loan. NMAC is now in with these dealers for $20 Million, and the construction loan is coming due in just 4 months.

- July 15, 2016: the 4 months have passed and the $12M construction loan is due. But it is not paid! NMAC is not deterred; it extends another $3M floor plan line to the client (July 20, 2016). NMAC is now in for $23 Million.

- September 7, 2016: 2 months later NMAC finally starts to develop concern about the $12M construction loan. They send a formal NOD to the client along with a demand for payment for $12 Million.

Then it gets really bizarre…

- October 7, 2016: another month after sending the NOD, NMAC works out a deal with the client. They extend the construction loan obligation and simultaneously expose an additional $7M floor plan financing loan. NMAC is now $30 Million in with the client. However, on the very same day NMAC performs a lot audit and discovers 63 floored vehicles have previously been sold for which NMAC has not been paid back! Uh oh…

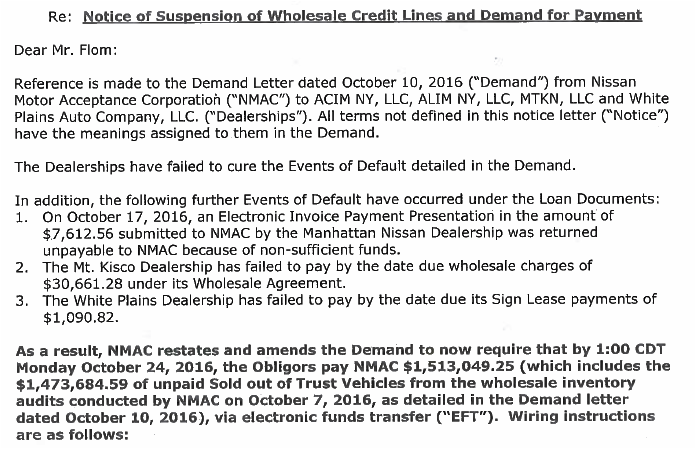

- October 10, 2016: just 3 days later, NMAC recants. It sends a new NOD to the dealers and demands an immediate $1.5 Million payment for the floored vehicles that were sold.

Finally, it hits the fan…

- October 20, 2016: 10 more days passed and the dealers have not yet remitted the $1.5 Million payment. In fact, the dealers attempt to pay a mere $7,612 but this amount bounces due to insufficient funds. NMAC immediately notifies the client its flooring line has been suspended, and demands additional payments:

- October 31, 2016: finally NMAC is in recovery mode. NMAC audits of all the client’s lots and discovers that actually a whopping 268 floored vehicles were sold for which payment has not been made! NMAC demands an immediate $5.7 Million payment and informs the client that a default status interest rate is now in effect.

- January 20, 2017: the dealer turns around and sues NMAC, demanding a restraining order so that it can continue to operate; claiming among other things that NMAC “fraudulently induced” the dealer principle into guaranteeing the loan obligations on which he defaulted.

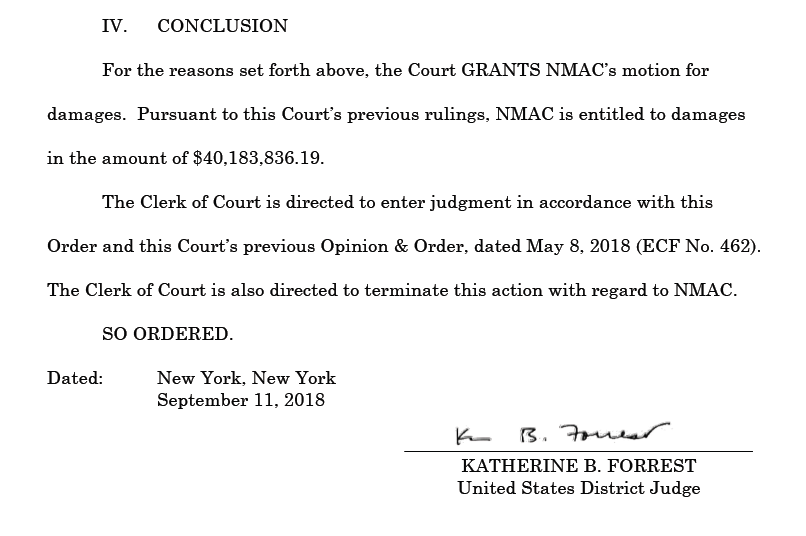

- September 2018: After 18 months of court proceedings, the US District Court judge rules in favor of the case’s defendant, NMAC, and awarded NMAC $40 Million to cover the debt, damages, and attorney fees.

Wow! And by the way, notes the judge, the claim of “fraudulent inducement” doesn’t hold up when parties are “sophisticated business people [who] hammer out … a multimillion dollar personal guarantee.”

What the data showed

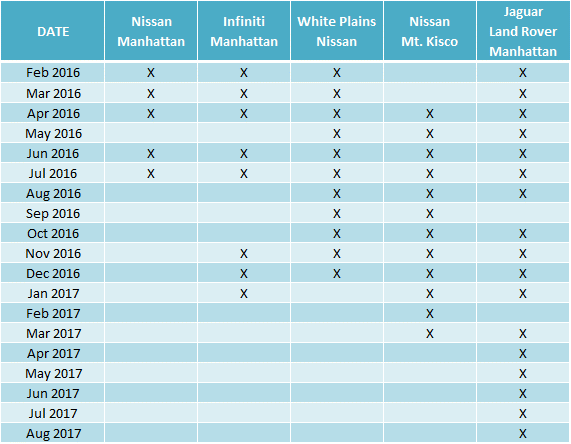

We know there are no real winners here. It should have been stopped earlier. Could we have seen it coming? To answer that, I inspected GF dealer behavior data from 2016 to see if any early indicators of problems were emerging. See the chart below. Yes, by May 2016 we started to see the dealers involved in this lawsuit were having business trouble. The chart denotes if the dealers had healthy advertising behavior each month. It reads like a credit report where “X” is good, blanks are bad. Specifically, bad means a dealer failed to update, use, or manage its website. This is a lead indicator of potential operational or financial problems with the dealer. Disclosure: NMAC was not a client of General Forensics.

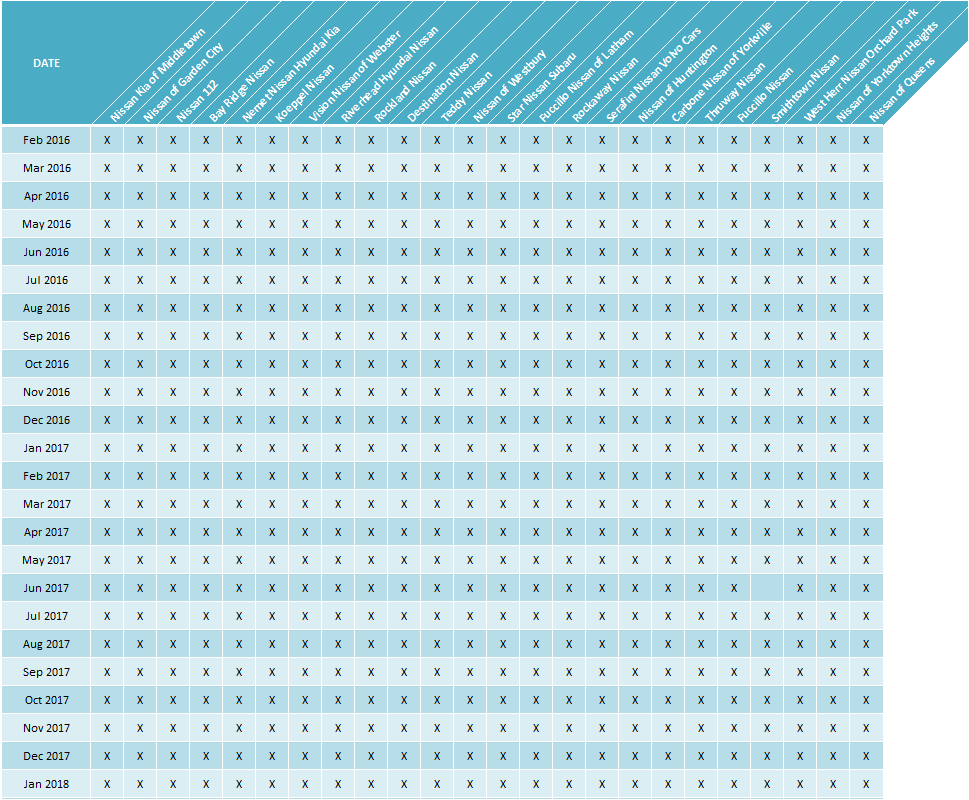

When we assess other dealerships during the same period we see a much better story. As the chart below shows, healthy Franchise dealers consistently show “normal and consistent” advertising patterns. All “X”s. The list of dealers below is just a small sample of NY area Franchise dealers. The vast majority appear as these do: healthy. Unfortunately, there are some showing patterns similar to above: risky. Using a report like this would tell you which to be concerned about.

The approach is powerful because it is clear and comprehensive. This report shows either “yes” a dealership is advertising or “no” its not. You can extrapolate all the implications you want from that difference. Second, data is available for all dealerships, both franchise and independent, and for dealerships in all 50 states. Third, website advertising behavior is a lead indicator of how much business a dealership plans to do, rather than financial metrics which show much business the dealer did in the past.

The Auto Finance industry (especially Floor Plan financers) have started to recognize larger Franchise organizations can present loss risk and a lot of risk mitigation can be managed by monitoring a dealer’s operating health. Historically lenders believed it was only needed for Independent dealers. Over the last several months we’ve learned Franchise dealers also fail and sometimes do in a big way.

Please share your thoughts below!

To learn more about General Forensics dealership risk management (or dealership marketing solutions) connect with me here and look for me at the Auto Finance Summit in Las Vegas on October 24-26, 2018. General Forensics works with Lenders, Banks, Public and Private companies. Auto Finance companies are invited to try any of our solutions for free.

Today’s job report puts unemployment at a sobering 8.1%, not by year end but today. This staggering number isn’t encouraging for anyone, and even though such truths have to be faced, I feel like the announcement will only further hurt consumer confidence, which will in turn hurt sales, which of course will force more job losses.

At some point we have to reach a psychological point where people say “I simply can’t expend any more energy on worrying about my job, and I can’t wait any longer to replace my vehicle.” I can only hope we’re closing in on that.