Fed mulls ‘game changer’ to jolt inflation: Decision day guide

Federal Reserve Chair Jerome Powell, who’s carefully telegraphed interest rate hikes over four years, looks likely to abandon gradualism and move more forcefully to stamp out inflation along with growing concerns that it will persist.

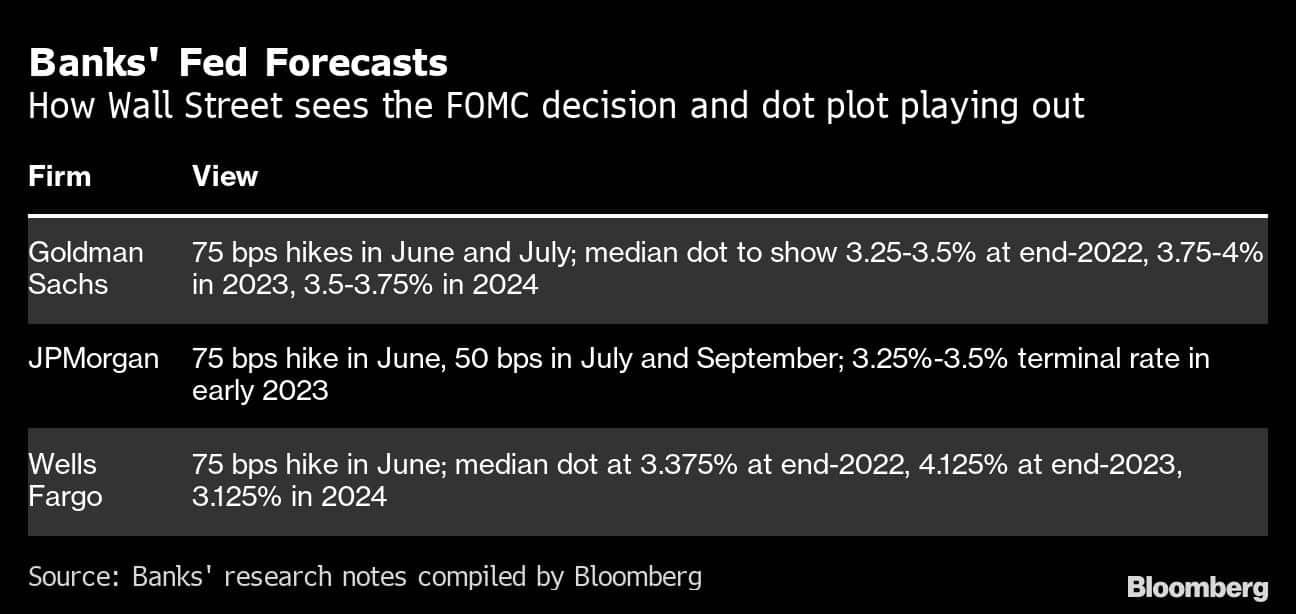

The Federal Open Market Committee is expected to raise rates 75 basis points by Wall Street firms including Goldman Sachs Group Inc., JPMorgan Chase & Co. and Barclays Plc, who cite rising inflation expectations among Americans in looking for the largest increase in nearly three decades.

The Fed will announce a decision and publish fresh forecasts at 2 p.m. Wednesday in Washington. Powell will hold a press conference 30 minutes later.

“The usual rule is, if you are worried about how your moves are going to affect financial markets, you move gingerly,” said Barclays senior economist Jonathan Millar, among the first to call for 75 basis points. “You worry about the risk of breaking something. In this case, it’s worth breaking something. We are at a very critical point where it looks like their credibility is starting to erode.”

Powell last month said the Fed wasn’t actively considering a 75 basis-point move, while not ruling it out if conditions changed. While the Fed chief laid out a baseline of 50 basis-point increases in June and July, he also hedged by saying that hinged on the economy evolving as officials expected.

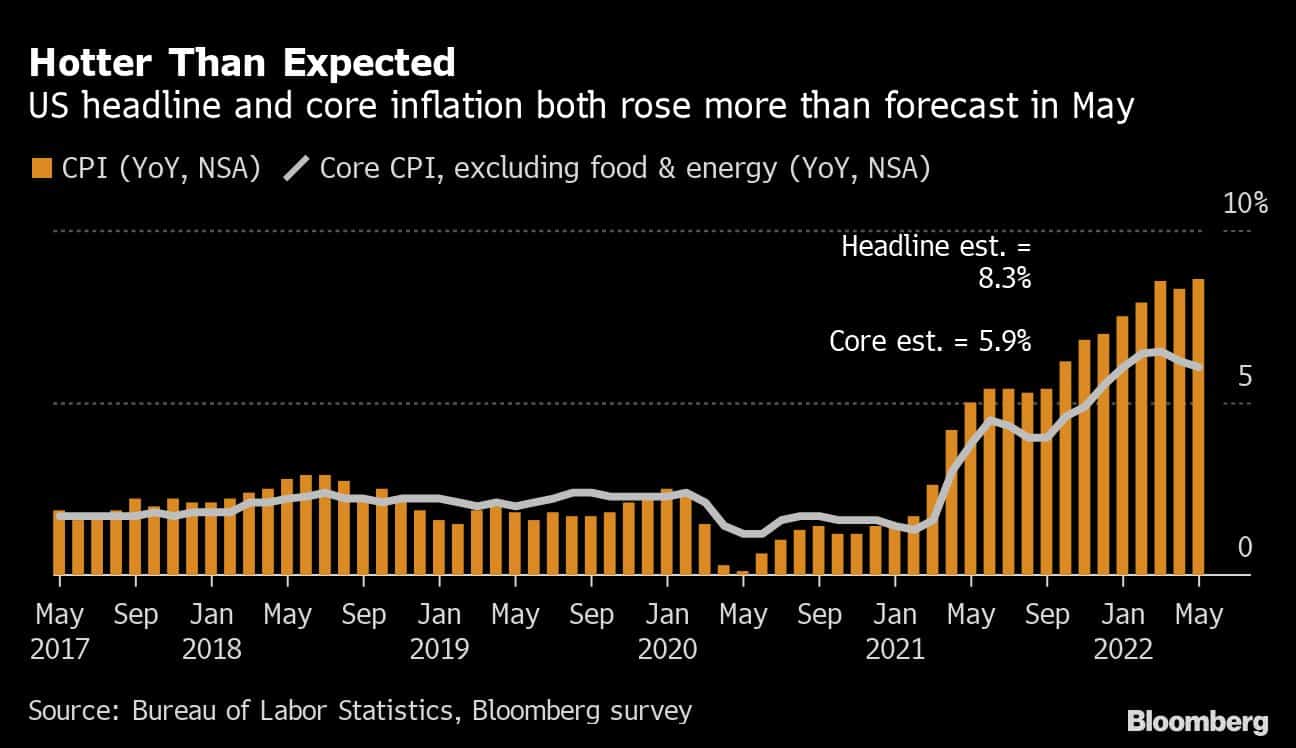

On Friday, data showed the consumer price index increased 8.6% in the 12 months through May, the most in 40 years and defying predictions that inflation had already peaked. The Fed has a goal of 2% inflation, based on a separate measure — the personal consumption expenditures price index, which was running at 6.3% in April.

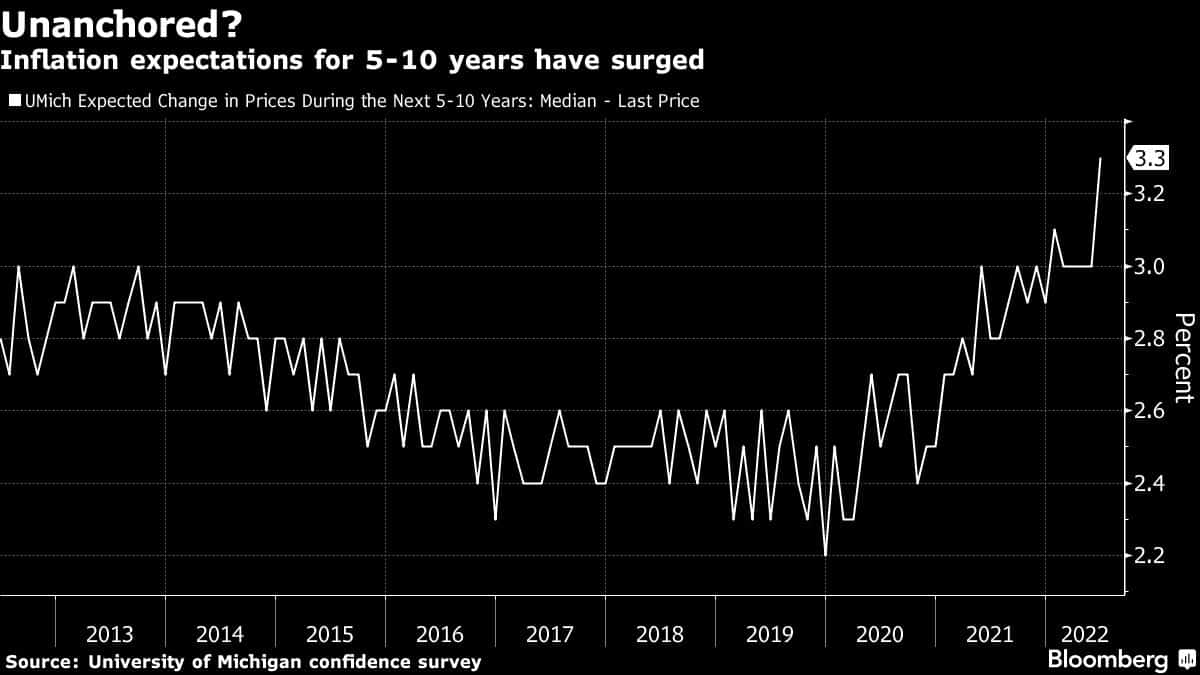

Even more concerning for central bankers was the University of Michigan’s sentiment survey showing respondents expecting prices to advance 3.3% annually over the next five to 10 years, the most since 2008 and up from 3% in May.

What Bloomberg Economics Says…

“The FOMC will raise federal fund rates by 75 bps at its June meeting. One or more dovish members of the committee may well dissent. Given surprisingly elevated inflation readings in recent months, Powell will argue that a supersized move is needed to preempt inflation expectations from unanchoring.”

— Anna Wong, chief US economist

— To read more click here

Both Barclays and Jefferies, who were among the first to change their Fed calls, cited the Michigan survey as key evidence that inflation expectations could be starting to become unglued, with Jefferies calling it a “game changer.”

Market Pricing

“The goal of the Fed is for inflation not to become entrenched,” said Diane Swonk, chief economist at Grant Thornton LLP. “People’s behaviors are changing. It will be that much harder to derail later on. You can’t make the mistake of the 1970s. You have to deal with bringing demand down in a supply-constrained world, as painful as that may be.”

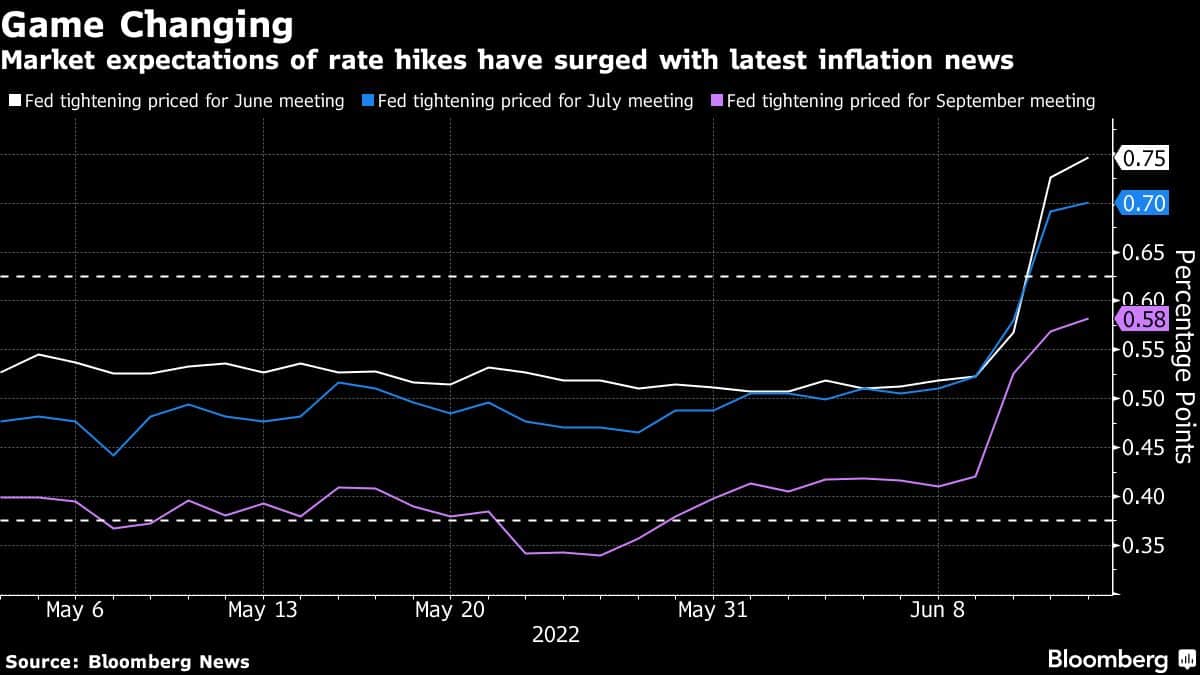

Markets started pricing in a 75 basis-point move following the New York Fed’s survey on Monday showing US consumers expect prices to rise even faster over the next year, as well as reports from the Wall Street Journal and other news outlets including Bloomberg News on the likelihood of such a move.

The central bank typically moves deliberately, trying to avoid excess volatility such as 2013’s taper tantrum, when Treasury yields surged suddenly under then-Fed Chair Ben Bernanke.

“Market pricing for aggressive Fed action has accelerated, and we believe policy makers are likely to lean into it,” said Robert Dent, a Nomura Securities economist. The Fed is concerned by “upside risk to the inflation-generating process. Markets have now provided the Fed with an opportunity to move more swiftly.”

While Powell has pledged to be “nimble,” a 75 basis-point move would be a striking change in how the chair guides markets. The FOMC gave investors several months of notice before stopping its purchases of Treasuries and mortgage-backed securities and raising interest rates from zero in March.

“Chair Powell just hates surprising markets,” said Vincent Reinhart, chief economist at Dreyfus and Mellon. While 75 basis points seems likely, “there is a higher chance than currently in markets that they stay on their original plan.”

Dot Plot

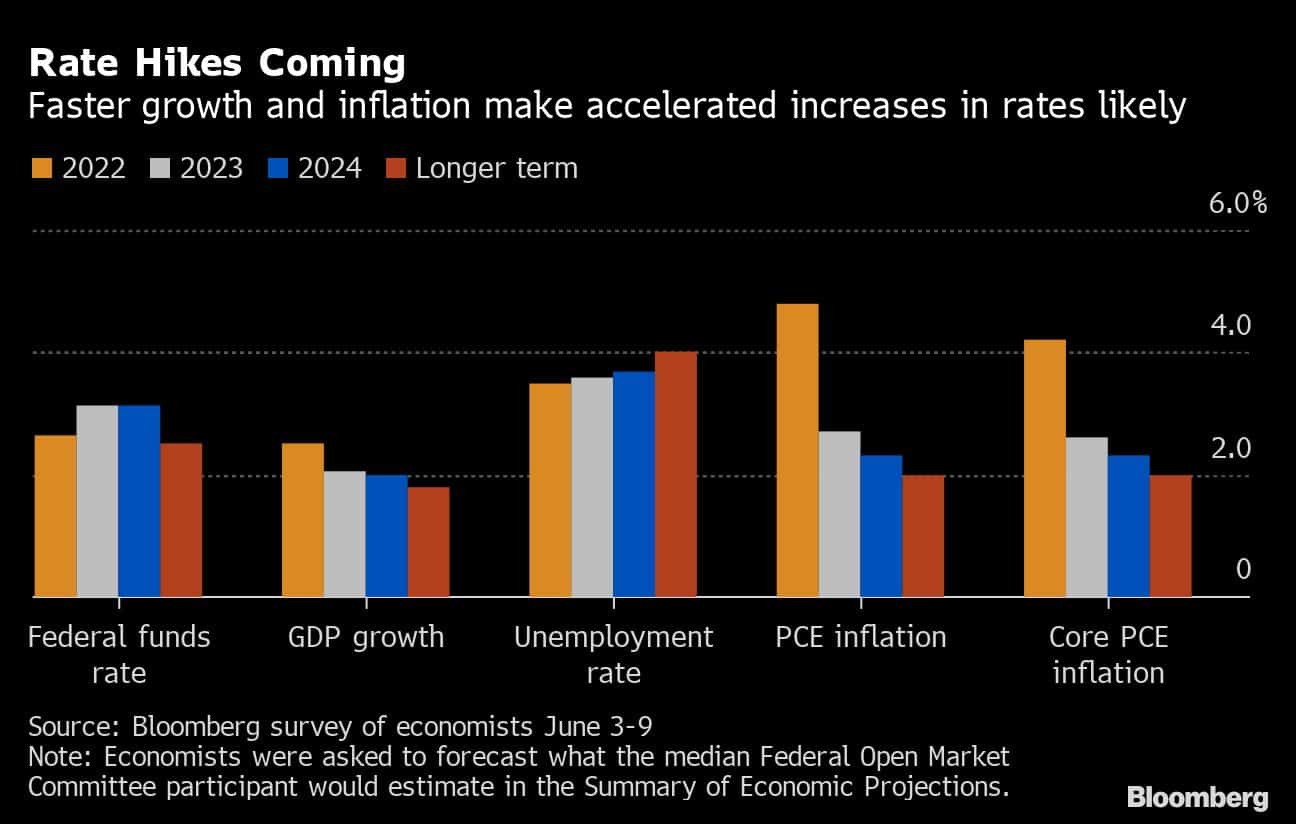

The median dot of their rate projections could rise to around 3% for year’s end, or 2 percentage points higher than the current rate. In March, officials estimated their policy rate would end 2022 around 1.9%.

That said, Fed leaders prepare their dot forecasts in conjunction with research teams well in advance, so there’s a risk the dots may not reflect the latest urgency over inflation.

While Powell has said his goal is a “softish landing” of low inflation and a still-robust labor market, the FOMC forecasts could also give insight into how comfortable the committee would be with some boost in unemployment to help cool off the economy and inflation. The projections could show the jobless rate rising in 2023 and 2024 from a 3.5% forecast for this year.

“Right now, they sound like inflation, inflation, inflation,” said Thomas Costerg, senior U.S. economist at Pictet Wealth Management. “What we’re going to try to read in between the lines is whether they truly believe or not that a recession is what’s needed to calm inflation. The code for recession is whether they see unemployment going up in 2023 or not. That would be a very bad message.”

The tone of Powell’s press conference emphasizing Fed commitment to controlling inflation will be especially important ahead of his June 22 and 23 semi-annual testimony before Congress.

Lawmakers are critical of high prices, which have become a top concern of Americans, hurting the standing of President Joe Biden’s Democrats with voters ahead of November congressional elections.

“He will be pretty somber,” said Reinhart. “You are going to have a relatively hawkish message to convey. He’s got to wear the black suit and dark tie.”

–By Steve Matthews (Bloomberg)