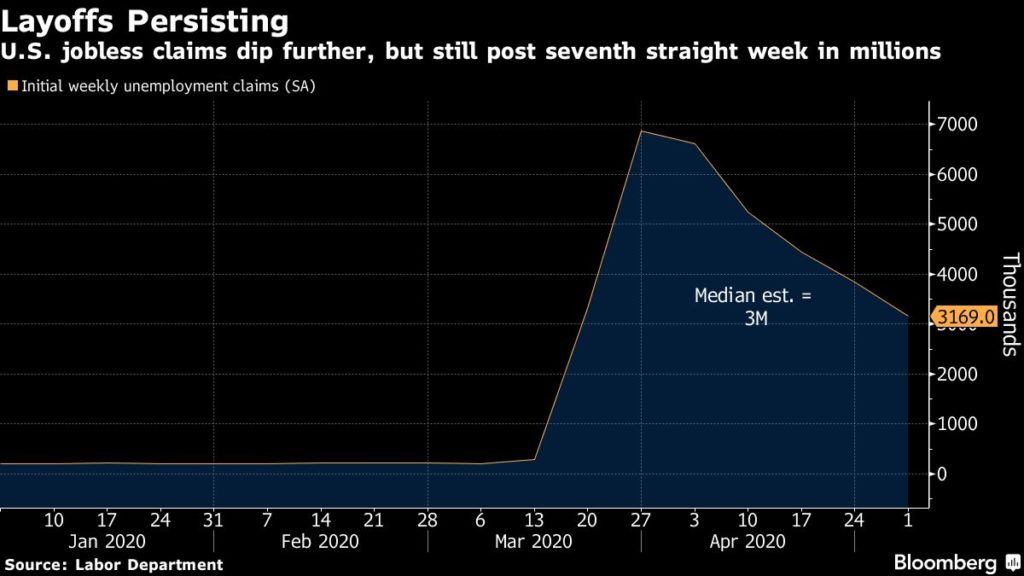

Another 3.17 million filed for US jobless benefits last week

The number of Americans filing for unemployment benefits topped 3 million for a seventh straight week, signaling little relief in sight for the economy since the coronavirus began closing restaurants, factories and offices from coast to coast in mid-March.

Initial jobless claims totaled 3.17 million in the week ended May 2 following 3.85 million in the prior week, according to a Labor Department report released Thursday. That brought the seven-week total to about 33.5 million. The median estimate in a Bloomberg survey of economists called for 3 million last week.

Continuing claims, or the total number of Americans receiving unemployment benefits, rose to a fresh record of 22.6 million in the week ended April 25. That, in turn, sent the insured unemployment rate, or the number receiving benefits as a share of the labor force based on eligibility, to 15.5%. Those data are reported with a one-week lag.

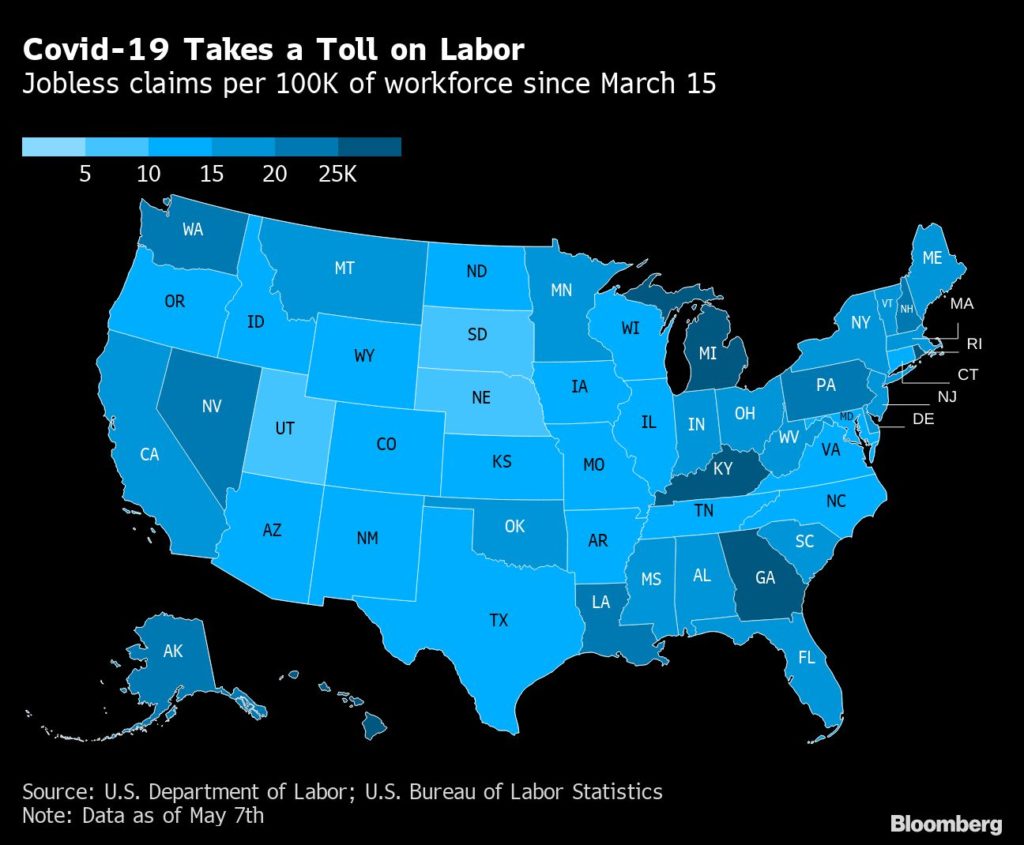

California, Texas and Georgia reported the highest levels of unadjusted initial claims last week. Most states posted declines from the prior week.

While jobless claims remain elevated, the weekly pace of filings is decelerating, suggesting the worst of the layoffs may be over as several states embark on limited reopenings of restaurants, retail shops and other businesses.

Still, with no effective solution for the disease yet in sight, joblessness could broaden and persist as pullbacks in consumer and company spending ripple through the economy.

The April employment report, out Friday, will highlight the unprecedented depth of job losses captured in weeks of claims figures and offer a more detailed look at the breadth of the layoffs from mid-March to mid-April. The median estimate in a Bloomberg survey of economists calls for a staggering 21.3 million drop in payrolls and for the unemployment rate to jump to 16%, the highest in monthly records dating back to the 1940s.

Millions more claims have been filed in the weeks since, but it’s unclear how many of the claims reflect recent layoffs versus continued backlog from overwhelmed state-government websites and call centers.

States could face further stress from the millions of people who need to file each week for continuing benefits. Washington state even posted tips online to avoid getting caught in the crush of required weekly claims.

Florida, which has had some of the most reported difficulties with its website, saw initial claims fall by more than half from the prior week to about 173,200.

Several states started phased reopenings in recent weeks, but to varying degrees.

Georgia, which allowed barber shops, nail salons and restaurant dining rooms to reopen with restrictions, saw initial claims decline tby about 39,700 to 226,900 on an unadjusted basis, holding about in line with the extremely elevated pace of filings seen in recent weeks.

Texas, which reopened retail stores and restaurant dining with limited capacity on May 1, saw claims little changed at 247,200.

States are also beginning to feel the financial burden of the now-enormous jobless population. California, the nation’s most populous state, recently borrowed millions from the federal government to pay out worker benefits.

Claims in California registered only a slight decline, to about 318,100 from 325,300.

–With assistance from Kristy Scheuble and Samuel Dodge.

— By Reade Pickert (Bloomberg)