Stocks rebound on stimulus hopes, Biden’s surge: Markets wrap

Stocks rebounded as investors digested a surprise in the U.S. presidential primary and weighed the potential for more of a concerted effort by the world’s largest economies to tackle the fallout from coronavirus. The dollar advanced.

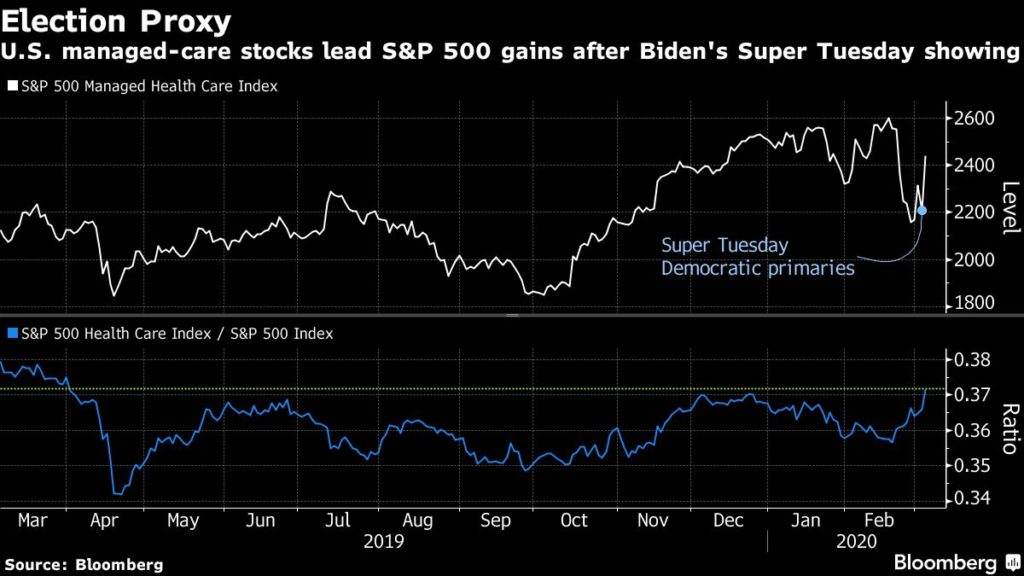

The S&P 500 rallied back from yesterday’s steep declines after former Vice President Joe Biden won a majority of state primaries on Super Tuesday, dulling some investors concerns about the possibility of a more liberal candidate challenging President Donald Trump in November. At the same time, 10-year Treasury yields fell below 1% and the dollar rose as traders waited for other top economies to follow the Federal Reserve’s emergency rate cut. Oil rose for a third day.

Stocks tumbled Tuesday after the Fed’s move wasn’t followed by other Group of Seven nations with rate cuts or fiscal stimulus in the face of the virus’s growing threat to the global economy. Equities got a boost after the Bank of Canada cut its benchmark Wednesday, and amid speculation the Bank of England and Europe would also take action.

Part of the rebound also came from Biden’s surprise win, particularly in corners of the market most sensitive to the race’s outcome. Managed-care providers, threatened by Senator Bernie Sanders’s “Medicare for All” platform, surged, with UnitedHealth Group Inc. and Anthem Inc. each gaining more than 9%.

“The major theme is central banks are aggressively easing now and trying to offset any potential demand shock from coronavirus,” said Dennis Debusschere, head of portfolio strategy at Evercore ISI, in a phone interview. “It’s clear from talking with investors that Bernie Sanders was a negative tail risk so you have some improvement in the outlook as it relates to removing that tail risk.”

Investors are anxious for promised action by the Group of Seven to confront the virus while they’re buying risk assets on dips and watching the world’s biggest bond market move closer to negative yields. The Democratic contest posed a fresh challenge to Trump as nine states went to Biden, who’s positioned as a moderate against a more progressive Sanders in the race for the party’s nomination to take on Trump in November.

These are the main moves in markets:

Stocks

- The S&P 500 Index advanced 1.3% as of 11:08 a.m. New York time.

- The Stoxx Europe 600 Index rose 0.9%.

- The U.K.’s FTSE 100 Index added 1.1%.

- The MSCI Asia Pacific Index climbed 0.5%.

Currencies

- The Bloomberg Dollar Spot Index increased 0.2%.

- The euro decreased 0.6%.

- The British pound rose 0.1%.

- The Japanese yen weakened 0.2%.

Bonds

- The yield on 10-year Treasuries fell three basis points to 0.97%.

- The yield on two-year Treasuries fell seven basis points to 0.63%.

- Germany’s 10-year yield fell one basis point to -0.63%.

Commodities

- West Texas Intermediate crude jumped 2.1% to $48.16 a barrel.

- Gold fell 0.2% to $1,641.80 an ounce.

–With assistance from Elena Popina, Katherine Greifeld, Nancy Moran and Todd White.

— By Randall Jensen and Claire Ballentine (Bloomberg)