BNPL picks up at dealerships as repair costs rise 6%

Provider Sunbit’s approval rates over 90%

Consumers are increasingly leaning on buy now, pay later services for maintenance and parts at auto dealerships as repair costs rise.

Buy now, pay later (BNPL) can be used to cover the costs of repair orders, maintenance, accessories and parts, Jon Meredith, national service operations manager at Volkswagen, told Auto Finance News.

Manufacturers including American Honda, Nissan and Volkswagen allow customers to finance purchases of parts and services at dealerships by spreading their payments over time. Many dealerships have signed on with BNPL providers such as Affirm and Sunbit.

Volkswagen in 2021 selected Sunbit as its preferred BNPL provider, according to a Sunbit release. The number of VW dealers signing on to Sunbit’s platform increases 20% to 30% annually, Meredith said.

“The volume of business that our dealers and Volkswagen are doing with Sunbit is substantial; it’s a lot of revenue,” Meredith said. “The trend is moving toward these payment credit solutions for consumers because the cost of repairs and services keeps rising.”

In fact, the volume of auto repair purchases through Affirm rose 29% year over year in the second quarter of the company’s fiscal year 2025, ended Dec. 31, 2024, according to the company’s Feb. 6 earnings presentation.

As of summer 2024, Affirm has facilitated more than $5 billion in loans for auto parts, accessories and servicing, Pat Suh, senior vice president of revenue at Affirm, told AFN. Affirm works with more than 130 institutional investors.

“We consistently see people investing in their vehicles through things like aftermarket auto parts and enhancements like better wheels around tax season, which may illustrate it’s an expense that consumers are interested in fitting into their budget,” Suh said. “Maintenance can be costly and at times unexpected.”

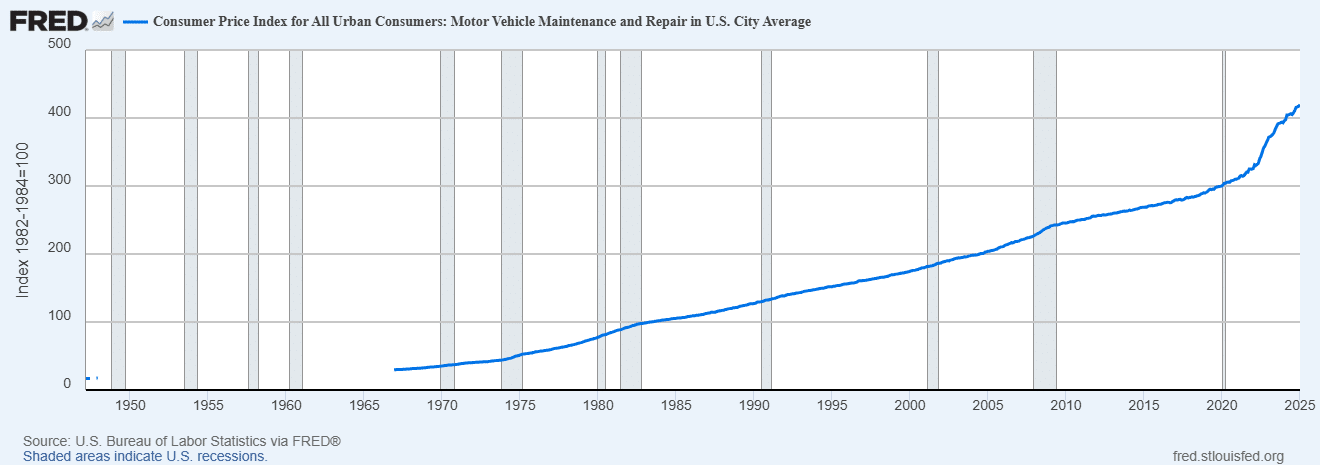

Repair costs up 5.9%

Motor vehicle repair costs rose 5.9% year over year in January, according to the U.S. Bureau of Labor Statistics’ Motor Vehicle Maintenance and Repair Consumer Price Index. The index rose to 149.4 in January, according to data published Feb. 12. Repair costs have steadily increased and experienced a sharp uptick in 2022, according to the index.

Consumer Price Index: Motor Vehicle Maintenance and Repair

Cerritos, Calif.-based Norm Reeves Honda Superstore Cerritos has seen steady growth in BNPL volume amid high costs, Mike Monell, service director at the dealership, told AFN. The dealership describes itself as the world’s largest Honda dealer, with more than 3,000 cars in inventory.

Norm Reeves Cerritos has used Sunbit for more than seven years and does about $1.2 million in parts and labor sales volume a year through the Sunbit BNPL program, or about $125,000 per month, representing about 15% of total parts and labor business, Monell said.

Dealerships pay a fee on each BNPL transaction completed at the point of sale, a spokesperson at Sunbit told AFN. Norm Reeves Cerritos pays a 3% transaction fee, Monell said.

Consumers can decide on terms once approved for BNPL financing. Sunbit offers 0% financing for three months for qualified borrowers at participating dealerships, but rates vary depending on the final term selected, the spokesperson said. Sunbit’s average approval rate is 90%, according to the company.

Driving aftermarket sales

BNPL supports sales of maintenance and parts, especially for lower-income consumers, Mark Thorpe, director of aftersales operations at Nissan Motor and head of Infiniti aftersales, told AFN.

He said that a large portion of consumers who opt for BNPL for service or parts carry a FICO credit score below 679 and may not qualify for traditional financing.

“This is their only option to be able to finance a repair,” Thorpe said. “It’s driving revenue in the service lane on maintenance and parts because these consumers are getting their vehicles repaired where they wouldn’t be able to get them repaired anywhere else, because they wouldn’t be able to use a finance option.”

BNPL is “driving revenue in the service lane on maintenance and parts because these consumers are getting their vehicles repaired where they wouldn’t be able to.” — Mark Thorpe, Nissan

Nissan implemented Sunbit in dealerships in 2019 and the penetration rate of dealers offering the program surpassed 80% in 2024, Thorpe said. “Triple-digit millions of dollars that have gone into that program,” he said, noting dealers use Sunbit, Affirm or other BNPL providers.

Santa Ana, Calif.-based dealership Freeway Honda has used Sunbit for BNPL in the service department for nearly 10 years, John Beyer, service and parts director, told AFN.

“It’s been a positive solution to some of the bigger repairs, and sometimes consumers use it for smaller, everyday repairs,” he said. Total service volume on a dollar basis rose 15% in 2024.

BNPL financing approval rates through Sunbit average around 93%, Volkswagen’s Meredith said. “Because of that, our service advisers offer it as a payment solution to their customers regularly,” he said.

Volkswagen also offers service and parts financing via a credit card powered by Citibank and car repair loans through auto finance company Dignifi, according to the manufacturer.

However, the credit card application process can be an obstacle for some consumers, Meredith said, noting that the application to apply for BNPL is faster and doesn’t require a hard credit check. The application also includes information on payments, interest and total repayment amount, he said.

“It’s transparent and the consumer can make an educated choice up front with the service consultant on what they want to do,” Meredith said.

Auto Finance Summit East 2025 is set for May 12-14 at the JW Marriott Nashville featuring fireside chats with Santander Consumer USA and Chase Auto. Visit autofinance.live for more information. Early-bird registration is available here.