Banks tighten auto credit standards, Fed reports

Auto Finance News Summit East 2025

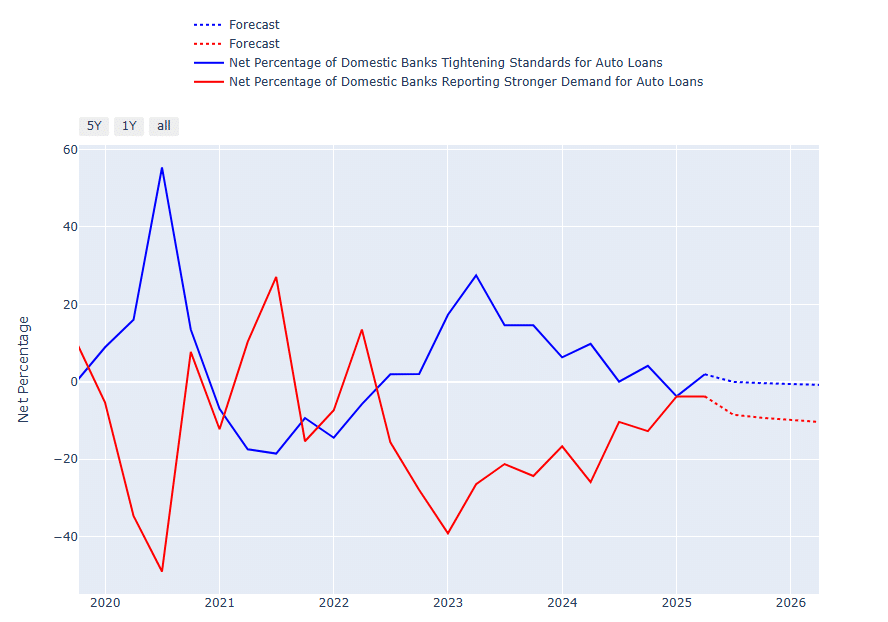

More banks tightened credit standards in the first quarter while consumer demand for auto loans held, though forecasts indicate both credit and demand may decline in 2025.

The net percentage of banks tightening their standards hit 1.9% in the Q2 reading of the Federal Reserve’s index, citing data from the April Senior Loan Officer Survey (SLOS) on Bank Lending Practices published May 12. The data reflects trends for the first quarter.

The index is up from -3.8% in the prior reading in February, and down from 9.8% in Q2 2024, indicating that banks are returning to stricter standards. Auto Finance News’ proprietary forecast predicts that banks’ standards will gradually tick down in the coming months.

To weather tighter credit access, auto dealers will need access to a variety of lenders, including smaller players that can focus on niche consumer segments, Justin Buzzell, vice president of financial services at Tampa, Fla.-based dealer group Morgan Automotive Group, said at Auto Finance Summit East 2025 this week.

“As credit continues to get tougher … we need to make sure that we’re looking full vision. You’re always going to have the prime lenders … but you need to help [consumers] that went through trying times and need a vehicle. That’s where [smaller and subprime lenders] come to play.” — Justin Buzzell, Morgan Automotive Group

Of the 54 banks that responded to the SLOS survey and originate auto loans, 87% said their credit standards for approving auto loans “remained basically unchanged,” according to the SLOS. Around 7.4% of banks said their standards “tightened somewhat.”

The survey includes responses from 70 domestic banks and 19 U.S. branches of foreign banks.

Credit demand holds firm

The net percentage of banks reporting stronger demand for auto loans held at -3.8% in Q2, flat from Q1 and down compared with -26% from Q2 2024.

In comparison, the Fed survey found 66% of 53 responding banks believed consumer demand for auto loans was “about the same.” Around 18.9% of the banks believed consumer demand was “moderately weaker,” and 15.1% believed consumer demand was “moderately stronger.”

AFN’s proprietary forecast predicts that auto loan demand will drop in the coming months.

One major consumer concern is car affordability, Chase Auto Chief Executive Leslie Wims Morris said at the summit on May 13. New-vehicle prices landed at $48,699 in April, according to a May 12 Kelley Blue Book report. The price was 1.1% higher year over year and 2.5% higher than in March.

“At the very top of the house, [affordability is] the fundamental question that we look at across the entire bank,” Wims Morris said. “What is going to be the health of the consumer, and how is that going to impact the rest of our business?”

Find more coverage from Auto Finance Summit East 2025 here.