Security Service FCU (ssfcu.org) scored highest overall — 9.18 out of 10. Toyota Financial Services (toyotafinancial.com) came in second place with a 9.11 score, and SunTrust Bank (suntrust.com) snared the No. 3 spot with an 8.82.

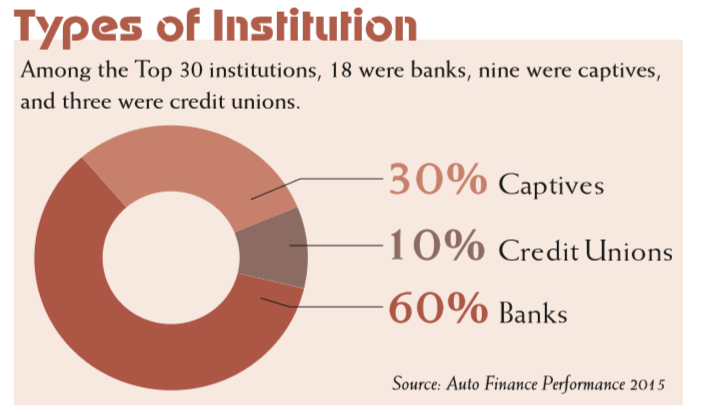

Though SSFCU topped the list, it was one of only three credit unions in the study. Of the Top 30 spots, credit unions accounted for three, banks for 18, and captives for nine.

Among companies designated by dealers as “prime” lenders, Security Service Federal Credit Union took the crown, with an overall score of 9.17. Among lenders deemed “subprime,” Toyota Financial Services topped the list, with a 9.19 score. It’s important to note that dealers determine the “prime” and “subprime” designations relative to their books of business.

Among companies designated by dealers as “prime” lenders, Security Service Federal Credit Union took the crown, with an overall score of 9.17. Among lenders deemed “subprime,” Toyota Financial Services topped the list, with a 9.19 score. It’s important to note that dealers determine the “prime” and “subprime” designations relative to their books of business.

Though dealers ranked lenders highest for their representatives, they consider service the most important factor in deciding on their lender. The implication: While dealers are increasingly pleased with the reps their finance sources are employing, lenders should focus on service levels and pricing to bolster performance.

The greatest drag on performance was the pricing category, which fell to 7.06 from 7.80, a 9.5% drop. Pricing has been a big focus for lenders in the past year, as the Consumer Financial Protection Bureau (consumerfinance.gov) and other regulators have zeroed in on potential infractions for discriminatory lending. As such, some financiers have altered pricing policies — and dealers have taken notice.

Other findings:

• Floorplan relationships generally led to higher overall performance scores from dealers.

• Geographically, dealers in the Midwest rated lender performance highest, so financiers aiming to bump up their performance scores should look to the coasts — and to Canada, in some cases — to find receptive dealerships and bolster overall scores.

• Despite the heightened focus on fair lending, fewer than half of respondents expect their dealerships to conduct fair lending training in the coming year.

• Most dealer respondents signed up with one to four new lenders in the past six months, though 30% have kept their financing partners unchanged.

To learn more about the AFP, visit www.autofinancenews.net/auto-finance-performance-the-nations-top-lenders. To acquire AFP data for your company, please contact Marcie Belles at 212-991-6733 or mdbelles@royalmedia.com.