Wholesale used-vehicle values plummet in early April

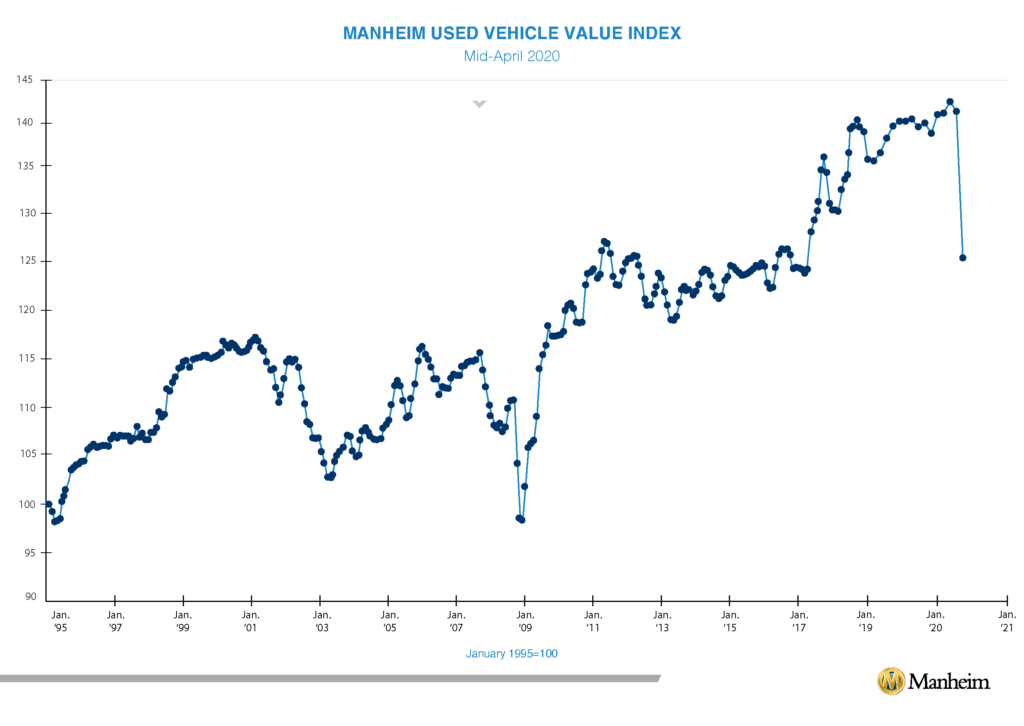

The Manheim used-vehicle value index plummeted 11.8% for the first 15 days of April compared to March, according to a new mid-month report issued by Cox Automotive. This is the first time Manheim has published a mid-month progress report on the index.

Wholesale used-vehicle index dropped 9.6% year over year to 125.2. If current wholesale vehicle values hold steady for the remainder of the month, the decline would set a record, outpacing falloffs not seen since November 2008, when the index dropped 5.5%.

“We are not anticipating much improvement until local markets start to reopen,” Jonathan Smoke, chief economist at Cox Automotive, told Auto Finance News. “More recovery of retail demand would lead to more serious buying activity in the wholesale market.”

Although wholesale prices are declining, retail prices are holding steady, falling 1% since March 16, according to an analysis of Dealertrack transaction volumes on a same-store basis. By comparison, when retail values dropped 10.5% in fall 2008, they were able to “fully recover after just seven more months,” the report noted .

It is unclear whether or retail prices will follow wholesale value trends, Smoke said. “This [downturn] is not what happened in fall 2008. New- and used-retail prices both fell alongside wholesale prices. That was a normal market reaction to a non-temporary decline in demand caused by a drying-up of credit and the worsening recession.

“The exact timing may be unknown but demand is considered to be temporarily suppressed. The fact that retail prices have been stable shows that dealers have not yet had to lower prices to sell the vehicles they are selling,” Smoke said.

Used-vehicle retail sales volume was down 50% YoY through the first half of April, compared with the 67% YoY decline in March. Similarly, new-retail sales volume was down 54% last Wednesday, an improvement compared with the 71% YoY decline in March.

Used-retail SAAR dropped 13.5% in March as a result of near-nationwide shelter-in-place directives implemented in the latter half of the month. The deterioration of used-vehicle values and decline in total sales volumes were expected to offer a glimpse of the severe drop-off the market would experience in April.