Buyers snapping up new cars, even if they’re the wrong color

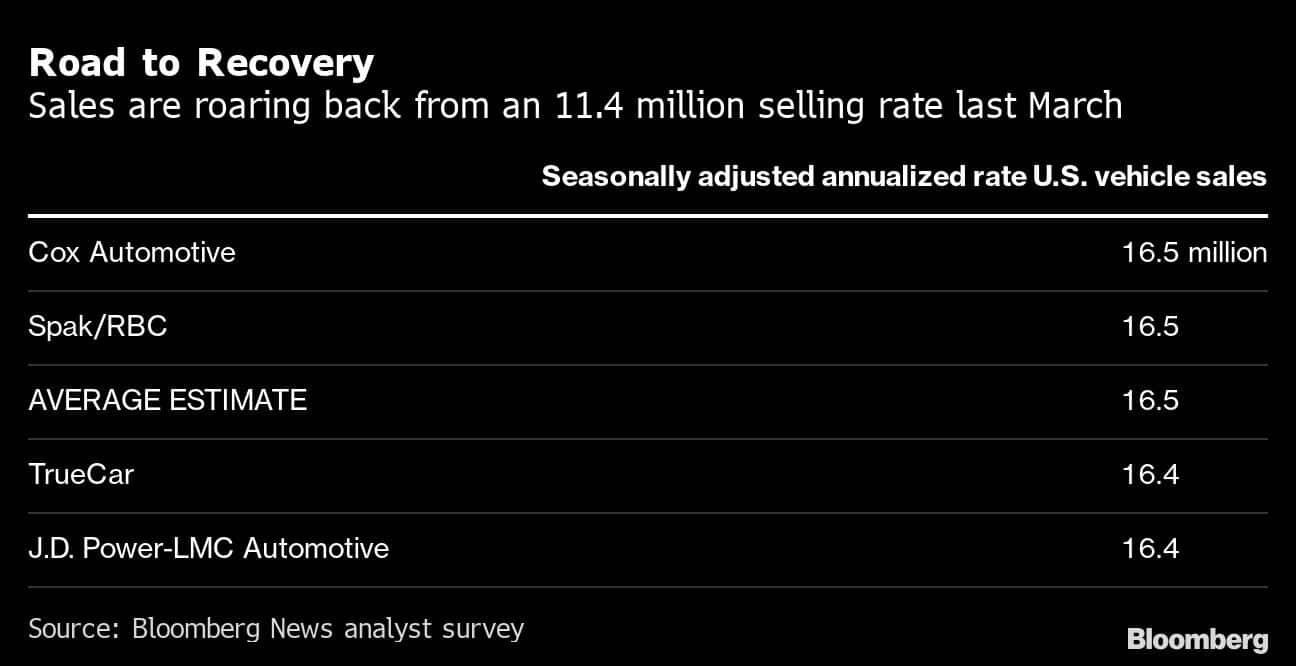

Emboldened by signs the Covid-19 crisis may be waning and fearful of potential vehicle shortages, consumers snapped up new autos at pre-pandemic rates in the first quarter as the U.S. car market’s recovery likely gained momentum.

U.S. auto sales surged by more than 8% in the first three months of the year, according to analysts’ estimates. The projected gain was powered by higher demand in anticipation of a return to offices and everyday travel as vaccination rates exceeded one-quarter of the population. Greater confidence in the economy spurred purchases as did fear of lower supplies of cars due to chip shortages.

That has left consumers scrambling for any steering wheel they can lay their hands on, accepting less-than-optimal colors, features and even swapping to a different model entirely if they must.

“There’s a little FOMO going on here, fear of missing out,” said Jeff Schuster, president of the Americas and global vehicle forecasting at researcher LMC Automotive. “Consumers have sacrificed on choice because the color combination or option combination they wanted wasn’t available, but they bought a vehicle anyway. You take what you can get right now.”

Most major automakers — including General Motors Co. and Toyota Motor Corp. — are expected to report their U.S. new vehicle deliveries for the January-March period on Thursday.

The projected sales acceleration is part of a trend that began soon after factories reopened last summer and has persisted in the months since then. This year’s gains come from retail buyers, whose purchases soared 20% compared to a year ago — a period that largely predated the onset of shelter-in-place orders. Retail deliveries are forecast to have reached 3.16 million vehicles in the quarter, the second-highest total ever, according to researcher J.D. Power.

The increase might even be more pronounced if it weren’t for the bottom dropping out from under sales to multiple-vehicle buyers. Those fleet purchases — often at discounted rates — to corporate and government customers fell by about 30% in the first quarter, according to analysts’ estimates. That reflected both lower demand from rental car and other fleet buyers as well as dwindling vehicle supplies as automakers prioritized higher-margin retail sales.

“If automakers have to choose between the [retail] customers and the fleet sales, they’re definitely going to choose customers,” said Jessica Caldwell, executive director of insights at researcher Edmunds.

Consumers, who flocked to showrooms and shunned public transport in the second half of last year, now fret about the industry’s shrinking inventories — and that’s created an impulse-purchase mentality, despite a dial-back in discounts.

“The retail consumer is really driving all of this right now and that’s in a market where incentives are flat at best,” Schuster said. “The semiconductor shortage has been so much in the news, that drove people to say, ‘I don’t want to be caught without a vehicle so I’m going to go get what I can.’”

Higher Prices

The dearth of deals hasn’t dissuaded buyers from choosing pricier models. The average price of a new vehicle was on pace to reach a record $37,314 in the first quarter, up $3,000 from a year earlier, according to J.D. Power.

“The combination of strong retail volumes and higher prices means that consumer expenditures on new vehicles is expected to reach a Q1 record of $177.9 billion, up 31% from 2020 and up 18% from 2019,” Thomas King, president of data and analytics at J.D. Power, said in a statement.

Looking ahead, questions loom about the effect of the chip shortage.

“Much of the impact on new vehicle sales remains to be seen at this stage, as inventory levels remain healthy enough to meet today’s demand,” IHS Markit said in a report. “As time goes on, the availability of high volume, popular vehicles may be an issue in larger markets.”

Indeed, a scarcity of models could hurt sales going forward and will take a bigger bite out of automakers’ bottom line than originally anticipated, Adam Jonas, an analyst for Morgan Stanley, wrote in a March 26 note to investors. Production cuts and temporary factory closings caused by the chip shortage could reduce 2021 profits for car companies by 25% or more, Jonas wrote. Earlier hopes that the lost production could be made up this year are fading fast as the situation worsens.

“The 4Q earnings season narrative was that any shortfalls in production would be made up for by year end,” Jonas wrote. “This is probably not a relevant statement anymore.”

– By Keith Naughton and Skylar Woodhouse (Bloomberg)

– With assistance from Craig Trudell (Bloomberg)