Investors clamor for the Fed to slash rates to zero

All of Wall Street’s eyes are on Washington again, but only Federal Reserve Chairman Jerome Powell is catching its gaze.

With discussions around a comprehensive fiscal policy response to the coronavirus from the U.S. government still ongoing in Washington, investors are looking to the central bank to fill the vacuum by supporting the economy and keeping markets functioning. It unleashed a trillion dollars on Thursday, but failed to halt the stock market rout.

That has investors clamoring for the Fed’s Open Market Committee to slash interest rates back to zero next Wednesday — or sooner.

“In light of the continued growth in coronavirus cases in the U.S. and globally, the sharp further tightening in financial conditions, and rising risks to the economic outlook, we now expect the FOMC to cut the funds rate 100 basis points on March 18,” Goldman Sachs Group Inc. chief economist Jan Hatzius and his colleagues wrote in a note Thursday.

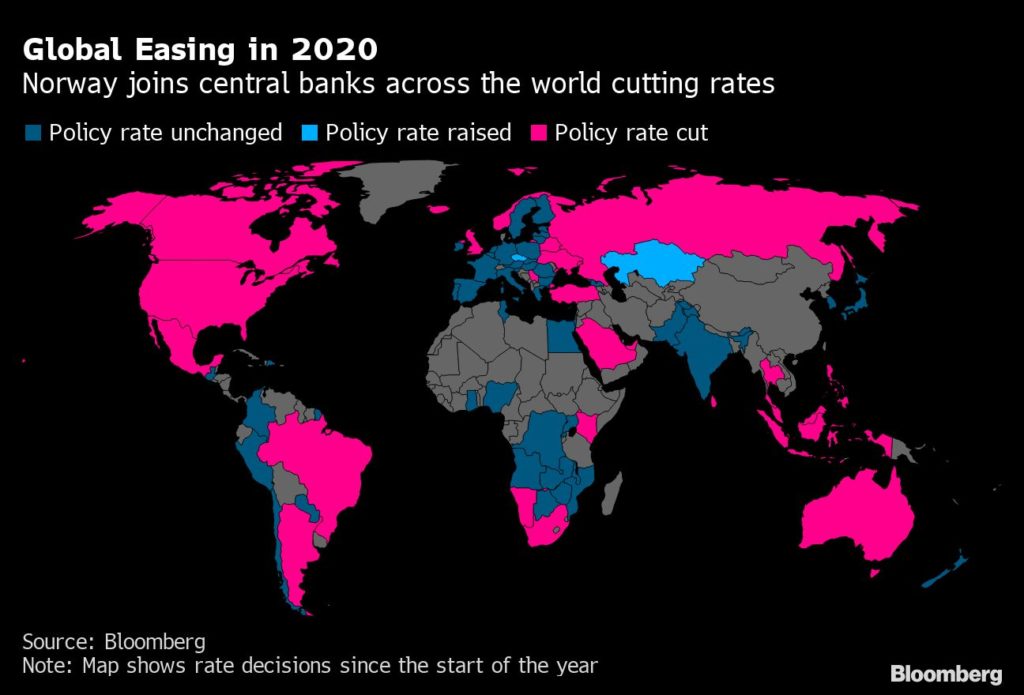

Other central bankers are also sweeping into action. The European Central Bank on Thursday took a series of steps which managed to disappoint investors and irritate politicians, forcing officials to try to placate critics. Then on Friday, the People’s Bank of China pared the amount of cash that banks have to set aside as reserves while Asian counterparts including those in South Korea, India and Japan moved to soothe markets. Norway slashed its key rate in an unscheduled meeting and Sweden lent money to banks.

Investors continue to question whether central banks can do enough to shelter their economies from the virus without help from governments.

In the U.S. that remains under debate despite assurances from President Donald Trump that it will come. His administration is talking to Congress about emergency legislation, but it would still take time to sign anything into law. Trump took to Twitter on Friday to repeat his frequent call for the Fed to cut rates.

While the Fed had hoped for a multi-pronged response by the government to contain the virus, which is disrupting national life and could end the country’s record-long economic expansion, it still has to do what it can to ease the pain and hasten the recovery.

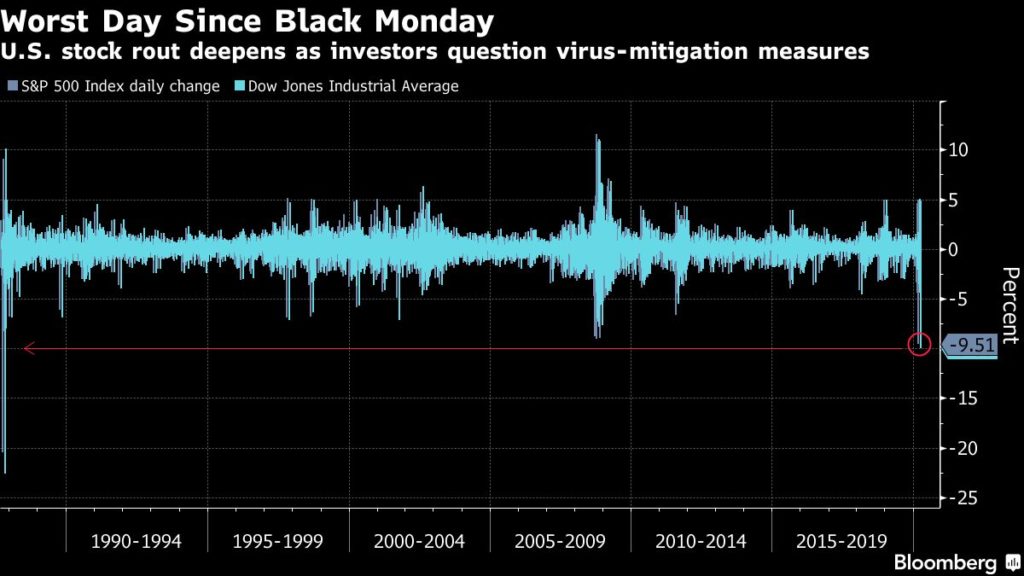

Last week it executed an emergency rate cut and then on Thursday it announced massive repo operations and expanded securities purchases to ease “temporary disruptions” in the market. Stocks briefly rallied on the dramatic news but then resumed the slide, with the S&P 500 ending down a staggering 9.5% for the steepest losses since 1987.

Policy makers are next scheduled to meet meet March 17-18 in Washington.

rump’s speech to the nation on Wednesday contained few details on fiscal stimulus measures, but his imposition of restrictions on travel from Europe to the U.S. deepened the sense of alarm.

“What’s changed is we thought we might get some meaningful policy response out of the White House. To the extent that we did get a response, it increased fear and uncertainty,” said Karl Haeling, head of strategic debt distribution at German banking group LBBW in New York. “We are moving toward a crisis of confidence in leadership generally.”

A growing number of economists — including at Morgan Stanley, Deutsche Bank Securities, Barclays and MacroPolicy Perspectives — have changed their calls and expect the Fed to use up its remaining policy space and cut to zero this month.

The Fed’s surprise move Thursday follows an emergency half-point rate cut last week that also failed to calm panicked investors as the virus spread. The most important input to economic analysis right now is the government’s response, and so far it’s been a disappointment.

“The markets are reflecting a view that what we have seen so far from fiscal policy is insufficient,” said Matthew Luzzetti, chief U.S. economist at Deutsche Bank Securities in New York. “The severe tightening of financial conditions we have seen — credit spreads are widening and volatility is rising — will have significant effects on the economic outlook.”

Trump’s error-laden speech from the Oval Office Wednesday left investors stunned. Stock futures fell overnight and the slide deepened over the day.

But a cut of the benchmark lending rate to zero next week would leave the Fed with limited options to further stimulate the economy.

It could ramp up bond buying above the current $60 billion monthly pace. On Thursday it extended those purchases beyond bills to coupon-bearing notes across the yield curve. It has since provided details of its Friday purchases, including $4 billion of buying in the 20- to 30-year sector.

Purchasing longer-dated securities goes in the direction of the quantitative easing, or QE, used during the financial crisis, though the Fed isn’t currently buying bonds to deliberately lower yields.

Even if it took that step and announced QE4, long-dated yields don’t have much further to fall. Ten-year Treasuries were trading at 0.8% in late New York trading Thursday.

The limitations on the Fed’s toolkit may also be eroding market confidence, which is leading some officials to say it is time to ask Congress for an expansion of what they can do.

“We should allow the central bank to purchase a broader range of securities or assets,” Boston Fed Chief Eric Rosengren said in a speech Friday in New York.

Even central banks that have broader powers are warning that these still won’t be enough to solve a crisis caused by a pandemic, which is disrupting everything from supply chains to travel.

“An ambitious and coordinated fiscal policy response is required to support businesses and workers at risk,” European Central Bank President Christine Lagarde said Thursday in Frankfurt. “Governments and all other policy institutions are called upon to take timely and targeted actions.”

Central banks can use their policies to address market liquidity and a big shock to aggregate demand, said Michael Hanson, global economist at JPMorgan Chase & Co. But they can’t do everything needed to curb the blow from a pandemic.

“You have this mythology around central banks that is becoming a little bit unraveled” during the coronavirus pandemic, Hanson said. “They are not superheroes, they are not going to save the world.”

What Bloomberg’s Economists Say…

“The Fed’s move to purchase Treasuries across a range of maturities beyond T-bills is part of a plan to mitigate forced selling in the market and alleviate liquidity strains. This is not explicitly QE, per se, as it is intended to support liquidity on a temporary basis.”

–Carl Riccadonna, Yelena Shulyatyeva and Andrew Husby

— By Craig Torres (Bloomberg)