Security Service Federal Credit Union snared the No. 1 spot in an exclusive ranking of dealer preferences about the finance providers they use.

Security Service Federal Credit Union snared the No. 1 spot in an exclusive ranking of dealer preferences about the finance providers they use.

The survey, called the Auto Finance Performance (AFP) data query and conducted by Auto Finance News sister company Auto Finance Advisors, quantifies and ranks lenders on service, pricing, representatives, and products — the four broad categories that drive dealers’ decisions about financing. The rankings drill down into each category to generate granular data to isolate areas in which lenders are doing well, and to identify areas where there is room for improvement. The AFP data has been analyzed based on prime versus subprime, by dealership size, floorplan participation, and geography, among other factors.

Unlike other rankings, the AFP scores lenders based on “performance,” as opposed to dealer “satisfaction.” Put simply, a satisfaction survey asks the dealer to answer the question, “Am I happy?” In contrast, “performance” measures, “How am I doing?”

In all, 3,338 dealers completed the AFP during the summer. Because each dealer could name and rate as many as six lenders —three prime and three nonprime or subprime — a total of 17,294 responses were received. The dealers came from across the nation and credit spectrum, with no particular concentration in either.

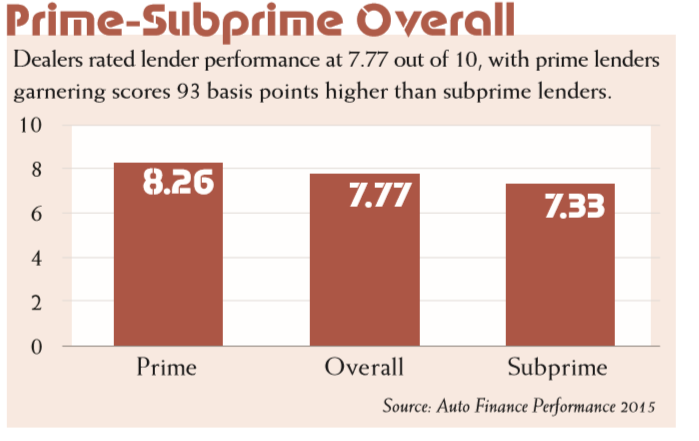

Overall, lender performance inched higher year over year. Dealers scored lenders an average of 7.77 of a possible 10, up from 7.69 in 2014. The stable scores come at a time when lenders are being forced to balance new offerings with already-pressured margins. Vehicle sales are up, and competition for financing those purchases is intense. Volume is up on the subprime side, which compels lenders to increase efforts in the high-touch sector. And while lenders are doing an OK job meeting dealer expectations, there’s certainly room for improvement.