U.S. economic growth slowed more than expected in the third quarter to the softest pace of the pandemic recovery period as snarled supply chains and a surge in Covid-19 cases throttled spending and investment.

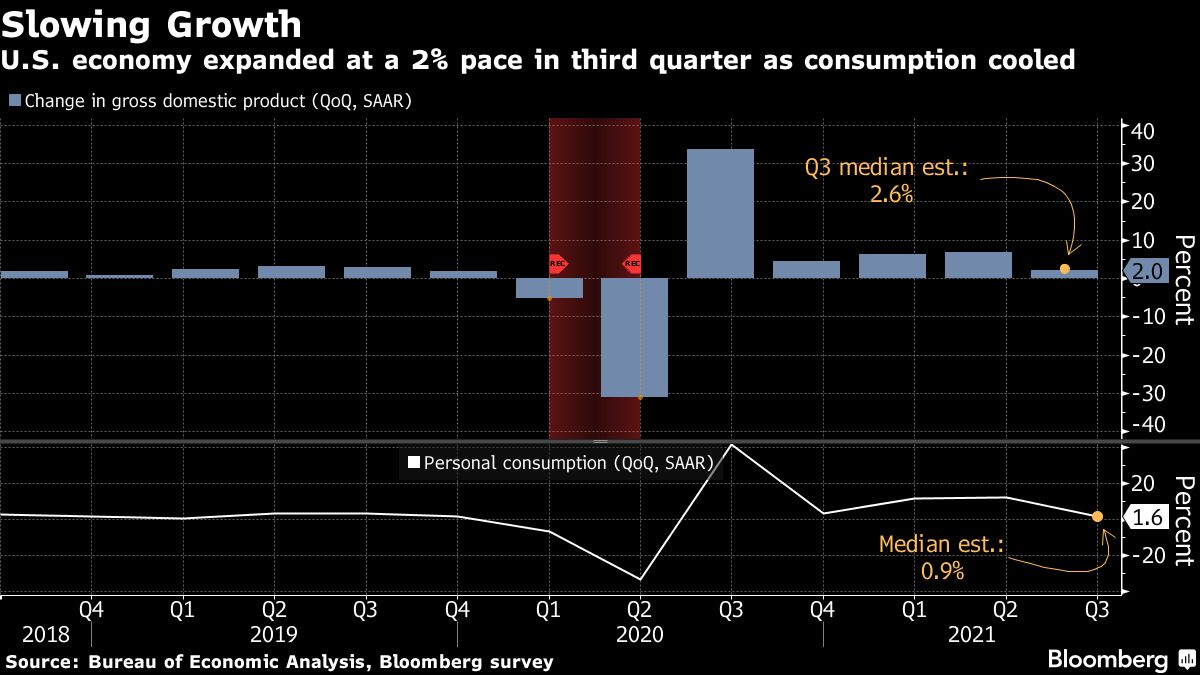

Gross domestic product expanded at a 2% annualized rate following a 6.7% pace in the second quarter, the Commerce Department’s preliminary estimate showed Thursday.

The deceleration reflected a sharp slowdown in personal consumption, which grew at just a 1.6% pace after a rapid 12% jump in the prior period. Shortages, transportation bottlenecks, rising prices and the delta variant of the coronavirus weighed on both goods and services spending.

U.S. economy expanded at a 2% pace in third quarter as consumption cooled.

The median forecast in a Bloomberg survey of economists called for a 2.6% increase in GDP. The S&P 500 opened higher, while the dollar fell and Treasury yields were little changed.

The latest data underscore how unprecedented supply constraints are holding back the U.S. economy. Understaffed and short of necessary materials, producers are struggling to keep up with demand. Service providers, who face similar pressures, fared better than manufacturers during the quarter despite the pickup in infections.

While supply chain challenges are expected to linger well into 2022, subsiding Covid-19 infections and elevated savings should support stronger household spending in the final three months of the year.

“Looking ahead, we see a stronger pace of growth in the fourth quarter on a rebound in household spending, albeit with downside risk from supply chain dislocations and shortages that could be a constraint for the economic expansion over coming months,” Rubeela Farooqi, chief U.S. economist at High Frequency Economics, said in a note.

Persistent supply constraints paired with other reopening effects have also driven up prices for a variety of products, spurring concerns about the breadth and duration of the recent spike in inflation.

The personal consumption expenditures price index excluding food and energy costs, an inflation measure followed closely by Federal Reserve officials, remained elevated, growing an annualized 4.5% last quarter after a 6.1% jump in the prior three months.

How Companies See It

“We don’t see the raw material or the inflation environment slowing down in any way.” — 3M Co. CFO Monish Patolawala, Oct. 26 earnings call

“Consistent with the broader market, we are experiencing inflation pressure… Next year we anticipate a more challenging inflation environment.” — General Electric Co. CFO Carolina Dybeck Happe, Oct. 26 earnings call

“I think the headwinds and the increased distribution costs will certainly be with us into 2022.” — Kimberly-Clark Corp. CFO Maria Henry, Oct. 25 earnings call

“On the cost side of the equation… we do not see any meaningful improvement until well into 2022.” — Sherwin-Williams Co. CEO John Morikis, Oct. 26 earnings call

“The risks are clearly now to longer and more persistent bottlenecks and thus to higher inflation,” Fed Chair Jerome Powell said last week. “We now see higher inflation and the bottlenecks lasting well into next year.”

Inflation-adjusted business investment cooled from the rapid pace of growth seen over the past year as manufacturers struggled to fulfill orders. Non-residential fixed investment rose an annualized 1.8%. Both outlays for structures and equipment declined on an inflation-adjusted basis, while the value of intellectual property surged.

The slowdown in consumer spending reflected weaker motor vehicle expenditures which subtracted 2.39 percentage points from GDP during the quarter. Automakers have been struggling to boost production and inventory amid computer chip shortages.

A wider trade deficit — reflecting record imports of foreign goods –further eroded growth. Net exports subtracted 1.14 percentage points. Residential investment also declined.

Inventories added more than 2 percentage points to GDP after consecutive quarters of declines.

A separate report Thursday showed initial jobless claims fell to 281,000 last week, a fresh pandemic low. Continuing claims, a measure of ongoing benefits, dropped by 237,000 in the week ended Oct. 16, the biggest decline since July.

Digging Deeper

- Excluding the trade and inventories components of GDP, final sales to private domestic purchasers, a gauge of underlying demand, rose at a 1.1% pace, the slowest of the pandemic recovery

- Motor vehicle output plunged an annualized 41.6%; excluding auto output, GDP rose 3.5%

- Services spending added 3.4 percentage points to 3Q GDP, while goods subtracted 2.32 points

– By Reade Pickert (Bloomberg)

– With assistance from Kristy Scheuble, Olivia Rockeman and Sophie Caronello