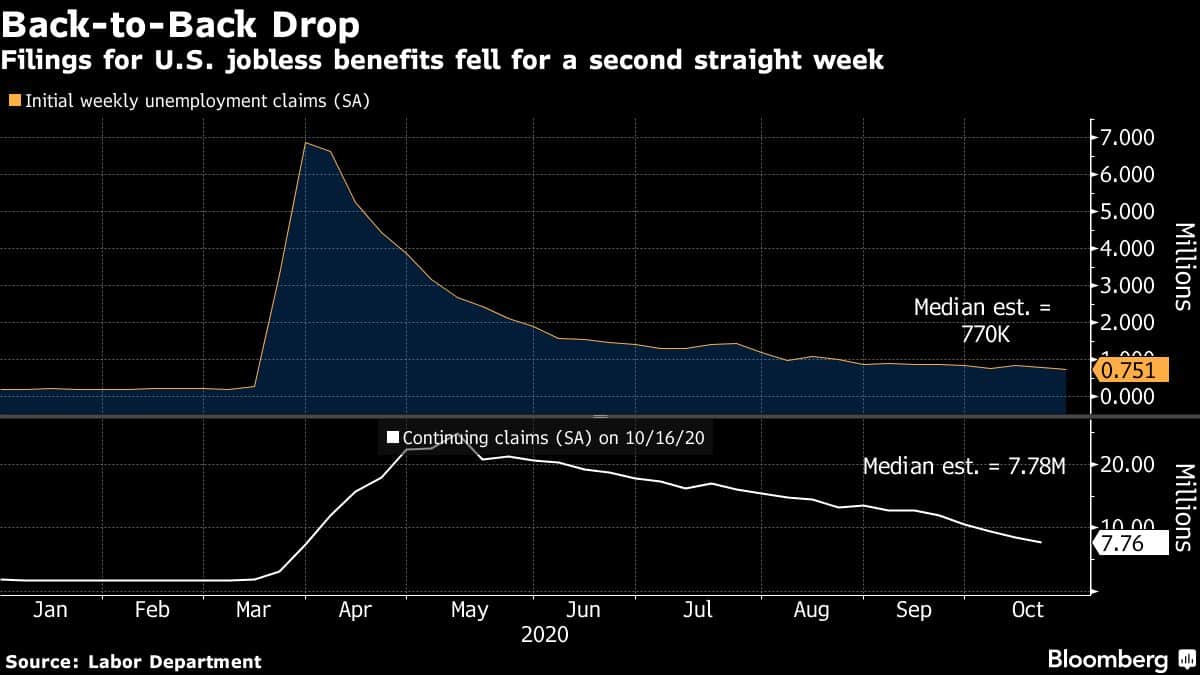

Applications for U.S. state unemployment benefits fell more than forecast last week, suggesting the labor market remains on the path of gradual improvement — while still far from its pre-pandemic health.

Initial jobless claims in regular state programs totaled 751,000 in the week ended Oct. 24, down 40,000 from the prior week, Labor Department data showed Thursday. On an unadjusted basis, the figure decreased by a little more than 28,000.

Continuing claims — the total pool of Americans on ongoing state unemployment benefits — decreased 709,000 to 7.76 million in the week ended Oct. 17. Continuing claims have fallen for five straight weeks. Still, the number of Americans on emergency assistance programs rose as many unemployed exhausted regular state benefits.

Economists called for 770,000 initial claims and 7.78 million continuing claims, according to the median estimates in Bloomberg surveys.

The figures, the last snapshot of the labor market ahead of Tuesday’s election, underscore a further, yet gradual, recovery in the job market. Nonetheless, a renewed surge in coronavirus infections across the country and a deadlock over new fiscal stimulus threaten to limit further progress.

The decline in continuing claims coincided again with an increase in Americans on Pandemic Emergency Unemployment Compensation, a federal program that provides an additional 13 weeks of benefits. That figure rose by more than 387,000 to 3.68 million in the week ended Oct. 10.

A separate report on Thursday showed the economy grew at a record 33.1% pace in the third quarter. But even with the outsize gain, gross domestic product is still below its pre-pandemic peak. Similarly, while weekly unemployment claims have improved significantly from April, they remain at more than three times their pre-crisis level.

Data have been volatile over the last month after California stopped accepting new jobless claims for two weeks and temporarily reported estimated numbers, inflating the national figures. Last week’s report showed revised data for California contributed to drop in overall claims. The state also reported fewer claims in the most recent week.

Florida, Texas, Louisiana and North Carolina were among other states registering the biggest declines in the period ended Oct. 24. Claims jumped in Michigan, Virginia and Illinois.

– By Olivia Rockeman (Bloomberg)

– With assistance from Jordan Yadoo and Sophie Caronello.