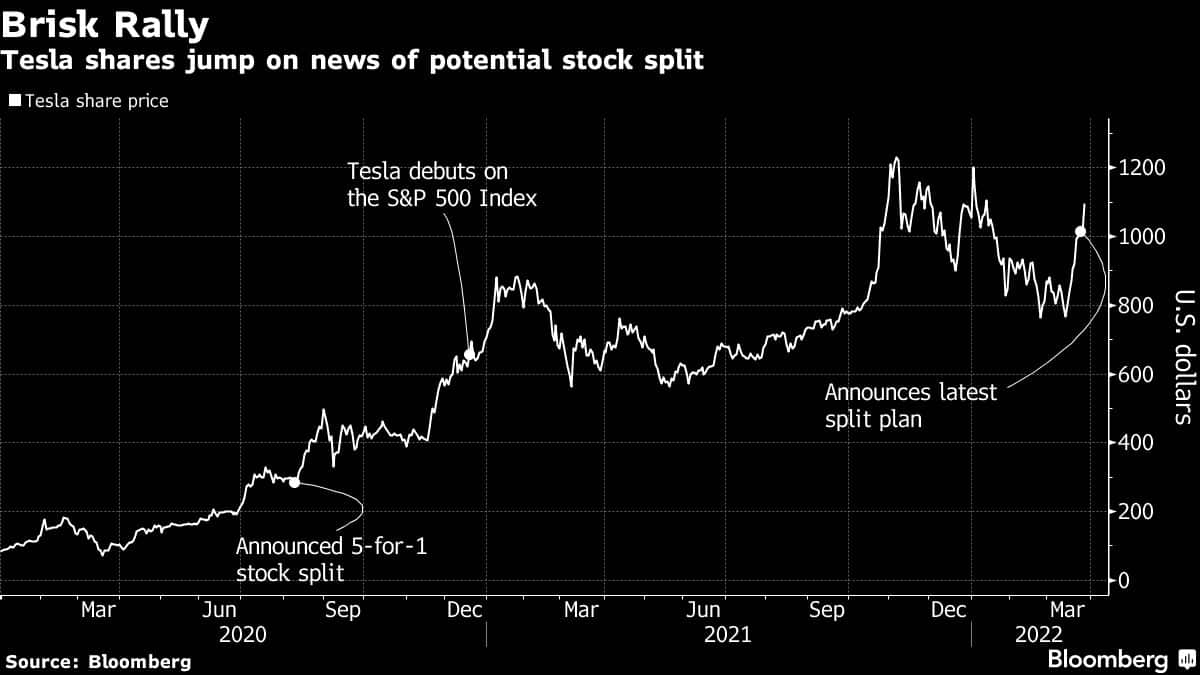

Tesla Inc. added about $84 billion to its stock-market value on Monday, more than Ford Motor Co.’s entire market capitalization, after the electric vehicle maker said it is planning a second stock split in about two years.

Stock splits for large companies have returned to the spotlight recently with Amazon.com Inc. saying earlier this month that it will do a 20-for-1 stock split, followed by Alphabet Inc.’s own plan announced in February, as these companies try to make their lofty stocks more attractive for individual investors.

The news, announced via a tweet, helped to add further fuel to a recent rally in Tesla’s stock. The company is the biggest gainer on the NYSE FANG+ Index this year. On Monday, the shares closed up 8% at $1,091.84, the highest level since Jan. 12.

The last time Tesla split its stock was in August 2020. Its share price rose a staggering 743% that year, and the split was often cited among one of the reasons that drove the gains.

While there are few details on Tesla’s plan, here’s some initial reactions from fund managers, strategists and analysts.

Sam Stovall, chief investment strategist at CFRA

- “It’s really just adding excitement to its name.”

- “We have the stock ranked buy, so we’re optimistic on its performance in the coming 12 months. By the company splitting its shares and introducing its dividend, will now broaden its appeal to income oriented investors.”

Marc LoPresti, managing director of The Strategic Funds - “A lot of people consider this to be a classic example of market psychology at work. If you look historically over time, most companies do well and perform well — and in some instances very well — following the announcement of stock splits.”

- “In a case like this, Elon Musk is absolutely brilliant at market psychology. He’s one of the masters of market psychology.”

David Trainer, CEO of New Constructs

- “Tesla’s desire to pursue a stock split doesn’t change the fact that its stock is still trading at a valuation completely disconnected from fundamentals.”

- “A Tesla stock split would dramatically reduce the price of Tesla’s stock, which would make it even more attractive to unsuspecting retail investors. This could further fuel the bubble in Tesla’s stock that has been brewing over the past two years.”

Daniel Ives, analyst at Wedbush

- Is not surprised that the company is heading for another stock split, especially with robust EV demand and the build-outs of the “flagship Berlin and Austin Giga factories now on a glide path.”

- “We view Tesla’s move following the likes of Amazon, Google, Apple and initiating its second stock split in two years as a smart strategic move that will be a positive catalyst for shares going forward.”

– By Esha Dey (Bloomberg)

– With assistance from Vildana Hajric and Isabelle Lee