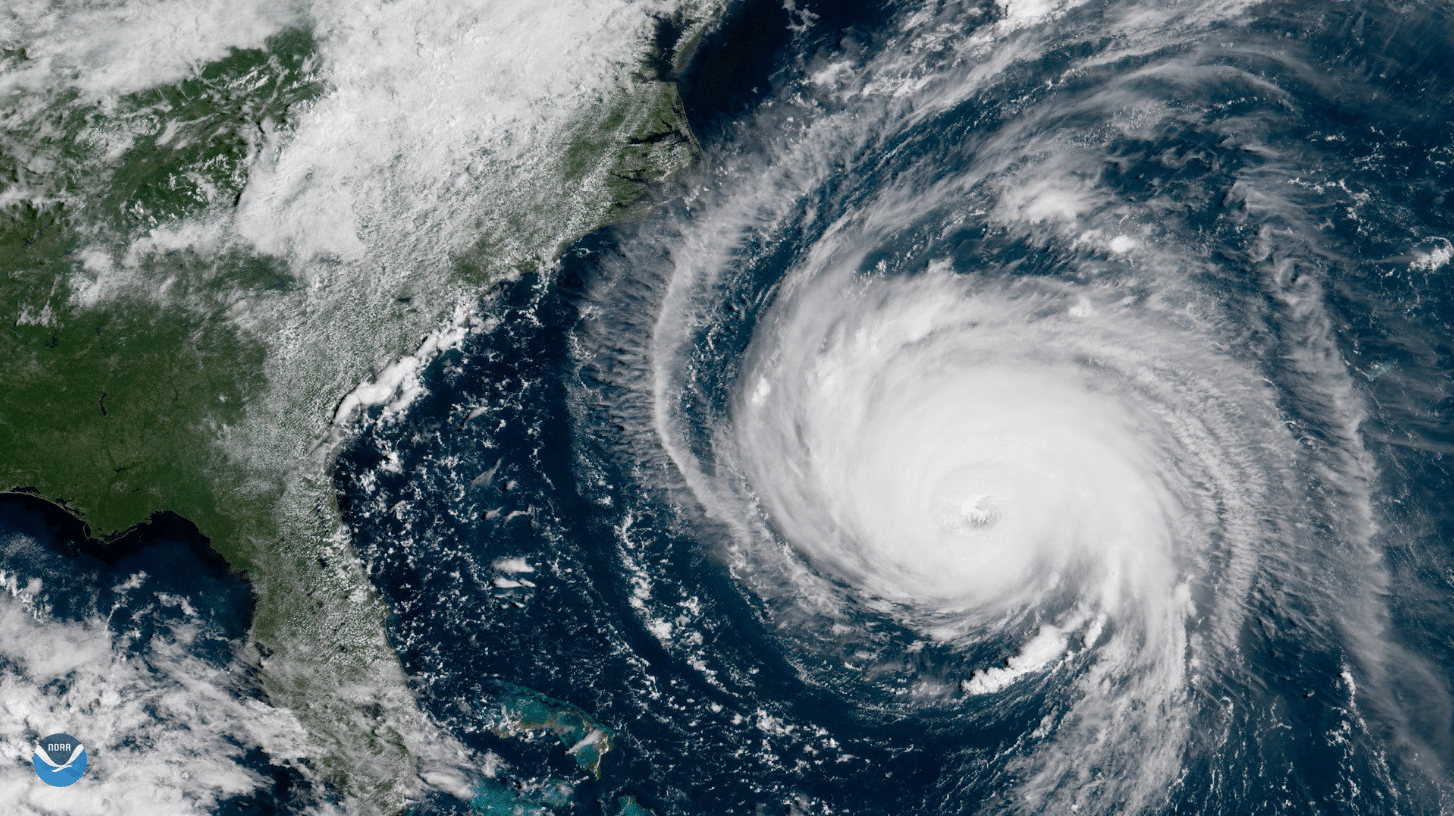

Hurricane Florence’s inevitable impact on the auto industry is still uncertain as the storm makes it way through the east coast, but early estimates predict North Carolina could lose 20,000 to 40,000 cars if the storm maintains its current path, said Jonathan Smoke, chief economist for Cox Automotive.

Economist and analysts are basing their forecasts on the results of 2017’s hurricanes Harvey, Maria, and Irma.

“Following the hurricanes last fall, there was a very rapid price appreciation in the used-vehicle market in September and October,” Smoke told Auto Finance News. “Then, we saw prices come back down and correct itself. It was a temporary imbalance in the market.”

Hurricane Florence is set to hit Raleigh, N.C.; Virginia Beach, Va.; Columbia, S.C.; Charleston, S.C.; Myrtle Beach, S.C.; Savannah, Ga.; and Fayetteville, N.C. In these areas, however, vehicle densities are about half of Houston, Texas where Hurricane Harvey hit. Therefore anticipated losses aren’t as extreme as last year.

The path area of Hurricane Florance is home to 9 million vehicles in operation, with a “vehicle density of 162 vehicles per square mile,” Smoke noted in an insights blog post on Cox’s website. By contrast, Houston has 326 vehicles per square mile.

CNBC is reporting that the storm has the potential to inflict record flooding, which is particularly damaging to vehicles in the region — as opposed to wind damage.

So far, lenders Ally Financial and Chase are already offering their help and support through their websites and via Twitter, though no specifics are noted yet as to what financial relief will be provided.

Manufacturers are suspending operations at factories located in the path of the storm. OEMs Daimler AG and Volvo Car Group have both suspended operations due to Hurricane Florence, Bloomberg reported earlier this week.

Click here to see how some lenders provided financial relief last year in the wake of Hurricane Harvey.

For more content like this, check out the 18th annual Auto Finance Summit, which will take place on Oct. 24-26 at the Wynn Las Vegas. To learn more about this year’s event — or to register — visit the Summit’s homepage here.