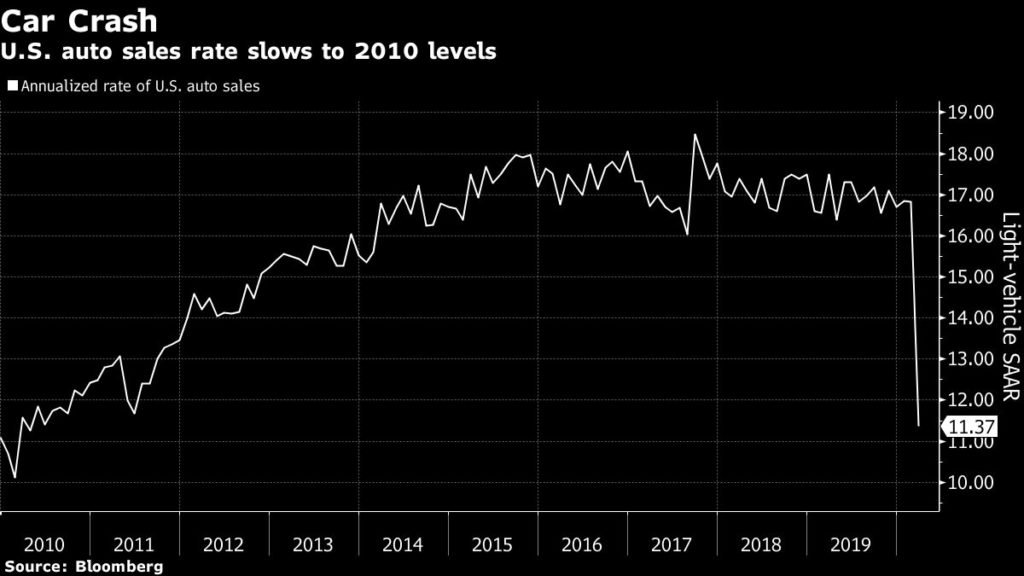

The auto industry — already fretting lengthy factory shutdowns and depressed new-vehicle demand — is starting to sound the alarm about a potential used-car price collapse that could have far-reaching consequences for manufacturers, lenders and rental companies.

Used-vehicle auctions are for now virtually paralyzed, much like the rest of the economy. The grave concern market watchers have is that vehicles already are starting to pile up at places where buyers and sellers make and take bids on cars and trucks — and that this imbalance will last for months.

If that fear is realized and prices plummet, it will be detrimental to automakers and their in-house lending units, which likely will have to write down the value of lease contracts that had assumed vehicles would retain greater value. Rental-car companies also will get less money from selling down their fleet of vehicles, which are sitting idle amid a global pandemic that’s been catastrophic for travel.

“Six months from now, there will be huge, if not unprecedented, levels of wholesale supply in the market,” Dale Pollak, an executive vice president of Cox Automotive, which owns North America’s largest auto-auction company, wrote in an open letter to auto dealers last week. “Cars are coming in, but they aren’t selling. Today’s huge supply of wholesale inventory suggests supplies will be even larger in the months ahead.”

Lease Extensions

Automakers are doing what they can to limit the damage. General Motors Co. and Ford Motor Co.’s finance units already are offering customers one-month lease extensions. In addition to relieving pressure on consumers wary of going into showrooms, this will delay some of the influx of off-lease vehicles headed to auctions that are for now operating only virtually.

But these measures are unlikely to go nearly far enough to address the asymmetry between the supply of used vehicles and demand that is unlikely to rebound anytime soon given that almost 17 million Americans sought jobless benefits in just the last three weeks.

“There aren’t a lot of people in gloves and masks running out to buy cars,” said Maryann Keller, a former Wall Street analyst who’s now an auto-industry consultant in Stamford, Connecticut. “Auctions are mostly shut down and they’re filled with cars that have no buyers.”

Residual Risk

Used-car sales fell 64% in the last week of March, according to Manheim. The Cox Automotive-owned auction company estimates that prices have fallen about 10% in recent weeks, though that figure is based on unusually low volume at auctions.

If that level of decline lasts or worsens, it could have huge implications for GM, whose General Motors Financial unit had $30.4 billion worth of vehicles leased to customers at the end of last year. If GM Financial needs to boost its estimate of how much those vehicles are going to depreciate in value, each percentage point increase raises the firm’s expenses by $304 million, according to a regulatory filing.

GM assumed a 4% decline in residual values this year. If the 10% drop Manheim has seen recently persists, depreciation expense could counter the $1.9 billion that GM Financial earned in pretax profit last year, said Joel Levington, a credit analyst with Bloomberg Intelligence. Ford Motor Credit faces similar risk, he said.

Ford said Monday it’s considering additional actions to raise cash after reporting a preliminary $600 million first-quarter loss. One option could be for Ford Credit to take advantage of thawing in the asset-backed securities market, Levington said in a report.

Read more: Ford’s finance arm generates more profit than ever before

Rental-car companies that appealed to the Treasury Department and Federal Reserve as a group last month for loans, tax breaks and other forms of support await a similar fate. Hertz Global Holdings Inc., Avis Budget Group Inc. and Enterprise Holdings Inc. all are trying to find ways to unload some cars without taking too big of a hit, said Keller, a former Dollar Thrifty Automotive Group Inc. board member.

If Avis and Hertz have to sell cars at lower values, it will add to the costs of maintaining their fleets. A big drop in residual values comes straight out of the bottom line and can create liquidity problems, said Hamzah Mazari, a Jefferies analyst.

For Hertz and Avis, every 1% increase in fleet costs saps about $20 million from earnings before interest, taxes, depreciation and amortization, Mazari said.

Motivated Sellers

Hertz hasn’t cleared out as many cars so far as Avis has, meaning it’s holding more vehicles with few customers to whom it can rent them.

But rental companies that sold aggressively in late March as Covid-19 was spreading did so at a cost, said Jonathan Smoke, Cox Automotive’s chief economist.

“Rental companies are motivated sellers,” Smoke said. “They moved cars quickly but saw the impact on price.”

Dealers also are looking to tap the used-car inventory sitting on their lots into whatever money they can muster. One of Manheim’s biggest tasks now, Cox Automotive’s Pollak wrote in his letter last week, is finding places to park the stream of vehicles headed for auctions.

“It’s critical for dealers to recognize what may be an unpleasant truth,” Pollak said. “It might take all the cash you can gather to sustain your business today and put it in a position to be viable when the market comes back.”