The Federal Reserve signaled it will start raising interest rates “soon” and shrink its bond holdings after liftoff has begun, moving toward ending ultra-easy pandemic support to fight the hottest inflation in a generation.

“With inflation well above 2% and a strong labor market, the committee expects it will soon be appropriate to raise the target range for the federal funds rate,” the Federal Open Market Committee said in a statement Wednesday following a two-day policy meeting. In a separate statement, the Fed said it expects the process of balance-sheet reduction “will commence after the process of increasing the target range for the federal funds rate has begun.”

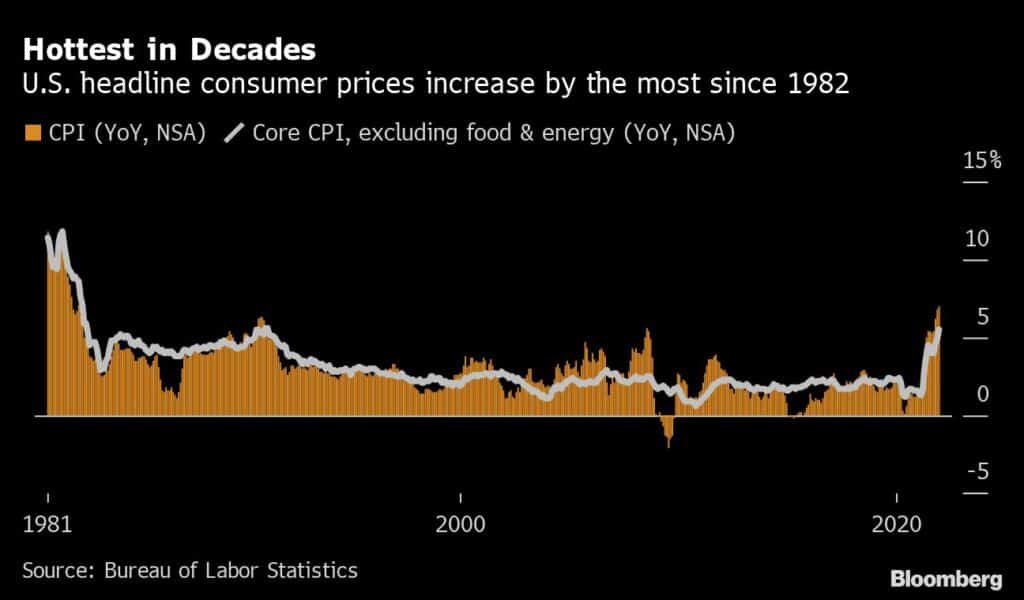

The pivot, against a backdrop of turmoil in stocks, comes amid consumer inflation readings that have repeatedly surprised and hit 7% — the most since the 1980s — and a tight labor market that’s pushed unemployment down faster than anticipated to almost its prepandemic level.

A rate hike would be the central bank’s first since 2018, with many analysts forecasting a quarter-point increase in March to be followed by three more this year and additional moves beyond. Critics say the Fed has been too slow to act and is now behind the curve in tackling inflation, though key market gauges don’t back that view. Even some Fed officials have publicly discussed if they should raise rates more this year than forecast.

The Fed stopped short of specifying March as the starting point of rate liftoff. It also reiterated that “risks to the economic outlook remain, including from new variants of the virus.”

The FOMC removed the previous opening line of its statement, which said the central bank was “committed to using its full range of tools to support the U.S. economy in this challenging time.”

The vote was unanimous. Chair Jerome Powell will address a virtual press conference at 2:30 p.m. Washington time. Philadelphia Fed President Patrick Harker voted as the alternate for the Boston Fed, which is currently without a president, while three vacancies at the Board of Governors reduced the number of voters at this meeting to nine.

Officials held the target range for their benchmark policy rate unchanged at zero to 0.25% as expected.

They also said they will conclude asset purchases on schedule, leaving them on track to end in “early March.”

The Fed’s balance sheet stands at nearly $8.9 trillion, more than double its size before officials began massive asset purchases at the onset of the pandemic to calm market panic.

Despite criticism that it has dragged its feet, the Fed is moving much quicker than it once expected to — prompted by the failure of inflation to fade as anticipated amid robust demand, snarled supply chains and tightening labor markets. As recently as September, central bank officials were split on whether any rate hikes would be warranted in 2022.

The meeting is the last of Powell’s current term as Fed chair, which ends in early February. He’s been nominated to another four years at the helm by President Joe Biden and is expected to be confirmed by the Senate with bipartisan support.

In his second term, Powell, 68, will need to persuade investors and the American public that the FOMC can successfully get inflation back down to the Fed’s 2% goal while also nurturing job gains as the labor market heals from the pandemic.

Biden last week endorsed the Fed’s plans to scale back monetary stimulus and said it’s the central bank’s job to rein in inflation, which has become a political headache for Democrats ahead of November midterm elections where they could lose their thin majorities in Congress.

-By Olivia Rockeman (Bloomberg)