Credit access ticks up 4.1% in October, approval rates fall

Subprime share of loans jumps 240 bps

Auto credit access improved in October, even as approval rates fell month over month.

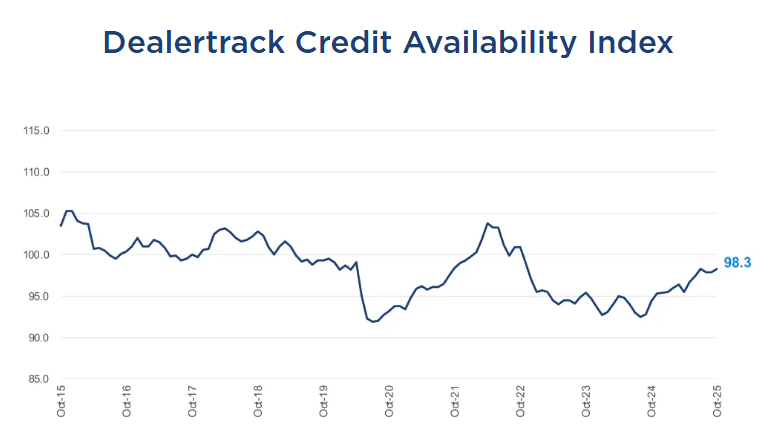

The Dealertrack Credit Availability Index, which measures access to auto credit, hit 98.3, up 4.1% year over year and 4 basis points (bps) MoM, according to the Cox Automotive report published Nov. 10.

The loosening of credit, alongside the Federal Reserve’s quarter-point rate cuts this year should be positive for the auto industry, for example by helping auto loan rates fall as seen in November, Erin Keating, senior analyst at Cox Auto, told Auto Finance News.

Credit availability in October:

- Climbed 2.1% for captives;

- Climbed 1.9% for banks; and

- Climbed 1% for credit unions and finance companies.

OEMs are focusing on affluent buyers, Keating said, noting that they are prioritizing volume over margins.

While banks and captives led the charge in credit access in October, their 60-plus-day delinquencies in the third quarter climbed, according to a Nov. 3 TransUnion report.

“Credit availability has been steadily improving for over a year. The most recent driver of this trend is the increased share of subprime consumers,” Jonathan Gregory, senior manager of economic and industry insights at Cox Auto told AFN.

Industrywide, approval rates fell 1.4 percentage points MoM to 72.6% in October, according to Cox.

The approval rate is one input in credit availability, he said, noting that it weighed down the availability alongside yield spreads. The downturn was, in part, offset by an increase in subprime lending as well as other factors.

“However, a higher presence of subprime consumers in the market can negatively impact approval rates, as we observed this month,” he said.

Subprime share of loans surges

The share of loans to subprime borrowers climbed 90 bps MoM and 240 bps YoY, according to Cox’s report.

The uptick follows a decline in 60-day-plus delinquencies from independent financiers that serve the subprime market and a 2-percentage point uptick in used-vehicle financing market share, according to TransUnion.

“This change suggests lenders are expanding access to higher-risk borrowers as overall credit loosens,” according to Cox.

Other factors that offset the decline in auto loan approvals and expanded access to credit:

- Longer loan terms, as the share of loans with terms greater than 72 months climbed 300 bps YoY and 70 bps MoM to 27.5%; and

- Reduced down payments, which dropped 70 bps YoY and 20 bps MoM to 13.3%.

“Loan terms have been extended to their highest levels since September 2022, while the size of down payments has decreased to the smallest amount since October 2022,” Gregory said. “These trends highlight the ongoing affordability issues in the market.”